Goodbye Middle Class, Hello Grim Economic Outlook

News you need to know about money and gold

Today’s key stories have to do with how American workers and consumers are doing, and where global inflation is the highest.

The wage statistics just released by the Social Security Administration show that the median wage for 2020 was just $34,612.04.

That means 50 percent of all workers made that or less last year, which prompted economic blogger Michael Snyder to say, “Goodbye middle class.”

Along the same lines, we ran across a story on CNBC with “tips for grocery shopping on a budget now that prices are going up.” Among the tips: “Buy less meat.”

Gee, thanks.

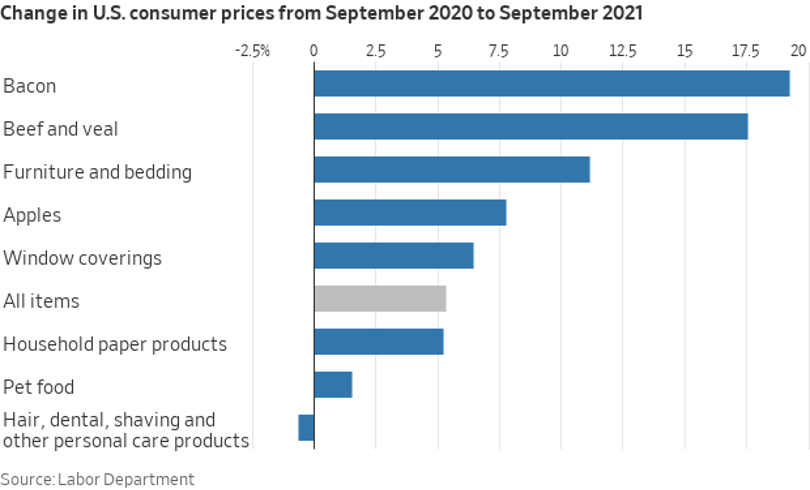

Here’s a chart showing some of the consumer price changes over the last twelve months:

Stephen Moore, who President Trump nominated to the Federal Reserve Board in 2019, but who withdrew his name from consideration, passed along some numbers about working Americans’ declining earnings.

Median weekly earnings in the third quarter,2021 were $1,003 – just 0.7 percent higher than a year earlier ($996). Inflation was 5.3% over the same period.

So, Moore writes, after adjusting for inflation workers are losing $50 a week under Biden.

And that is before adding in the rising costs of gas and groceries.

Billionaire hedge fund manager Paul Tudor Jones says inflation is here to stay and that it poses a major threat to the U.S. markets and economy.

On CNBC last week (10/20) Jones said, “I think to me the No. 1 issue facing Main Street investors is inflation, and it’s pretty clear to me that inflation is not transitory.”

Jones said, “It’s probably the single biggest threat to certainly financial markets and I think to society just in general.”

A new CNBC poll finds that 79 percent of respondents judge the economy as just fair or poor. That’s the most since 2014. 46 percent believe the economy will get worse in the year ahead, the grimmest outlook in the poll’s history.

And finally, a few words about the gold standard from Ludwig von Mises:

“The gold standard did not collapse. Governments abolished it in order to pave the way for inflation. The whole grim apparatus of oppression and coercion, policemen, customs guards, penal courts, prisons, in some countries even executioners, had to be put into action in order to destroy the gold standard.”

We hope you recognize that the US economy is at a dangerous inflection point. Speak with a Republic Monetary Exchange precious metal professional to find out more. Don’t forget to pick up a copy of my new book Real Money for Free People at our offices. No cost or obligation. Just vital information.