How Did We Get Here?

12 MONTHS OF MARKET CALLS, ADVICE, WARNINGS, AND RECOMMENDATIONS

See Where We’ve Been and What We’ve Said about Where We’re Going!

Here at Republic Monetary Exchange, we spend a lot of time and energy to see that our friends and clients get the very best market analysis possible. And while we don’t claim modern-day Nostradamus status, we have a distinct advantage over others who attempt to look down the road as we have done: We have been at this a long time and have seen a lot of monetary malpractice first hand, and have studied the precedents from other times and places.

We thought that now, with America at an inflection point, not quite moving to restore our former state, and only on the verge of moving into a “brave new world,” it would be helpful to review some of the market calls, advice, warnings, and recommendations we have made over the past 12 months, beginning last April.

We’ve taken short extracts from our popular blog posts over the year, highlighted essentials, and provided a link to the entire commentary.

So here you go:

IT’S THE TITANIC AND THE ICEBERG- FULL SPEED AHEAD

April 5, 2019

A look back at 4/5/19: Even a year ago it was apparent that the Fed would have to revert to more QE money printing to try to inflate away the otherwise unpayable national debt.

The Federal Reserve “printed” almost $4 trillion during the Quantitative Easing episode. Most of that hasn’t entered the consumer economy yet, but a lot of it has been stovepiped Wall Street’s way; hence the stock market bubble. Watch out.

There’s no reason that it won’t try to inflate away much of the national debt with more money printing.

Of course, that will sink the dollar. And send gold prices to the moon.

The debtberg lies straight ahead. Think of the Titanic. We are perilously close and incapable of changing direction in time.

You need to protect yourself and your family with gold.

THE FED BUBBLE

April 12, 2019

A look back at 4/12/19: It is impossible to know in advance what exactly will pop the latest central bank money bubble. You can only know for sure that it will pop…

None of this will be enough to keep the stock market bubble from popping, no matter how much it gets juiced. You can juice a runner with something to keep him going, but not forever. Eventually, he can’t be juiced any more.

We survey world events -- deep economic trouble in China, the European Union coming apart at the seams, trade hostilities growing – and add in a weakening domestic economy – and there is no shortage of pins to pop this bubble.

You’ll be happy to have moved to gold when the air comes out of stocks. And wait until you see what happens then, even crazier Fed policies like “helicopter money” that we wrote about here, and even “Modern Monetary Theory,” the newest hyper-inflationary enthusiasm of people like Alexandria Ocasio-Cortez.

We’ll keep you informed. But get out of the way.

Now.

MMT AND HELICOPTER MONEY

April 26, 2019

A look back at 4/26/19: We ourselves hoped against hope a year ago that Washington wouldn’t buy the Modern Monetary Theory nonsense. But it’s being implemented today in the Fed’s Covid-19 policies.

You can’t believe how crazy things are in Washington.

Things haven’t been sound on the money front for a long time. Certainly not since the Fed was created and we left the gold standard.

But things have gotten crazier than ever. Now people in Washington and their academic minions are working on hyper-inflationary schemes you probably haven’t even heard of!

Like “Helicopter Money.” And “Modern Monetary Theory.” That’s the one Alexandria Ocasio-Cortez likes.

The Fed’s printing press has been destroying the dollar anyway, but now the crazies want to get their hands on it.

…MMT is all the rage. Academics who should know better (and they would know better if they had studied historical schemes like John Law’s Mississippi Bubble debacle three hundred years ago) are climbing aboard. And politicians, many of whom will subscribe to any scheme that allows them to promise to give things to people and get re-elected, are falling all over themselves to sign up.

MMT hasn’t reached critical mass yet, but I suspect it will soon. Remember the old saying that those whom the gods would destroy, they first make mad.

Protect yourself and profit from the madness of our times with gold.

HANGING BY A THREAD

May 1, 2019

A look back at 5/1/19: We developed quite a reputation for our timely warnings about the stock market at the end of 2018. And we earned that reputation again this year…

What took place in stocks late in the year can honestly be described as a bloodbath. Only the most extraordinary policy reversal by the Federal Reserve was able to keep Wall Street, hedge funds, and their robot algorithms trading in the game.

… Stock market valuations are an illusion, the product of the Fed’s monetary sleight of hand.

In other words, the stock market is once again hanging by a thread.

Now you would think that after the dot.com bubble and the housing bubble, the people would be in no mood for a third Fed-engineered bubble in this young century. But the people don’t really understand how these things work. And the media doesn’t help them.

