Hyperinflation, Anyone?

Just a short message today to let you know that in establishment financial circles the term “hyperinflation” has popped up.

In a post last week, Temporary Inflation, we pointed out that — unable to deny that prices are rising throughout the economy – the Fed and the Biden administration have begun using the talking point “transitory.”

It is a meaningless term. All inflation is transitory. It always ends sometime. It may end in the destruction of an entire nation and its economy as it has in so many times and places, but it always ends.

But now we have seen the ante raised by a major bank with the introduction of the term “transitory hyperinflation.”

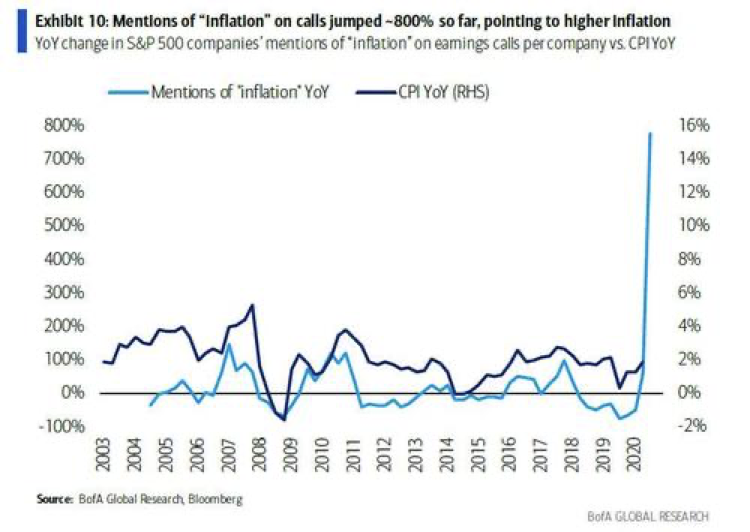

Last week a Bank of America/Merrill Lynch analyst, took note of the huge spike in the use of the term “inflation” in earnings calls from S&P 500 companies (see chart).

The head of US Equity & Quantitative Strategy at BofA wrote that this points to “at the very least, “transitory” hyperinflation ahead.”

Hyperinflation is not a term tossed around lightly. The term hyper comes from Greek, meaning over or above. One might say someone is hyper-sensitive or hyper-active. It is a mistake to try to pronounce that some fixed level or inflation rate is hyper-inflation. It is an attempt to ape the physical sciences in which measurements have quantifiable meanings. Like the temperature at which water freezes or boils.

But hyper-inflation is not a particular number. It is a prevailing monetary condition. You know it when you see it. Double-digit US inflation in the 1970’s, as destructive as it was, was not considered hyper-inflation.

Hyper-inflation ruins entire countries and destroys economies. In hyperinflation, people catch on to what is being done to the money. They become desperate to exchange the failing currency for anything tangible that has real value. The financially sophisticated prey upon the naïve. Nobody enters into transactions expecting to deal fairly; everyone is hoping to use superior knowledge or guile to exploit someone else.

Hyper-inflations pave the way for even more criminal government, as can be seen in the experiences of Germany and France. They usher in a war of all against all.

And they leave ruination in their wake.

The best protection is owning gold and silver.

It is not a good thing that a major financial institution sees hyperinflation ahead. Even if they try to soft-pedal it by calling it transient.

We urge you to find out more. Speak with a gold and silver professional at Republic Monetary Exchange today.