I See Inflation

“In Every Single Aspect of Life, I See Inflation”

It is everywhere he looks. Inflation, that is. We have written about Kyle Bass before. The last time was just two weeks ago. The official Consumer Price Index reports that prices have risen five percent over the past 12 months.

But Bass says the actual inflation rate is probably about 12 percent. He sees evidence of inflation everywhere.

Bass is the founder and chief investment officer of Hayman Capital Management. We follow him because his analysis of the housing bubble was spot on. He made a half a billion dollars disregarding government economists like Alan Greenspan and Ben Bernanke.

We may see a short interlude of slightly lower inflation, he says. That is because the huge burst of inflation that hit in the last few months was enormous. If reported inflation rates ease off from those sudden climbs, it may make inflation look transitory as the Fed has insisted.

But Bass says to keep your eye on the ball, the burgeoning money supply:

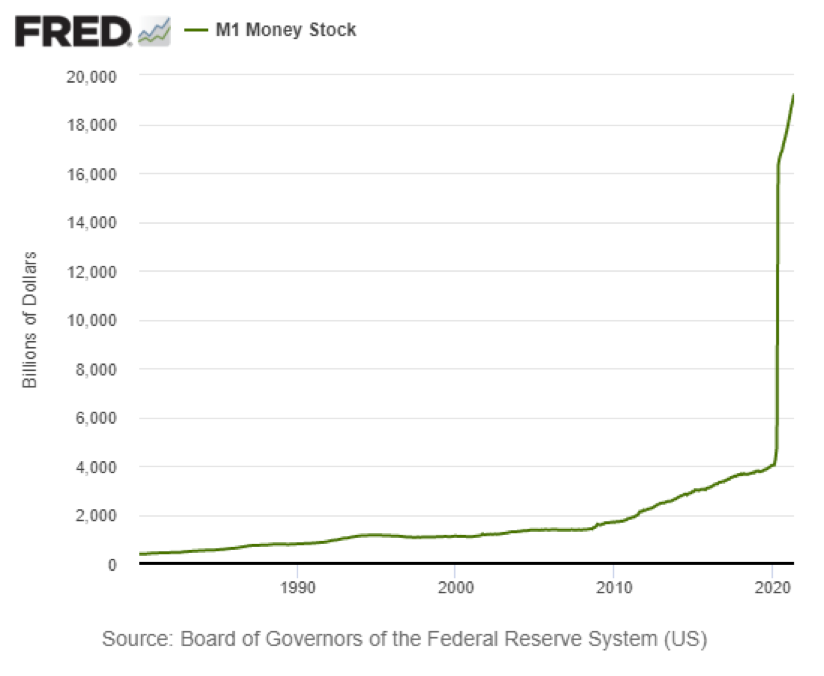

“When you look at the money supply, the broad money in the US system from 1980 to 2010, it vacillated between 50 and 60 percent of GDP. Post the global financial crisis it moved up from roughly 60 to 68 or 69 percent GDP. Now we’re approaching 90 percent.

“In the one-year period, one-and-a-half-year period since COVID started, we have introduced 34 percent more broad money in our system in the shortest time period in the history United States.

“So, we’re going to see prices stay high, and move higher over time if the Fed continues to expand its balance sheet.”

And of course, the Fed has taken no step to halt the expansion of its balance sheet, now growing at a rate of almost $1.5 trillion a year.

The answer for investors, says Bass, is hard assets. That is a topic he knows something about. Bass is a member of the University of Texas endowment board. He was instrumental in having the endowment invest in a billion dollars’ worth of gold. Why? Because, he said, the Fed cannot print more gold!

Which is exactly what we say.

Keep you eye on the ball!