Gas Price Déjà vu!

Another real-life indicator of our inflation calamity!

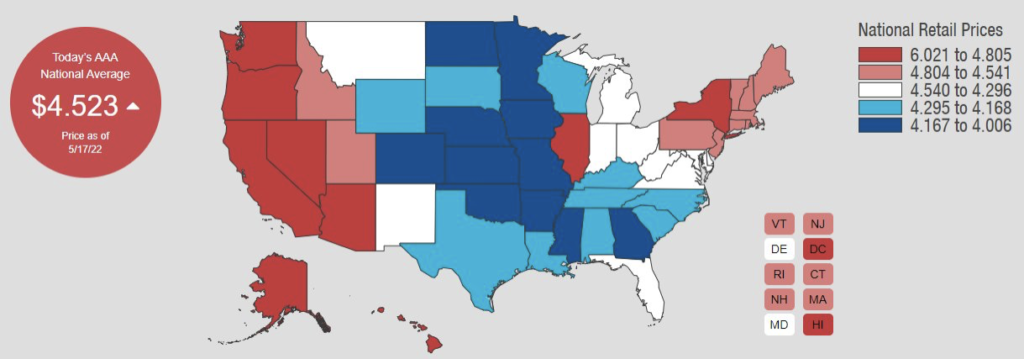

Gasoline prices are now over $4 everywhere in the country. But California gets the award for being the first state to cross over $6 a gallon.

Why are gas prices so high? In a nutshell, it is because your US dollars don’t buy as much as they did.

When people say this is the highest inflation in forty years, they are really saying that the dollar is losing purchasing power at the fastest rate in forty years.

There are other reasons, of course, for today’s sky-high oil prices, including a growth-killing Washington, DC war on oil.

We have been through energy crises like this before. In the early 1970s, when Nixon suddenly cut the last ties of the dollar to gold, foreign oil producers wondered why they should keep selling us their oil at the old prices. After all, the oil they sold was produced at the cost of real capital. It demanded costly exploration, expensive drilling and pumping operations, refining, and transportation. But the dollars they sold it for could be created in any denomination – just add a zero – at the cost of nothing more than paper and ink. Indeed, these days it is all created digitally without even the expense of paper and the messy trouble of big printing operations.

So, the OPEC producing nations warned repeatedly in the Stagflation Decade that if the dollar kept losing value, the oil price would have to move sharply higher. And it did. The oil price shocks of the 1970s had a repressive effect on the US economy.

Today energy costs are just another burden on the slowing US economy, depleting the wealth and lowering the savings and discretionary spending of the American people.

Of course, the government could do something about that. It could get out of our own way in energy production. It would quit trying to prolong the needless war in Ukraine and let Russia sell its oil to the people of the world at lower costs.

Here is a chart of oil prices (West Texas Intermediate Crude) since Biden’s election on November 3, 2020. Perhaps you will remember that on Inauguration Day, in January 2021, President Biden canceled the federal permit for the construction of the Keystone XL oil pipeline. Keystone was expected to deliver 800,000 barrels per day from Canada to the US.

Returning the US to a stable and honest monetary system would help tremendously, too. That would require a return to honest money that cannot simply be rolled off a printing press somewhere.

In the meantime, for real wealth protection in an age of monetary, financial, and resource confusion, speak with the gold and silver professionals at Republic Monetary Exchange.