Economic Pessimism Growing

Remember, the authorities can’t print more gold!

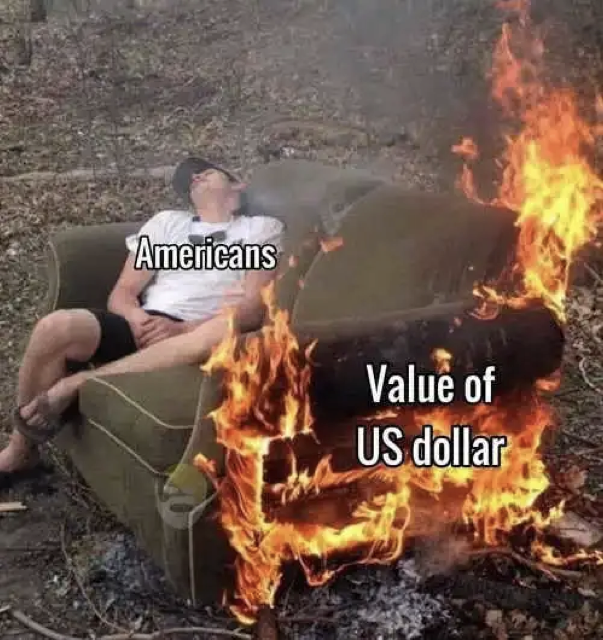

Gallup, the polling organization, tells us that consumer confidence has fallen off a cliff. It lower today than during the worst of the pandemic shutdown.

In fact, consumer confidence has not been this low since the Great Recession with the mortgage meltdown and the housing bubble bust.

Collapsing consumer confidence is a leading indicator of recessions.

The problem today according to Gallup’s survey: High inflation and rising interest rates.

Meanwhile, President Biden had a photo op with Federal Reserve chairman Jerome Powell on Tuesday (5/31). It was a chance for Biden to make sure Powell and the Fed take as much of the blame as possible for our inflation crisis. “I’m not going to interfere with their critically important work,” said Biden at the start of the meeting. “They have a laser focus on addressing inflation, just like I am [sic].”

Officials can pose and blame shift all they want, but Texas hedge funder Kyle Bass says there are two things that they can’t change. “They can’t change the global supply problem for hydrocarbons, which has been based upon a decade of bad policy, and they can’t change the price of food.”

“We’re in a scenario where we have a stagflationary environment,” Bass said. “I think the economy’s going to cool off, I think we’ll have a recession by the end of this year or the beginning of next year.”

We take his opinion seriously. Bass is the founder and chief investment officer of Hayman Capital Management. He made half a billion dollars disregarding government economists like Alan Greenspan and Ben Bernanke.

We wrote about Bass a year ago when he was challenging the Fed to talk about transitory inflation. The massive increase in broad money measures since Covid started, said Bass, rules out transitory. “So, we’re going to see prices stay high, and move higher over time if the Fed continues to expand its balance sheet,” he said.

The answer for investors is hard assets, according to Bass. He is a member of the University of Texas endowment board and was instrumental in having the endowment invest in a billion dollars’ worth of gold. Why? Because, said Bass, the Fed cannot print more gold!

That sounds like something we’d say! And in fact, we have said it over and over.

Speak with a Republic Monetary Exchange gold and silver specialist today, for wealth preservation and profit.