Dollar Woes

How much are you willing to lose at the hands of Washington?

Over the years we have mocked reports, repeated like a mantra by the mainstream media, about the strength of the US dollar.

Sure, sometimes one of the major world currencies is losing value faster than the dollar, and sometimes more slowly, so the dollar can be said to be up or down against the bluro or the yawn or some other unbacked fiat currency.

But just don’t call that strength. If the dollar buys you less, it is in no way strong. It is weak.

And as Americans know, the dollar is buying them a lot less these days. And its not just the price of eggs, either.

Jeffrey Tucker from the Brownstone Institute describes the real living experience of the American people this way:

The bottom line is undeniable: in a mere two years, many of the things you loved, healthy food for your families—I’m not talking about the all-carb diet they want us to adopt—has now doubled in price.

Some is up 50 percent and some is up 150 percent. This damage is absolutely not captured in the CPI, which has huge drawbacks by being calculated on an annual basis and for being a weighted index number that fails to capture the reality on the ground.

The reality you see on the shelves of your local store. The grocery prices tell the truth that you are being pillaged.

The pillaging is not limited to this problem however. And by the way, this is NOT going to improve. It would take a dramatic deflation to restore our living standards. The Fed will never permit that. At best, their intention is to take down the inflation rate to 2 percent per annum. It now stands at about 6 percent, maybe. So even if it happens to fall to zero, all prevailing prices will stick. That means that you have been robbed.

All of this has happened out in the open. The responsible parties have been hiding in plain sight, says Tucker:

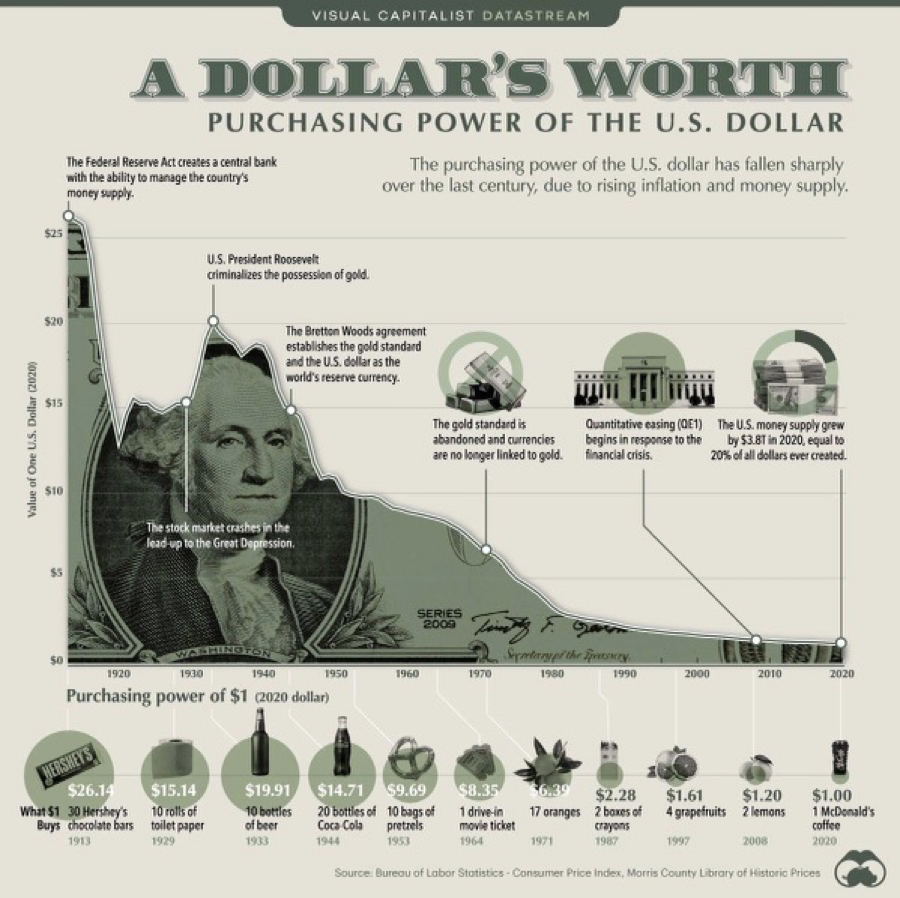

Please understand: this was accomplished not by Putin or greedy corporations but by the Federal Reserve. They have the legal power to counterfeit. They do it by buying government debt with money that had not previously existed. This new money makes its way through the economy, watering down the value of existing money.

… It does not matter that the dollar can buy more foreign currencies than ever. That has nothing to do with anything. What matters is not how much foreign currency it can buy but how many goods and services it can buy. The reason it buys far less traces to the outrageous monetary expansions of 2020 and 2021. That’s the whole reason. At one point, monetary expansion was running 26 percent per year!

They robbed you to fund their outrageous lockdown experiment and put as many businesses and people on the payroll as possible. They might as well have dropped money from helicopters. Now we are paying the price for this monetary malfeasance.

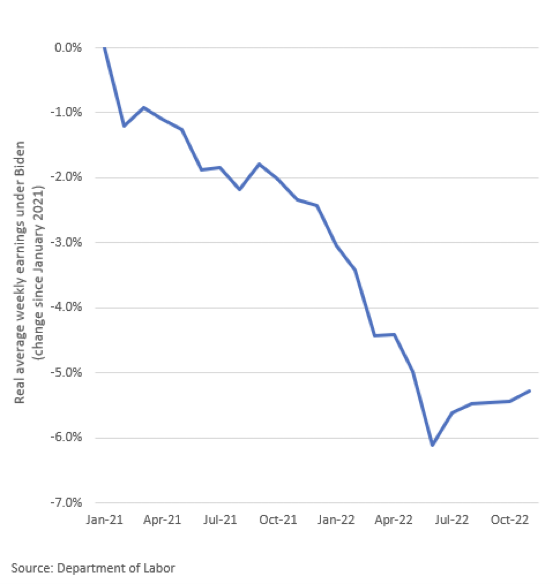

Of course, it is not the Davos crowd that is paying the price of this malfeasance. It is the average American family that has lost $4,000 to $5,000 in real-take-home pay in this period.

So, maybe you are paid in dollars. Your income is in dollars. Just don’t be fooled by the mainstream media with their on-again, off-again talk of a strong dollar. It is not true and you don’t have to save in a wasting currency.

In fact, take a look at your dollar holdings and ask yourself how much you are willing to lose at the hands of Washington. When you decide that enough is enough, come see us at Republic Monetary Exchange.