That’s why we take it as part of our job to help them figure it out with these posts, to show them the wizard behind the curtain.

ANOTHER BUBBLE

May 8, 2019

A look back at 5/8/19: Once again we pointed out last May that the stock market bubble would be popped… because that is the fate of all bubbles…

This stock market is a bubble. It’s not a bubble because we say it is a bubble. It’s a bubble because like all bubbles it is driven by the artificial creation of money and credit.

And like all bubbles, it will meet its pin.

That pin could be anything. Expected or unexpected.

Now, you would think that after the dot.com bubble and the housing bubble, the people would be in no mood for a third Fed-engineered bubble in this young century. But as we have been saying, the people don’t really understand how these things work.

And the media sure isn’t going to tell them.

GOLD TAKES OFF! NEW SILVER STRENGTH!

June 20, 2019

A look back at 6/20/19: Last summer we identified the beginning of the new bull market…

We cannot be more clear: These powerful moves in gold and silver are not accidents. The world is growing more dangerous by the moment, and central bank authorities, not just at the Federal Reserve, but in Europe and around the world, know no other course but massive credit creation and money printing.

It is a path of dollar destruction.

It is a road of no return.

We advise our friends and clients to add aggressively to their precious metal holdings now.

TWO THOUGHTS FOR THE SECOND HALF OF 2019

July 2, 2019

A look back at 7/2/19: A few months earlier, in April, we had advised clients that “so far this year, any pullback of gold below $1,300 has been a favorable opportunity to add to your holdings.”

By June, with the new gold bull market underway, we raised our target, suggesting clients take advantage of any dips below $1,400. We got a few such breaks in July.

Still, modesty demands that we chalk up to good luck that our clients had several opportunities to buy gold below $1,300 as we suggested before the bull market sprang to life in June….

We would like to suggest now that any pullback to $1,400 or below is a good gold buying opportunity. But be warned: it may not last. There is a very real and broad-based rotation into gold taking place at the level of governments and major institutions globally.

Something big is happening. Take advantage of the price break while you can.

THEY’RE BUYING GOLD

July 14, 2019

A look back at 7/14/19: If you could watch only one indicator for the future of both the dollar (lower) and gold (higher) it should be what foreign central banks are doing…

Foreign governments and their central banks have lost faith in the US dollar.

Trust in the dollar dates back more than a century when people used expressions like “sound as a dollar,” or “the dollar is as good as gold.”

Although faith in the dollar lasted for a long time, today it is eroding rapidly.

… Foreigners have reasons of their own for shying away from the dollar. Things like the Iraq war didn’t help. Economic sanctions that have replaced diplomacy are another reason that foreign nations are abandoning the dollar.

But those reasons wouldn’t really matter, and the dollar’s preeminence would last, if the dollar were still as good as gold.

But, of course, it is not.

That’s why China added 10.3 tons of gold to its reserves in June. That’s the seventh straight month that China added to its official gold position. It is in addition to the 74 tons it added in the six months through May.

The last year has seen China reduce its US Treasury holdings by around $70 billion.

THE BULL MARKET: GOLD AND SILVER HEAD HIGHER!

August 3, 2019

A look back at 8/3/19: In this post we confirmed the new gold and silver bull market was off and running...

Other authorities, like gold expert and former presidential candidate Ron Paul, have joined us in identifying this as a gold and silver bull market.

Let’s review what has happened.

Gold is up more than $400 an ounce since its low of $1046 in late 2016….

This market is just getting going. Wait until you see what happens when large swaths of the public begin to realize they need to protect themselves from stock market bubbles, criminally destructive monetary policies around the world, and compounding government and corporate debt.

Then you won’t need a textbook definition to recognize the bull market!

DEFAULT RISK

September 10, 2019

A look back at 9/10/19: Even before COVID-19, few Americans had a clue how their prosperity will be impacted by the rippling waves of default and bankruptcy that were already on the horizon. But if it was bad before, now it is about to become overwhelming…

One of the most important reasons to own gold and silver is to avoid major risks common to stocks, bonds, banks, and other financial assets and transactions: the risk of insolvency and default.

All these financial markets and institutions carry a risk of insolvency and default. Those are risks that grow more threatening with each passing day.

But gold and silver are monetary commodities in their own right. They are not claims to something else somewhere else down the road. The value of an ounce of gold or silver is utterly indifferent to the issuer’s total debt, or the wisdom of its political leaders. An ounce of gold is an ounce of gold no matter whose image or national motto is engraved on it.

