Is the Dollar the New Big Short?

Michael Burry, made famous in the movie about the bursting of the mortgage bubble The Big Short, has gone on a tweetstorm warning about looming US inflation.

Burry, who was played by Christian Bale in the movie, made himself and the investors in his fund hundreds of millions of dollars by shorting mortgage credit instruments. In his new warnings about inflation, Burry is not talking about just a little inflation. Between Modern Monetary Theory policies, unconstrained debt, and money supply growth, Burry is citing the precedent of the historic Weimar Republic hyper-inflation the brought Germany low a hundred years ago.

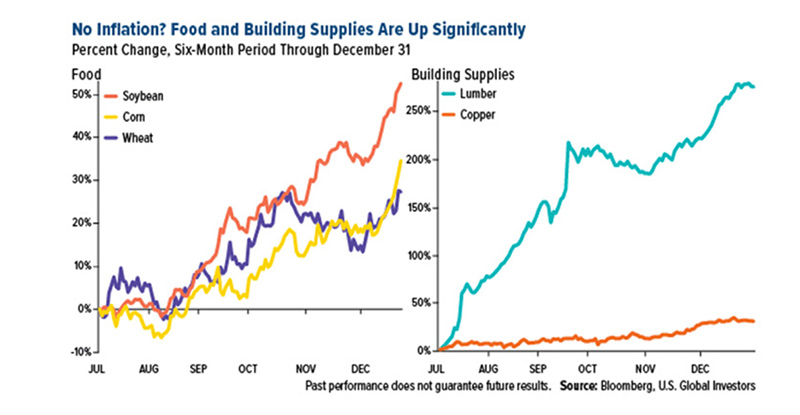

The evidence for the return of inflation is all about us. Just days ago, we reported on the big jump in the Producer Price Index and that food prices climbed 3.9 percent higher last year.

We also reported recently on the rising prices of building supplies here.

We have written repeatedly about Stephen Roach’s crucial warning of the collapse of the dollar’s value.

But now other news on the price inflation front is coming so fast and from so many places that it will soon be hard to keep up.

Shipping and trucking rates are soaring. New and used vehicle prices are climbing. Gas prices are up almost 25 percent in just the last few months. (Biden will eventually pay a political price for halting construction of the Keystone XL oil pipeline.)

Import prices are reflecting the dollar’s weakness. Import prices rose 1 percent in December and 1.4 percent in January.

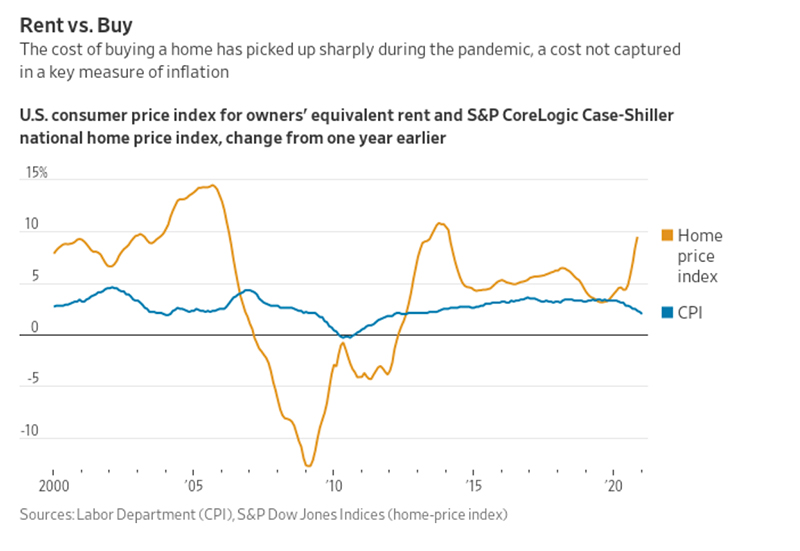

This week a Wall Street Journal piece confronted the fact that the Federal Reserve’s inflation metrics underreport asset inflation and housing inflation.

For example, the following graphic shows the “owner’s equivalent rent” metric that is used in calculating the housing component of the Consumer Price Index, compared to the Case-Shiller index of national home prices, which has turned sharply higher.

We think Michael Burry is right again. Each new federal budget, each deficit dollar spent, each act of liquidity injection and stimulus by the Fed is another step in the devaluation of the dollar. The US dollar is “the big short” of our age.

Let us help you protect yourself and profit from looming price inflation. Owning gold (and silver) is the easiest and safest way that we know of being short the dollar.