Gold Will Continue Its Climb in 2018

Gold Will Continue Its climb in 2018, According to WGC

The World Gold Council (WGC) released a report on Friday that predicts gold will continue its climb in 2018. This year it is up 9% and in 2016 it was up 8.5% for the year. This followed after three years of decline for gold. It is worth noting as well that metals rose these past two years even as the dollar remained bullish and the stock market continued its bull run.

The World Gold Council (WGC) released a report on Friday that predicts gold will continue its climb in 2018. This year it is up 9% and in 2016 it was up 8.5% for the year. This followed after three years of decline for gold. It is worth noting as well that metals rose these past two years even as the dollar remained bullish and the stock market continued its bull run.

Metals rose this year on an increased amount of geopolitical tensions from North Korea, Saudi Arabia, and Israel, and most expect further escalation going forward. The WGC report also stated that monetary policy and increased demand around the globe will fuel the rise. Furthermore, it looks like the Federal Reserve is going to continue to hike rates and unwind its balance sheet while the Bank of Japan reins back quantitative easing and the European Central Bank slows its monetary policy. This could contribute to gold demand around the world. Gold demand has been on the rise in countries like Russia, Germany, India, and China, and these trends are projected to grow further.

What this means for investors: Gold prices have been struggling against a stock market that has hit multiple new records this year. Prices are down from the highs over $1,300 that it experienced this year, but metals have managed to stay slightly bullish. Long term growth looks positive for both gold and silver.

Federal Reserve Hikes Rates, Dollar Fluctuations Move Gold

Gold was up and down this week. It was fluctuating inversely to the dollar index as it moved up and down this week as well. Uncertainty on the tax reform bill going through was partly responsible, as was the release of U.S. economic data. On Wednesday after the Federal Reserve announced a quarter point rate hike, metals rallied with the stock market. Generally higher rates would send gold down, as higher interest rates would lower demand for non-interest bearing assets like gold. However lately interest rate hikes have been slightly bullish for gold.

Gold was up and down this week. It was fluctuating inversely to the dollar index as it moved up and down this week as well. Uncertainty on the tax reform bill going through was partly responsible, as was the release of U.S. economic data. On Wednesday after the Federal Reserve announced a quarter point rate hike, metals rallied with the stock market. Generally higher rates would send gold down, as higher interest rates would lower demand for non-interest bearing assets like gold. However lately interest rate hikes have been slightly bullish for gold.

What this means for investors: Gold prices are likely looking at the long term picture and rising. The dollar index fell after the Fed announcement despite its anticipation that it was going to happen. This was a contributing factor to gold’s rise. The dollar fell because long term growth projections remained largely unchanged and the Fed did not adjust its plan for interest rates for next year.

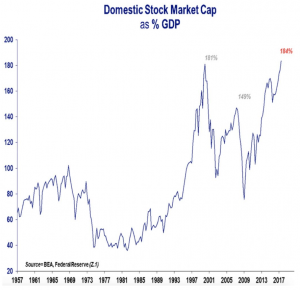

A Chart to Watch Going into 2018

This is an important chart to watch going into the new year. It represents the domestic stock market cap as percentage of U.S. GDP. Right now, the stock market cap is 184% of GDP.

What this means for investors: The other two times in recent history that the stock market cap reached such levels was in about 1998 and 2007. This predicated market crashes and recessions. Currently, the percentage is even higher. The market is overvalued, and will have to undergo a correction eventually.

Bitcoin Eating Away at Gold Investing?

I’ve discussed several times now the relationship between gold and cryptocurrencies like bitcoin. As the bitcoin craze continues to surge, investors are taking out mortgages on their houses to buy it, taking out loans to buy it, and, it turns out, selling gold to buy it.

I’ve discussed several times now the relationship between gold and cryptocurrencies like bitcoin. As the bitcoin craze continues to surge, investors are taking out mortgages on their houses to buy it, taking out loans to buy it, and, it turns out, selling gold to buy it.

What this means for investors: Bitcoin and other cryptocurrencies are up in some cases over 1000%. It is starting to look more and more like a massive, speculative bubble. When investors start using debt to buy up something like bitcoin, it stinks of a bubble. It looks like it could still run for a while yet, but if the bubble bursts, it would give gold a boost when all that debt money disappears from bitcoin.

Stay Connected to the Markets. Subscribe Now to Get the Gold Market Discussion Delivered Every Sunday Directly to Your Inbox!

As always, I encourage you to speak with your broker at RME for more market updates. Expert brokers are available Monday-Friday from 9 AM- 5 PM or by special appointment after hours. Call today at 602-955-6500 or toll-free at 877-354-4040.