Inflating the Debt Away

If you’re like the rest of us, you’re probably hearing more and more complaints about rising prices.

Well, get used to it.

Washington could have done the right thing, but it never does. Politicians are too busy buying votes with giveaways and thanking lobbyists for contributions with crony legislation.

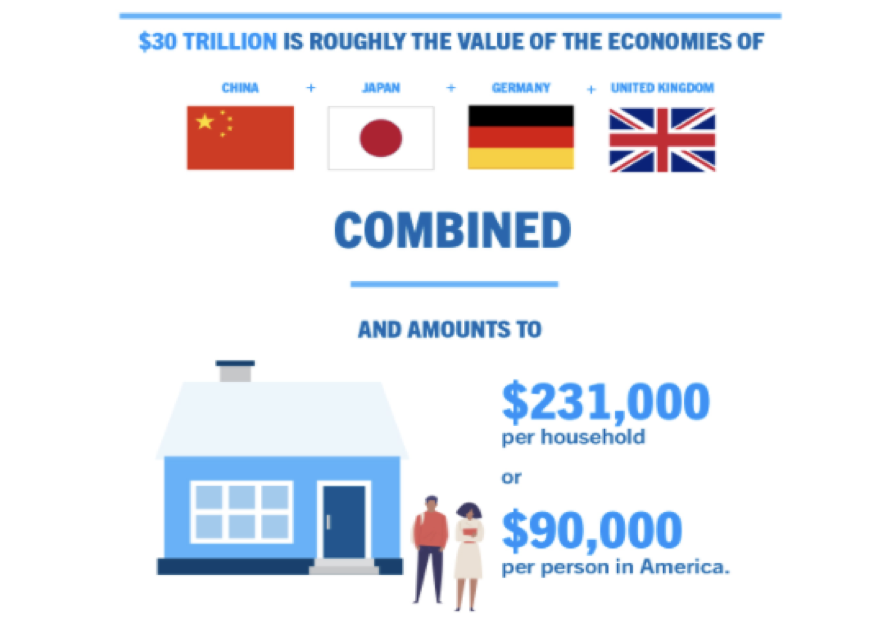

It’s been going on for a long time, and now – just days ago – the US national debt reached the unthinkable level of $30 trillion!

