Fed Interest Rate Moves Rule the Markets

Time to be wary! Move to the sidelines with gold!

Has there ever been so much blather about a Fed interest rates policy change – especially one so long in coming?

In hopes of minimizing the impact of the rate hike when it actually hits, the Fed has been telegraphing its forthcoming decision for months. The most widely anticipated step is that a 50 basis point (1/2 percent) increase in the Fed funds rate will be announced at the conclusion of the Fed’s May 3 – 4 meeting. Already the Fed is talking up additional hikes of the same amount in both June and July.

Higher US interest rates have buoyed the US dollar in currency markets recently.

This is the source of much confusion among the investing public. It is true that the dollar has risen compared to other currencies. But the dollar and the currencies that it is compared to are all losing purchasing power.

Let us restate that: The dollar is said to be higher. But in reality, it is lower. It buys less than it did before. The dollar index is up about 13 percent over the last year. But the dollar buys much less – perhaps 10 percent less than it did a year ago.

So, if you are, like the famous Seinfeld character Art Vandelay, involved in some indeterminate importing-exporting business, you may care about the dollar index and your payables and receivables in foreign currencies.

But if like most Americans, you are paid in dollars, you spend dollars, you save in dollars, and you plan your future in dollars, what really matters to you is the purchasing power of those dollars.

Once again: THE PURCHASING POWER OF YOUR DOLLARS IS DOWN.

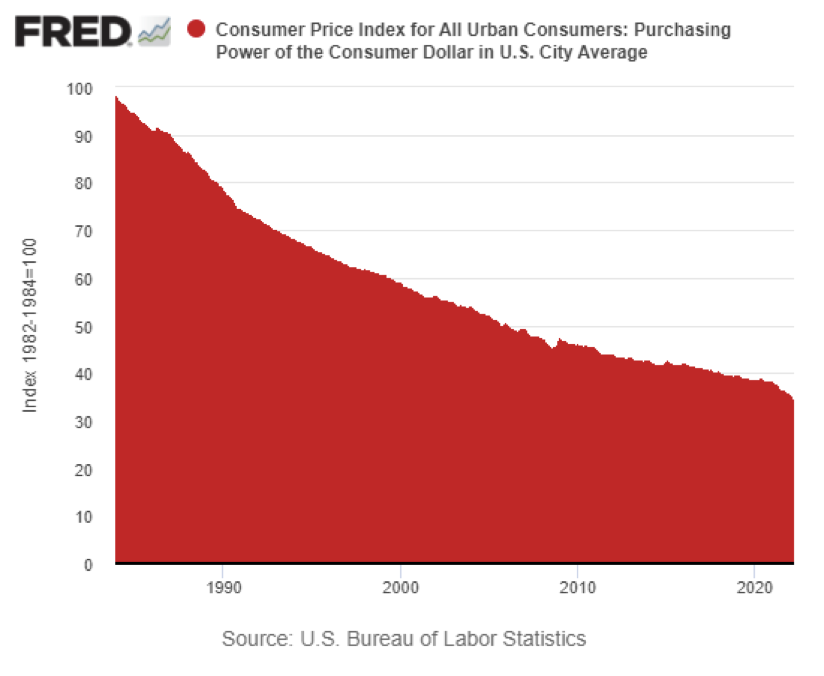

The median age in the US is 38 years. This chart shows what has happened to the purchasing power of the dollar during this average American’s life span:

What is coming with this new Fed tightening cycle? David Stockman answers: “What’s coming down the pike is not your grandfather’s recession. That is, an economic contraction caused by the Fed hitting the brakes on credit growth because the housing and business investment sectors got too hopped up on cheap debt.”

No, this time, “the Fed will be forced to keep on tightening–until real interest rates finally become meaningfully positive. And that will mean that the epicenter of the recession this time around will be Wall Street, not main street.

“As we said, what is coming down the pike is not your grandfather’s recession.”

Pay no attention to the financial news chatter that tells you the dollar is up, or that the Fed has wise policy choices on the drawing board.

It is all sleight of hand designed to distract y0u from a calamity that we have not witnessed in our lifetimes. Give all unbacked, digital, and printed fiat money wide berth as they work their way to their ultimate commodity value.

Which is nothing more than paper and ink.