Currency Games and Paper Money Shenanigans!

As you know from our repeated comments, the Federal Reserve is moving headlong toward the issuance of its own crypto-currency dollar. This is as good a reason as any to protect your wealth with gold.

The Fed’s new digital currency is a variation – although a much more threatening one – on old-fashioned money printing: the issuance of currency unbacked by anything real. Money-printing governments at least have the logistics of paper and ink to slow their emission of evermore fresh fiat currency. State digital crypto-currency issuers will have no such complications to slow their currency creation.

This comes to mind with the recent news that Venezuela – the socialist catastrophe that is a case study in wealth destruction and currency ruination – has ordered up additional, new banknote paper.

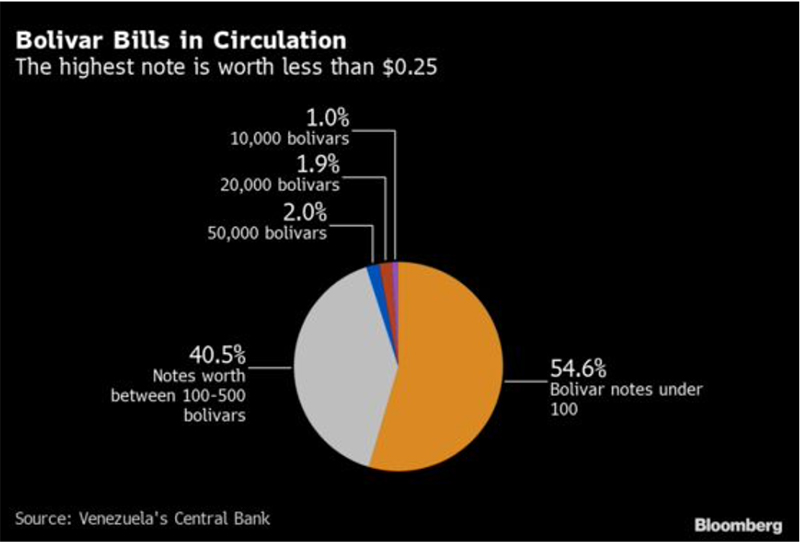

Bloomberg News reported that the country ordered 71 tons of banknote security paper from an Italian provider as it prepares for a gusher of new 100,000 bolivar notes. It was expected that the new bills would have a value of $0.23.

But of course, that value would be fleeting. Afterall, inflation in Venezuela ran 2,400 percent last year.

Getting a new paper currency stock from abroad is only one of Venezuela’s problems. Its mint has the same problems keeping the presses functioning that its energy sector has keeping its oil wells working, thanks to the parts shortages that plague socialist States everywhere. And like everything else in Venezuela – soap, toilet paper, food – shortages are even a problem with the ink the mint uses.

But think how fast inflation could run in Venezuela if the country went all-digital currency, as the US Fed envisions. Going all digital has the added advantage of enabling an authoritarian state to surveille every single financial transaction. We are not surprised the regimes like Maduro’s want to spy on everything that its people do, but there are still Americans who don’t yet understand that the US government wants its citizens’ private affairs under constant state scrutiny.

For those that would like some privacy in their financial affairs, and to get off the grid before it breaks down, we suggest gold and silver. Their importance in privacy and wealth preservation will grow with each advance in the Fed’s new digital money schemes.

A Republic Monetary Exchange gold and silver professional is standing by to help you protect you family and wealth from paper and digital currency shenanigans.