Its value is not contingent on someone else’s integrity.

THREE MORE NUGGETS OF NEWS

September 24, 2019

A look back at 9/24/19: We made a pretty good call when we warned our friends and clients about the October Effect in the stock market. The DJIA hit a high of 27.000 at the beginning of October and began falling. Hard. Over the next three months, it fell to 21,700. That’s a loss of more than 20 percent. Same with the S&P500.

On the evidence, we believe the stock market is being floated on Fed policy and not on economic reality. Indeed, the level of corporate debt is so high that there is a real risk of a prairie fire of defaults and bankruptcies sweeping corporate America in the event of a and economic downturn.

In any case, as September comes to an end, we want to warn stock market investors of the October effect. Goldman Sachs is warning about October volatility, which it saying runs 25 percent higher than other months dating back to 1928.

The October Effect stock market crashes include the Panic of 1907, Black Tuesday (1929), Black Thursday (1929) Black Monday (1929) and Black Monday (1987).

IMPEACHMENT AND THE STOCK MARKET

October 1, 2019

A look back at 10/1/19: Once again we warned that the stock market was being sustained by money manipulation and that a crash was inevitable, regardless of political developments…

President Trump says that if he is impeached, the stock market will crash.

We think that he is right.

We also think the stock market will crash even if he is not impeached.

That is because stocks are kept aloft by monetary policy. It is a neat trick, to appear to levitate the entire economy by monetary magic and the printing press, but that is an illusion that will shatter….

All evidence and precedent suggest another stock market crash is inevitable. We urge you to avoid the risk and to move to the safe havens of gold and silver – no matter what happens with the impeachment.

GOLD COINS FOR BLACK SWANS

October 9, 2019

A look back at 10/9/19: We have insisted all along that the problems with our debt and monetary malpractice would be their own undoing. They could be triggered by anything. In this October post, long before anyone heard of COVID-19, we speculated about some of those triggers, including “the spread of disease like the flu epidemic of a century ago…”

A Black Swan is an unexpected event.

9/11 was a Black Swan event.

So, what will the next Black Swan events be? It’s hard to say because they are unexpected….

Making a list of the possible trigger events for such a calamity is an inexhaustible exercise. We write often about the financial possibilities since they loom larger and more certain with each passing day: the ending of the dollar reserve system; unpayable sovereign and other debt; cascading government and private bankruptcies; bank failure; foreign dumping of US treasuries; runaway inflation and crippling stagflation.

But we need to allow for even less predictable Black Swans that can trigger these economic/monetary calamities. Those include everything from the sudden outbreak of war, widespread crop failures, and the spread of disease like the flu epidemic of a century ago, to uncontrollable civil turmoil, power grid failures, earthquakes, volcanic eruptions, and even less likely events like an asteroid impact.

Unexpected? Unlikely? Precisely the qualities of the Black Swan events that order and reorder just about everything in our lives.

MONEY PRINTERS GONE WILD!

October 27, 2019

A look back at 10/27/2019: The Fed didn’t announce it. In fact, it tried to hide it. But we noted a new round of Quantitative Easing in late October. Now, less than six months later, it is proving to be bigger that anyone could have imagined…

The Federal Reserve has quietly launched a massive new round of money printing.

We hope you will take time with this very important piece. It should be shared widely. It describes a new phase of Fed monetary management, a turning point that people will look back on as a crucial moment in the US economy, and one that will drive gold to new heights.

The Fed has quietly launched a new round of Quantitative Easing (QE), the most outrageous monetary experiment in American history.…

This money supply growth and the new QE is a policy error that must result in serious consequences for the general economy, as well a much higher gold prices.

The Fed can create more dollars with a computer keystroke, but it can’t print more gold.

That’s why gold goes up.

ANOTHER RATE CUT? MORE THAN MEETS THE EYE?

November 3, 2019

A look back at 11/3/19: We knew that liquidity trouble was brewing behind the scenes in the US economy and pointed it out in this post. The depth of the liquidity problem is still not widely understood and has been overshadowed by the Fed actions of the last month. But it will not go away…

The stock market is cruising along around all-time highs. The economy, we are told, is doing great. In fact, we are in the longest economic expansion in history, we are told. On Friday we learned what the Fed would already have had a peek at, that employment was strong, with “blowout” numbers.

But if everything was hunky-dory, why did the Fed feel it was necessary to cut rates three straight times in a row?

