Inflate or Die, Part 1

The Fed can’t stop printing money.

Now it has discovered that the trillions of dollars it already “printed” can’t be neutralized or rolled back.

The genie can’t be put back in the bottle.

The Fed tried that. It tried to undo some of the trillions of dollars of funny money it created in Quantitative Easing. That’s because even Fed officials know that if those trillions of dollars aren’t somehow unwound before they work their way into the general economy, they will eventually create a real Third World-style inflation here in the US.

Worse than that, the Fed not only can’t undo what it did in its QE money printing spree, it now is scrambling to print more money to replace what it tried to roll back last year.

The Fed is in a real bind. A mess of its own creation. And since we are all helpless victims of its policies, we are in a mess, too.

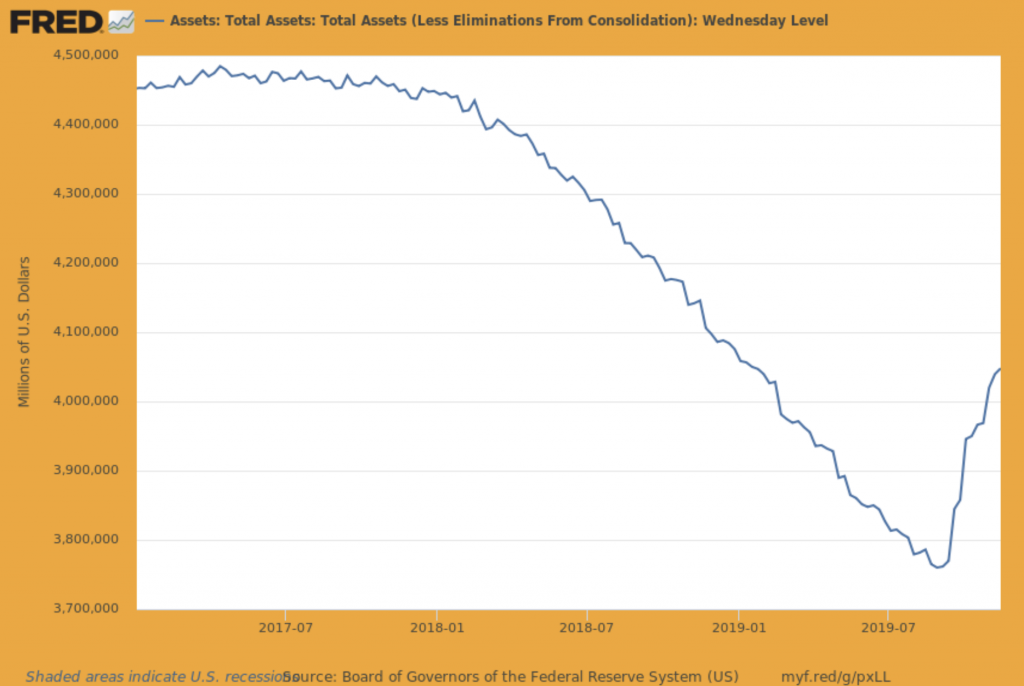

Here’s the story. It can be seen in the chart below.

The Federal Reserve reacted to the mortgage meltdown in 2008 by creating almost $4 trillion. It was all just made up digital money. It did this so that it could buy toxic mortgage and other bonds from the crony banks. To help them out. And, boy oh boy, did it ever help the crony banks out!

The spree lasted from 2008 to 2014.

This chart shows the assets on the Fed books after QE ended. It had assets bumping along close to $4.5 trillion dollars.

Recognizing the inflationary potential of that liquidity when, under certain circumstances, it starts finding its way into the commercial banks and into the consumer economy and sets off a nightmare inflation, the Fed decided to undo what it had done.

It didn’t go well. We’ll tell you what happened then and why it matters to you and the gold market in our next post, Inflate or Die, Part II.