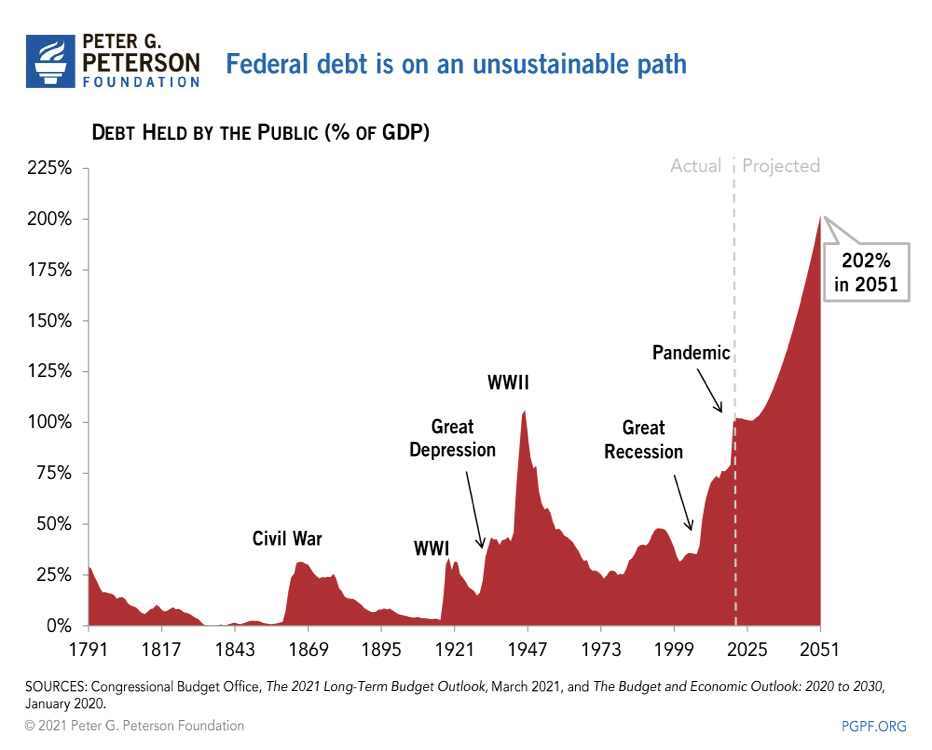

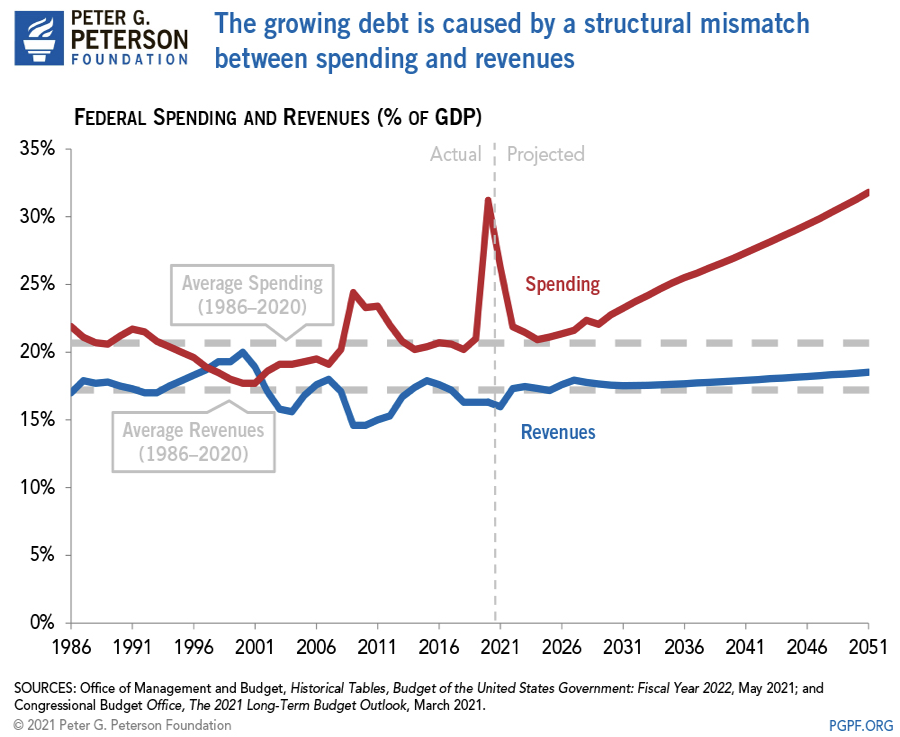

Where is this debt crisis headed? Here’s a guess from the Peterson Foundation, one that we think is a quite modest projection of future debt. That is because Washington is liable to usher in a recession in the next few years. In a recession, government revenues fall, while government social spending rises.

And the debt widens.

Our recent history is clear. As the debt widens, the Federal Reserve steps in to make up much of the shortfall with a gusher of printed money. It attempts to inflate the debt away.

Such inflation extremes are the ruination of countless governments and the source of incalculable suffering by the people.

Inflation at ten percent devalues a $30 trillion government debt by $3 trillion a year. Except for an outright default, that is the only way out for Washington.

If you would like to learn about the calamity that results when governments try to inflate their debt away, read Jim Clark’s new book REAL MONEY FOR FREE PEOPLE: The American Gold Story.

It is vital that you have this information. Stop by Republic Monetary Exchange on Camelback just east of 40th Street and we’ll be happy to give you a copy. No cost. No obligation.

We just urge you to inform yourself before it is too late.