Extraordinarily Uncertain

Federal Reserve chairman Jerome Powell has proclaimed the future “extraordinarily uncertain.”

It is one of the few times that he has spoken that we find ourselves nodding in agreement.

Here are some uncertainties that spring to mind: Will people ever go back to movie theaters in the numbers they did before? Or will they stay at home and watch Netflix? Will more and more companies discover they can cut commercial real estate expenses with employees working from home? How will travel and hospitality recover? What happens when the number of people defaulting on their rent climbs? What replaces all the capital, the product of years of savings, when small businesses close and lose everything? What happens to car sales if fewer people stop commuting? What happens to tax revenue with depressed economic activity and million unemployed? What happens to social welfare spending?

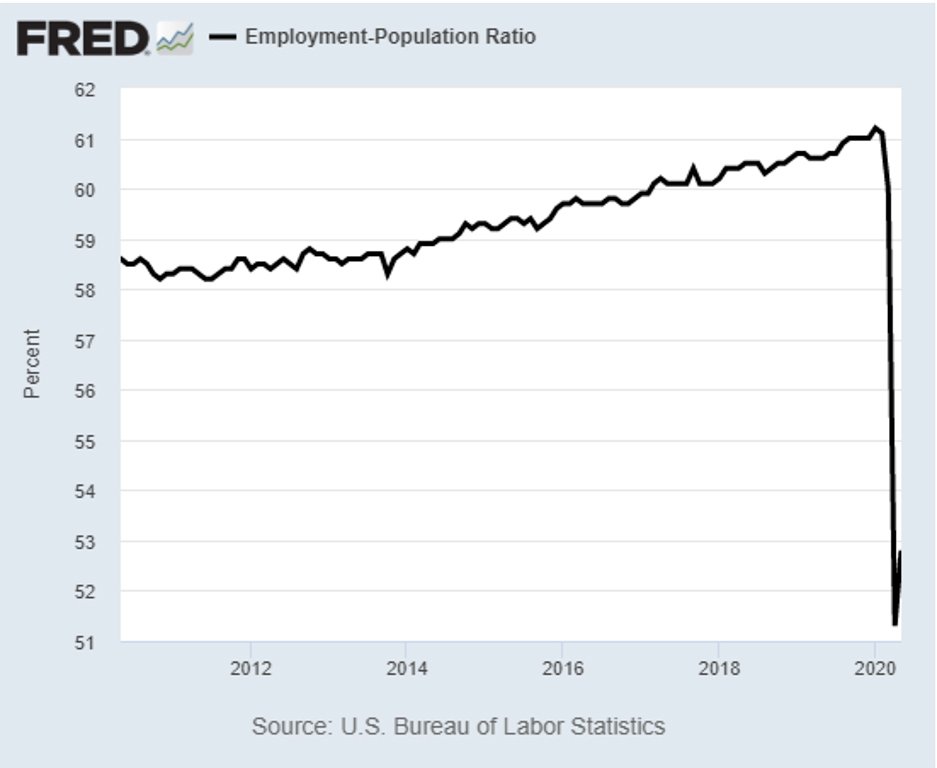

What happens when—as shown in the following chart—almost half the adult population doesn’t have a job?

What happens? Powell is right. The future is extraordinarily uncertain.

Or at least part of it is uncertain.

So instead of making wild stabs at guessing what the future will look like, let’s look at what we know for certain.

The US government has met the challenges of this year with unprecedented deficit spending. It added $3.12 trillion to its national debt in just the first six months of this year. That brings the unpayable national debt to $26.31 trillion.

The Federal Reserve has made up, conjured up, printed into existence $3 trillion that it did not have on New Years’ Eve 2019.

And with the made-up money, it has purchased the corporate debt of private companies: Wal-Mart, Berkshire Hathaway, Phillip Morris. It has purchased government securities, agency securities, and junk bonds.

In other words, Washington’s bubble makers are blowing up bigger bubbles in government debt, in corporate debt, in agency debt. They are doing so the way they always do it, with Fed money printing.

From Reuters:

“The Fed has cut rates to near-zero, bought trillions of dollars of bonds and rolled out nearly a dozen credit backstopping programs to boost the economy and steady markets. The Fed has also pledged that it will use the ‘full range of tools’ to support the U.S. economy.”

Using the full range of its tools is how they blew up the mega-housing bubble and the huge dot com bubble: by the artificial creation of money and credit.

The Dow Jones Industrial Average is down 3.5 percent this year. We get that. We don’t think a shut-down economy, smashed-up businesses, and broken-down employment is good for stocks, either.

But the one thing we know for certain is that every problem will be met by Washington with more deficit spending, and by the Fed with more money printing.

Every problem. Of that we can be certain.

They are one-trick ponies. That’s all they have. They make the bubbles bigger, the economy less resilient, and the eventual meltdown more painful.

And they make gold go up.

No wonder, then, that gold is already up about 17 percent this year. Gold is up almost 18 percent in terms of the euro and 25 percent in the British pound.

Gold has climbed 28 percent higher over the last 12 months, while silver has climbed 18 percent.

We’re just getting started.