Look What They Are Doing to the Dollar!

Don’t Take Any Wooden Nickels

It’s time to take a closer look at the financial measures authorities around the world have taken in response to the Coronavirus.

Bloomberg estimates that between direct spending, new money and credit creation, bank guarantees and loans, governments have spent $8 trillion on “stimulus” measures.

That’s more than ten percent of global government debt, which totals over $70 trillion.

The US government alone has spent $2.3 trillion. And that’s almost ten percent of existing US debt.

That’s not the end of it. Washington has more spending already on the drawing boards: more aid, more cash, direct payment to farmers, government purchases of meat and other provisions, more payroll support, and infrastructure spending.

But wait! There’s even more!

In a piece from the Mises Institute, The Fed Has Gone Nuts. And It Can Get Worse, business professor Peter St. Onge starts with what the Fed has already done:

“Pushed interest rates to zero and expanded into ‘unlimited’ buying of assets, now reaching to corporate bonds and local government bonds. These bring the same concerns we had in 2008: trillions in new money to dilute the spending power of current savers, along with the risk of ‘moral hazard’ where the government covers the losses for corporate, and government, irresponsibility.

“What’s more concerning is what the Fed might do next. Proposals are floating up for four very corrosive measures: negative interest rates; directly subsidizing bonds; writing Fed checks for corporate equity or for a universal basic income up to $72,000 per year; and letting poor countries effectively print their own US dollars.”

Now the group president Trump calls “the Squad” is getting behind something even crazier. It’s a proposal that pops every few years. In the latest incarnation it would have the Treasury mint two $1 trillion platinum coins, and add that amount, $2 trillion, to the government books against which it would write welfare checks to the American people.

Why platinum? To pretend that this made-up coin is real money. But they could use anything, plastic, paper, mulberry bark, or wood, print some numbers on it and call it trillions.

But it wouldn’t be real money anymore that new digital bookkeeping entries on the Fed’s books represent additional real value.

Once upon a time the wise and experienced used to advise the young and foolish not to take any wooden nickels.

These days Americans are apt to fall for just about anything.

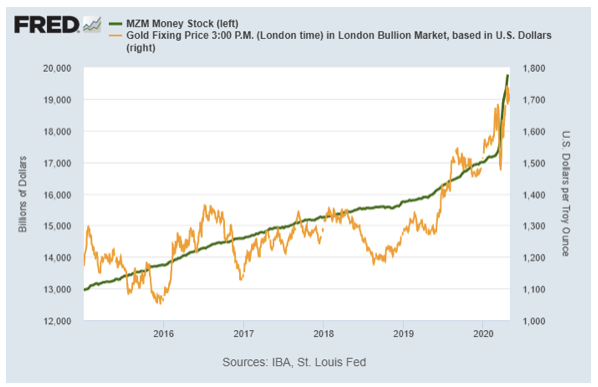

Here’s a chart a colleague shared the other day. It represents the US money supply MZM (a measure of cash and cash-like deposits, Money of Zero Maturity) in green, against the gold price.

You can see that the money supply line that was already increased by a trillion dollars a year, turned straight up with the pandemic this year.

But notice that as the money supply climbs, it pulls gold right along with it!

All of these shenanigans will end in ruination for the value of the dollar.

That’s why informed people refuse to take any wooden nickels. They prefer to own gold and silver.

Contact us here at Republic Monetary Exchange today. And get out of the way of the coming dollar calamity.

The Fed is printing dollars like crazy!

That’s one reason gold keeps marching higher!