“Colossal” Gold Demand from the World’s Central Banks

Central Banks are choosing gold over cash… and investors should follow.

The numbers are now all in for the end of the year, and Central banks continue to look down the road at developing monetary conditions and increasingly opt to hold gold in their reserves.

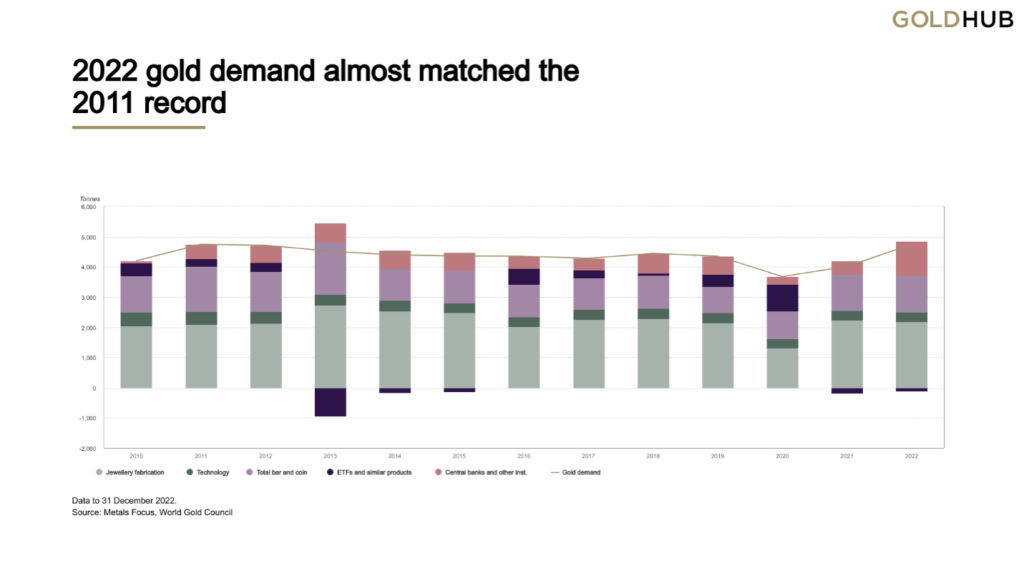

The World Gold Council (WGC) reports that annual gold demand reached an 11-year high in 2022.

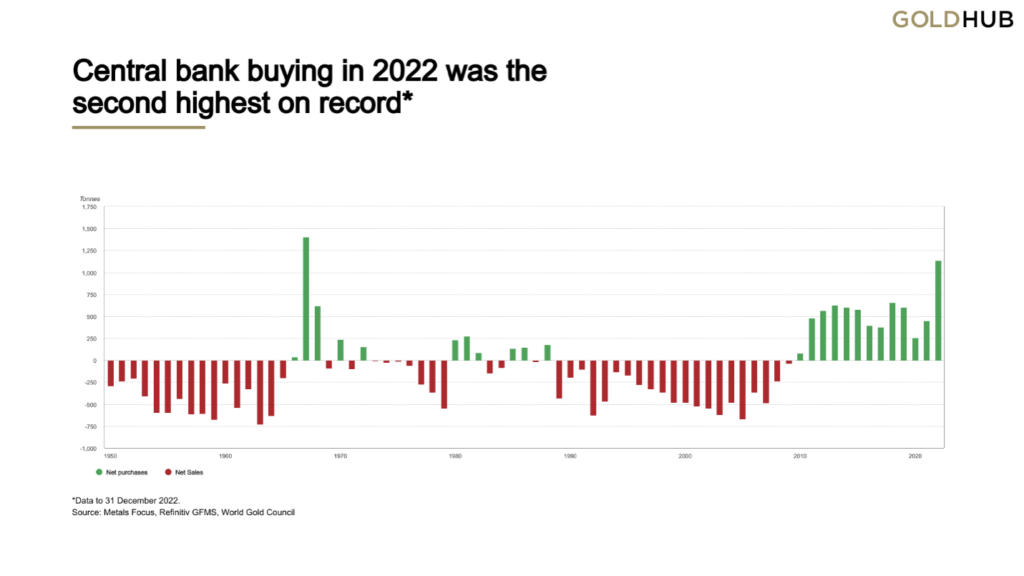

The WGC characterized central bank gold buying as “colossal!”

Central bank gold purchases hit a 55-year-high, for total acquisitions of 1,136 tons.

Overall gold demand was strong all year, including the finishing quarter. “Annual gold demand (excluding OTC) jumped 18 percent to 4,741 tons, almost on a par with 2011 – a time of exceptional investment demand.

Retail demand for coins and bars was brisk in 2022 as well, setting a nine-year high.

The trade association expects investment to rise in 2023. “Gold ETF and OTC demand – depressed during 2022 – looks set to take the baton held by last year’s strong retail bar and coin demand. Retail investments will likely be lower in Western markets albeit still healthy, as inflation fears fade, but should be robust in Asia on higher growth. However, elevated recession and geopolitical risks will likely sustain interest in gold and present upside potential as the year progresses.”

With failing confidence in the debt state monetary authorities, government debt in the unpayable range, and wars possible on two fronts, accompanied by nuclear saber-rattling, we expect significantly higher gold and silver prices in 2023. Find out more. Speak with a Republic Monetary Exchange precious metals professional today for the latest news on prices and trends.