Fed to Borrow $1 Trillion to Finance Deficit

A Trillion Here, a Trillion There…

A Bloomberg story begins with this headline: U.S. Treasury Set to Borrow $1 Trillion for a Second Year to Finance the Deficit.

A trillion here, a trillion there, and pretty soon you’re talking about real money.

That phrase, adapted from a quote attributed to the late Illinois Senator Everett Dirksen sometime in the 1960s, shows you just how far we’ve come. Because the line actually was, “a billion here, a billion there, and pretty soon you’re talking about real money.”

How quickly we went from measuring federal spending by the billions to the trillions.

Well, a billion dollars isn’t what it used to be.

Literally.

In fact, the 1960 dollar has lost 88 percent of its purchasing power.

How did the dollar lose so much value?

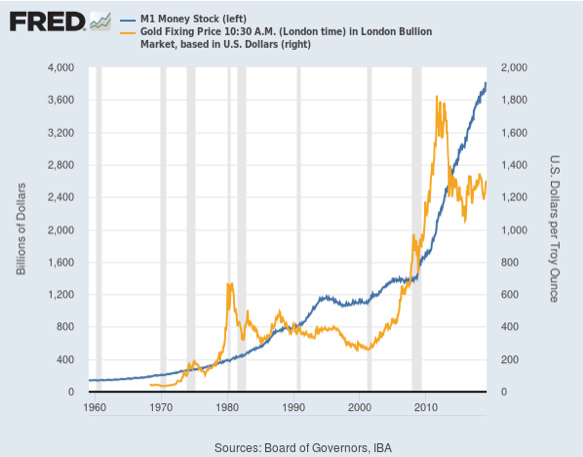

Simple. The Fed created a lot of money and credit out of nothing. As a sort of shorthand, we say the Fed “printed” a lot of dollars. The chart below is a rudimentary illustration. The blue line on the chart below depicts the growth of the US money supply since 1960 (M1: basically spendable cash, and cash equivalents like checking accounts and other demand deposits, travelers’ checks).

The gold-colored line tracks the gold price, pulled ever higher by the trajectory of the Fed’s money printing.

The Bloomberg story describes the Treasury Department’s plans to “maintain elevated sales of long-term debt to finance the government’s widening budget deficit, with new issuance projected to top $1 trillion for a second-straight year.”

Don’t ever forget that when the government borrows, it crowds out other borrowers. Every dollar the government borrows is a dollar taken out of the private wealth and job creating economy. It is true that the government spends the money it borrows, but at best government spending is just a wash. At its worst it is a black hole for the wealth of the American people such as when, for example, it pays people not to work or not to grow crops; or it spends money to blow up schools and bridges in foreign countries and then spends more to rebuild them; or it squanders the money in private subsidies for cronies, bailouts for banksters, or windfalls for beltway bandits.

Mainstream news sources mostly are missing the bigger government borrowing story. There is more to it than just the growing deficit that needs to be borrowed. Several incremental additions to the government’s borrowing needs are converging at once.

It’s a train wreck in the making.

We don’t know how far the fiscal and monetary insanity will go in this country but note that some Treasury advisors are aware of the incremental, intersecting borrowing demands ahead. But they aren’t trying to figure out how to stop it. They are scratching their heads trying to figure out how to keep the game going.

More about all of that in a future post. In the meantime, remember that one of these days even a trillion dollars won’t be what it once was. That is not an exaggeration. Not too long ago, watching its currency be destroyed, people in Zimbabwe were asking themselves what come after a quadrillion.

Better to own gold and not have to worry about such things.