In September the Fed began providing billions of dollars to the repo market, the overnight and short-term borrowing market among financial institutions, banks and hedge funds, which found itself in a “liquidity event.”

The Federal Reserve has tried to soft-pedal it, but in October it launched a massive new money printing program….

They don’t do this because they think everything is just fine.

Nor was QE money printing a policy option created for times when everything is alright, either.

There is more to all this than meets the eye. Extreme measures are being taken. Extreme measures imply extreme conditions. The Fed is acting like something big is brewing.

BEWARE THE MOTHER OF ALL BUBBLES!

November 12, 2019

A look back at 11/12/19: We remember the money Americans lost in the popping of the dot com bubble, and the millions who lost their homes in the middle of the mortgage bubble. So in November we wrote about the pain of the popping of the latest bubble. Right now, during the lockdown phase of the Coved-19 pandemic, few are looking ahead at the pain this bubble will mean…

Market bubbles don’t just happen. They are the result of the government or its financial arm artificially creating excesses money and credit conditions. Fractional reserve banking, policies like Quantitative Easing, outright money printing, and interest rate manipulations are the tools they use to create these excesses, sending misleading signals to investors and businesses alike.

The pain of bubbles popping – the unemployment, the impoverishment of millions, the bankruptcies, the loss of families’ hard-earned financial security, even the loss of freedom and the ruin of entire countries – seem like they should be reason enough for bubble policies to be avoided in favor of sound, gold based monetary systems. But the inevitable suffering of the people is never enough to stop the bubble-blowers.

BUY GOLD SAFELY: FACE TO FACE!

November 24, 2019

A look back at 11/24/19: We must have been looking down the road when we wrote this piece. But it’s only because we’ve seen it before… Other dealers and our competitors that can’t deliver precious metals and ask their clients to pay and wait for their gold and silver… eventually.

Don’t do that! Republic Monetary Exchange makes immediate deliver!

We believe everyone should own gold and silver. But we encourage people to use best practices in both buying and selling precious metals.

Said differently, we encourage people to use common sense.

We just don’t think it’s a good idea to buy gold and silver from boiler room operators or to send your money somewhere across the country to a voice on the phone. At a place you know nothing about.

And then wait for weeks to get your gold.

You should be able to buy with confidence. Face-to-face. Getting your gold and silver right then for most of the commonly traded products. On the spot upon receipt of good funds. That’s how we do business. Best practices.

WHAT IS THE FED SO AFRAID OF?

December 15, 2019

A look back at 12/15/19: Of course, Federal Reserve officials knew more than we did about the extent of liquidity problems caused by their manipulations when we wrote about it in mid-December. But we spotted their desperation and knew something was up…

The Federal Reserve is panicking. Or at least it is acting like it, with moves of seeming desperation that are not clearly explained.

The Fed is quietly printing money like crazy. But it isn’t saying what it is so afraid of.

For anyone steeped in the unhinged Keynesian theories that rule at the central bank, three interest rate cuts in 2019 are not internally logical. The US economy is enjoying the longest sustained boom in history, now running 126 months. And unemployment is said to be at a 50-year low.

Keynesian theory calls for lowering rates, deficit spending, and loose money when the economy is in contraction. Not in an expansion.

And now the Fed has cranked its money creation machines to eleven. As the rock music parody motion picture Spinal Tap showed, eleven is even faster than the top rate of ten!

And indeed, the new money printing regime is faster than Quantitative Easing, the unprecedented monetary experiment that gushed forth almost $4 trillion beginning in the Great Recession.

Liquidity operations, more repo funding, more QE. We refer to them generically: more money printing.

What is going on in the Marriner Eccles Building in Washington? Why has the Fed cranked the presses up faster than fast?

Although it’s all shrouded in mystery, we can suggest some possibilities.

Informed sources say the Fed is desperately trying to stop interest rates from flaring up… and spreading like wildfire.

STANDING IN LINE TO BUY GOLD

January 22, 2020

A look back at 1/22/20: No amount of standing in line has been able to help people trying to get gold from many of our competitors… They just don’t have the goods. At Republic Monetary Exchange, we have inventory and continue to deliver for our clients…

It has happened before. And it will happen again.

We didn’t expect it to happen now. But it did, in Germany earlier this month.

We’ve seen it before. People standing in lines that snake around the block, that is, waiting for their turn to buy gold. Hoping that they’ll get their turn before it’s too late.

THE CORONAVIRUS, BLACK PLAGUE, AND BLACK SWANS

January 28, 2020

A look back at 1/28/2020: We left it to others to comment about the long-term outlook for the coronavirus, but we are well-situated to comment on the outlook for gold….

