Gold Breaking Out as Wholesale Prices Continue to Rise

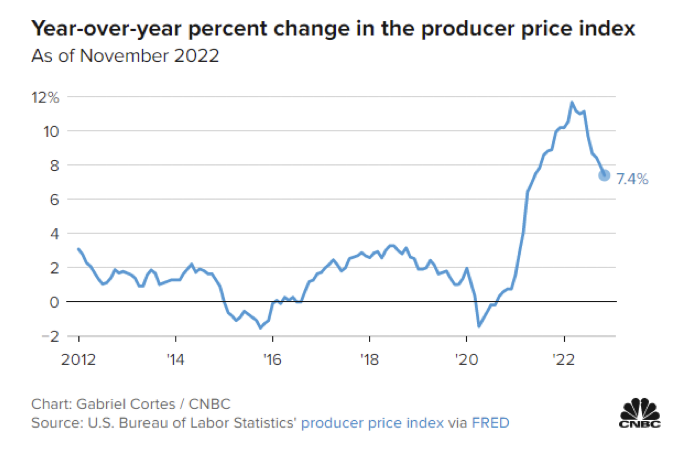

Wholesale prices keep on climbing. And so do gold and silver!

Wholesale prices have risen at a 7.4 percent rate in the 12 months ending in November.

Does anybody think a 7.4 percent hike in the Producer Price Index represents a victory over inflation and that the Federal Reserve Board members can all come out and take a bow?

Probably not. Remember that wholesale prices are in the pipeline headed toward you as consumer prices. Consumer prices through November will be reported on Tuesday (12/13/22).

Then the Fed announces its policy changes the next day, Wednesday. If it raises its Fed funds rate by one-half percent, it is effectively taking a bow, telling itself that it has done well. If it doesn’t raise rates more, a possible 75 basis points, it means it is more worried about a general slowdown and is settling for halfway measures on the inflation front.

One of the financial news site headlines called the producer price numbers “a surprise inflation read.” Seem like the financial press has been surprised by just about everything lately.

Blackrock, the world’s largest investment firm might have a better idea about things right now than the media consensus. We’re entering a period of heightened instability, it says, and watch out for the stock market: “Equity valuations don’t yet reflect the damage ahead.” As if to confirm that view, for the week of December 7, US equity funds experienced the biggest outflow in about a year and a half.

Blackrock must have noticed as well that the personal savings rate is at a 17-year low, but consumer credit card debt is at an all-time high.

For our part, we notice all the things Washington is going to pay for with money it doesn’t have. For example, President Biden intends to bail out union pension funds with a $36 billion gift. And more money for Ukraine again. Seriously, do they think money grows on trees?

Probably not. And who needs trees when they can just create the money they need with a computer keystroke at the Fed building?

Walmart probably has a better handle on real consumers that the financial press, and it says consumers remain “stressed” by inflation.

The gold and silver markets certainly don’t think inflation is yesterday’s news, either. From a low in November of $1618, gold has climbed swiftly to around $1800.

It looks like a breakout, as we said last week in this commentary.

Speak with a Republic Monetary Exchange professional today.