Grocery Prices Take Off

The authorities cannot print trillions of dollars, money unbacked by anything and conjured out of nothing, without impacting prices.

And that is probably the best reason today to buy gold. Because the Federal Reserve has been printing money like there is no tomorrow.

Last year at this time, in the middle of June, the Fed carried $3.8 trillion of assets on its book. That’s $3.8 trillion dollars worth of financial instruments, mortgage bonds, debt securities, government bonds.

Now, twelve months later its assets have climbed to $7.1 trillion. That means that in the last twelve months the Fed has purchased $3.3 trillion more. It has printed $3.3 trillion in the last year. Most of it in the last three or four months.

All that new money blows the stock market bubble back up for now. That’s why they do it. As David Stockman said, the Fed is the vassal of Wall Street and the banking cartel that created it in the first place. Bubble after bubble. The Fed “dances with them that brung ‘em.”

Sometimes a Fed money printing spree blows consumer prices higher. Look back to the 1970s and double-digit consumer price increases.

Sometimes the money printing inflates dot com stocks. Another time it is housing prices. The next time it’s the stock or the bond market.

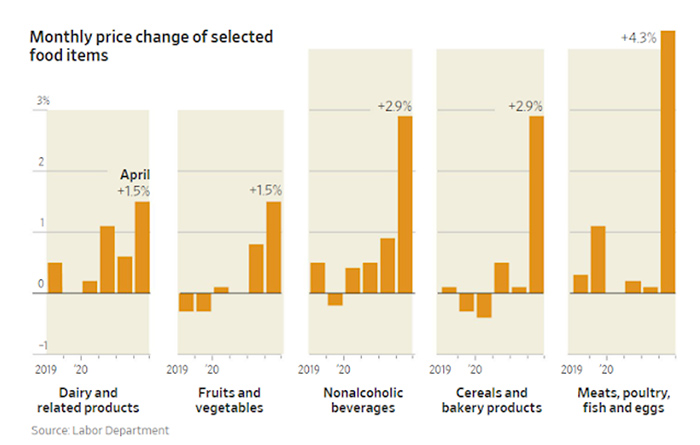

This time it could very well be consumer prices that take off. A hat tip to economist Robert Wenzel at Economic Policy Journal for pointing out news from the Wall Street Journal that we might have missed, the “Fastest-Rising Food Prices in Decades.”

Food prices increased 5.8 percent between March 1 and May 30, compared with the same time a year ago.

The Consumer Price Index reports that steaks, ribs and pork roasts are up 10 percent. Just the April 2.6 percent increase in grocery prices is the biggest monthly increase since the inflationary 1970s.

It would be fair to blame some of it on the coronavirus pandemic. It certainly hit the meat industry hard. But no matter what sector of the economy forms the biggest bubble, as Wenzel says, “It is only the beginning folks.

“Mad Jay Powell is pumping trillions of dollars into the economy that will be bidding for the goods and services out there.”

The best thing you can do is protect yourself with precious metals. We know a thing or two about periods like this because we’ve lived them before. Call or visit Republic Monetary Exchange today.