For now, we only wish to point out that the coronavirus outbreak is a classic “Black Swan” event. A Black Swan is an unexpected event that has an outsized impact.

9/11 was a Black Swan event.

Black Swan events are almost always destructive to the established order. That would be things like government finances, trade, state currencies, and stock markets.

They are almost always bullish for gold.

PANDEMIC – STOCKS, GOLD, AND CENTRAL BANKS

February 4, 2020

A look back at 2/4/20: As the pandemic continued to unfold in early February, the stock market sell-off had only just begun. We wrote that there is no way out for the Fed. There is no way out for the US economy as a whole, or for the monetary system. There is only the opportunity for people to protect themselves individually…

If the Coronavirus has the deadly punch that many fear, its financial impact on the stock markets will be devastating and gold will rocket higher. If Coronavirus proves to be less than a pandemic-level catastrophe, the central banks’ additional money printing will send gold higher as well.

The central banks are in a box of their own creation.

The risk to stocks is extraordinarily high. Gold is the only safe haven.

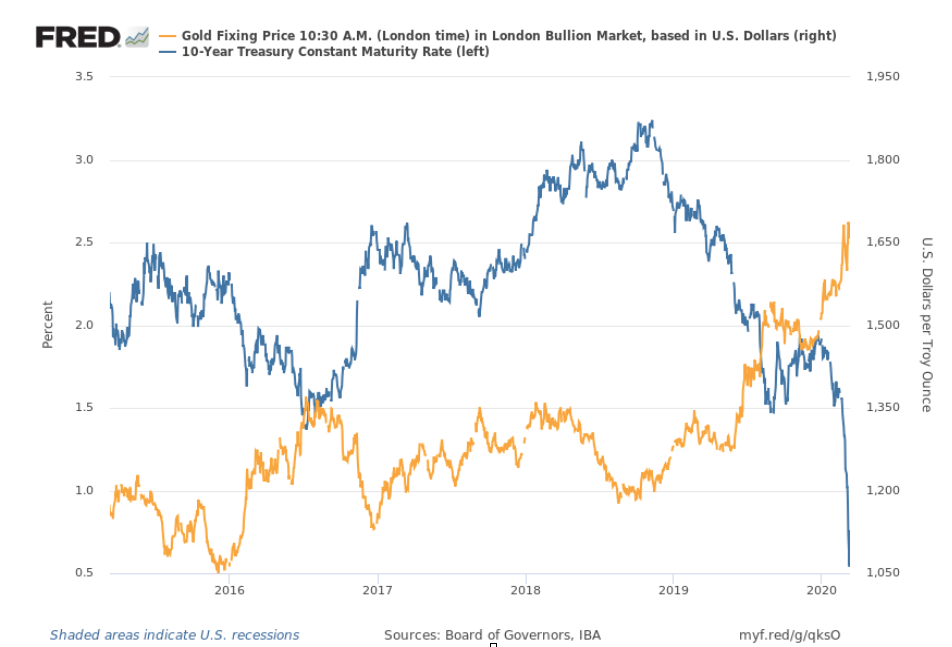

CHARTS AND THE STAMPEDE TO GOLD

March 11, 2020

A look back at 3/11/20: The Fed doesn’t know what to do other than try to force interest rates lower and “stimulate” the economy by printing money. In March we provided a graphic representation of mirror image between the Fed’s artificially low interest rates and higher gold prices.

Now the Fed has forced interest rates to never-before-seen lows, with the 10-year yield has actually dipped below .5 percent. Plunging rates in 2020 on the right side of the chart are impossible to miss. They foretell higher gold prices.

We would not like to have the job of persuading US Treasury bond buyers and auction bidders that loaning money to Uncle Sam for 10 years at for a paltry one-half a percent annual return is a good deal. Especially since it is clear that the Washington big spenders are going to have to borrow an additional trillion dollars or more each year for the foreseeable future.

A guaranteed loss is assured since it is the policy of the Federal Reserve to erode the purchasing power of the dollar at four times that rate each year.

● ● ●

So there is a review of some of our market calls, advice, warnings, and recommendations from the last 12 months. You will be well-informed by a review of these articles. But remember, it is not enough to know. One must act.

Bookmark our website. Read our alerts. We even encourage you to share these posts on Facebook and Twitter.

Then, when you’re ready to act, call or stop by Republic Monetary Exchange.

But don’t wait until it’s too late!