How is the Coronavirus Affecting the Markets?

THE CORONAVIRUS, BLACK PLAGUE, AND BLACK SWANS

We are not epidemiologists.

It is because we are dealers in precious metals and not epidemiologists, that we will leave it to others to speculate on the long-term outlook for the coronavirus, its strands, and mutations. We are innately suspicious of all government reports and news releases, to begin with, and that certainly includes whatever information about the coronavirus that comes out of Beijing!

But we don’t mind commenting on the outlook for gold.

For now, we only wish to point out that the coronavirus outbreak is a classic “Black Swan” event. A Black Swan is an unexpected event that has an outsized impact.

9/11 was a Black Swan event.

Black Swan events are almost always destructive to the established order. That would be things like government finances, trade, state currencies, and stock markets.

They are almost always bullish for gold.

The initial reactions of the markets confirm this. The Dow Industrials quickly gave up a thousand points as the coronavirus story began to spread. Gold moved up.

That is easy to understand. Stock markets and paper money schemes display fragility in the face of the unknown. Gold is robust, as its history of millennia shows.

The Black Plague decimated trade, emptied cities, produced starvation, and slammed shut the door on economic growth. It produced periods of high inflation and other economic disruptions.

Meanwhile, back in this century, here is the lead from a Wall Street Journal story, “Coronavirus Tests Market’s Faith in Global Economy,” this week:

“Investors who began the year feeling largely sanguine about the stock market are struggling to make sense of whether a growing coronavirus outbreak could upend their bets on a global economic recovery.”

From Bloomberg came this headline, “Safe Havens Shine as Spreading Virus Spurs Rush to Buy Gold.” From the story:

“ ‘News flow on the virus is pushing safe-haven buying,’ Gnanasekar Thiagarajan, director at Commtrendz Risk Management Services, said by phone from Mumbai. ‘In this kind of an environment, stock markets could tank and that fear is further adding to the risk-averse sentiment. The outlook is bullish for gold, targeting $1,610 in the near term.’ “

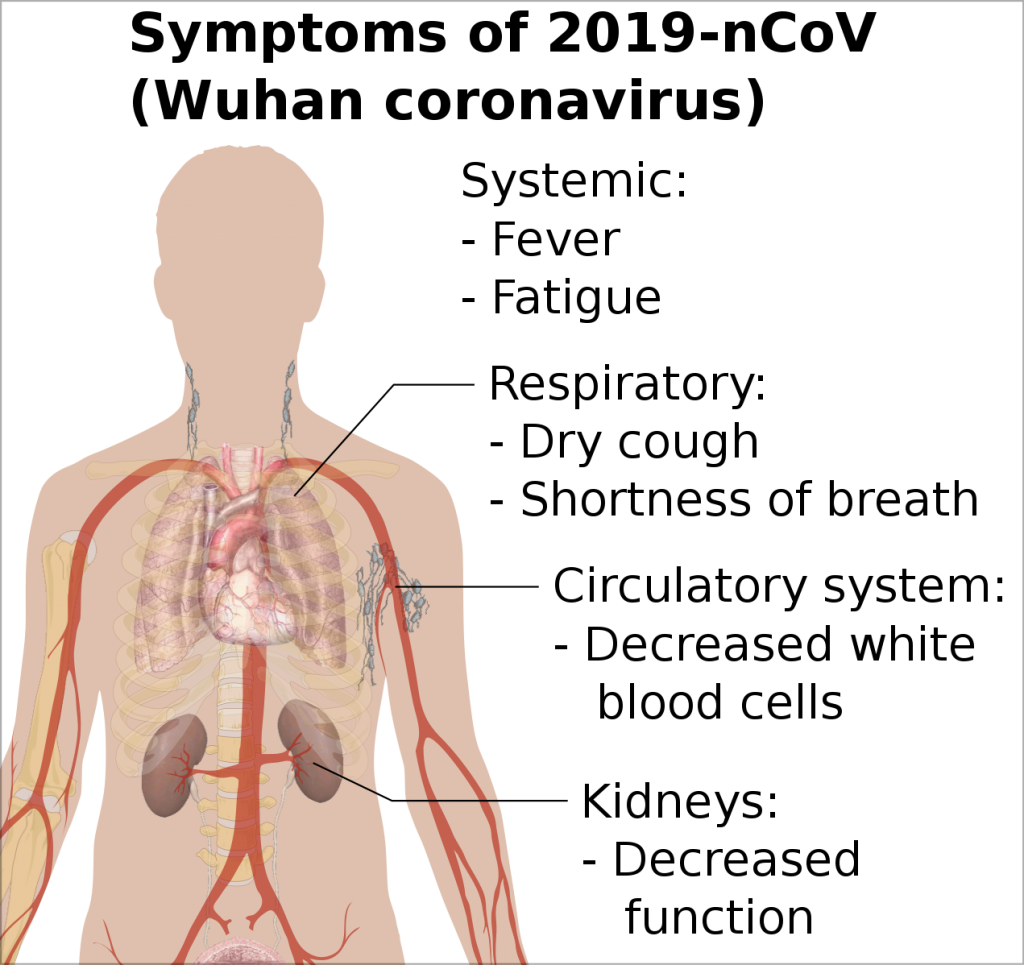

The coronavirus story is moving fast. It may be no more deadly that was swine flu or sars. On the other hand, what we know of it looks very worrisome indeed. It may be much bigger than anything the world has experienced since the Spanish flu epidemic that claimed hundreds of thousands of American lives just over 100 years ago.

We urge you to take the appearance of the coronavirus into account and take steps to protect your wealth. Use it to focus for a few moments, considering all the other so-called Black Swans events that can occur at any time: tsunamis and earthquakes, nuclear accidents, wars, and terrorist events, illnesses, and famines.

Consider as well just a few of the things that January 2020 has brought along with it:

- The deadly raging fires in Australia.

- Substantial earthquakes in Jamaica (7.7), Turkey (6.7), and the Solomon Islands (6.3).

- The assassination of Iranian major general Qasem Soleimani.

- The impeachment trial of President Trump.

- Flash floods in Jakarta, Indonesia,

- A major shakeup at the top of the Russian government.

- The coronavirus.

We think the coronavirus and its unknown impact, and all these other things are ample reasons to review your financial situation and take steps to preserve and protect your wealth with gold.