China Keeps Buying Gold

A lot of what China does is like an iceberg. It’s hidden from open view below the waterline. But one visible activity of the Chinese People’s Republic is acquiring gold. A lot of gold.

China is up to something. It has been on a gold-buying spree for five consecutive months now. A growing position in gold is clearly a move toward assuring itself financial resilience when the prevailing fiat monetary calamity unfolds.

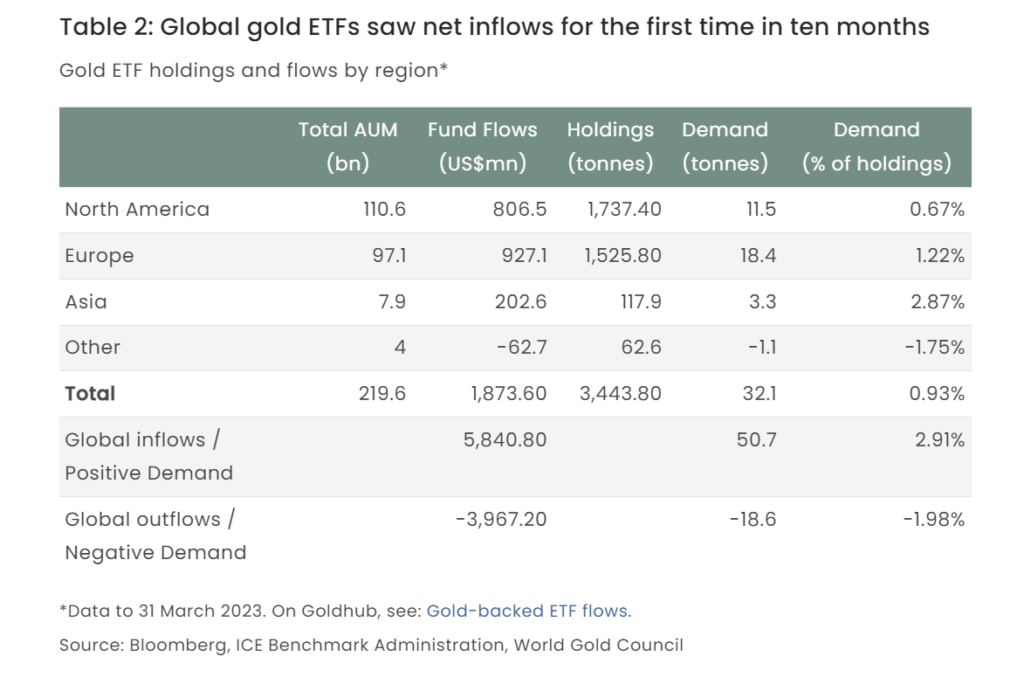

Krishan Gopaul, a World Gold Council senior market analyst, reports that China purchased an additional 18 tons of gold in March. That brings its purchases over the last five months to 120 tons.

China’s purchases have come even as the gold price has marched toward all-time highs.

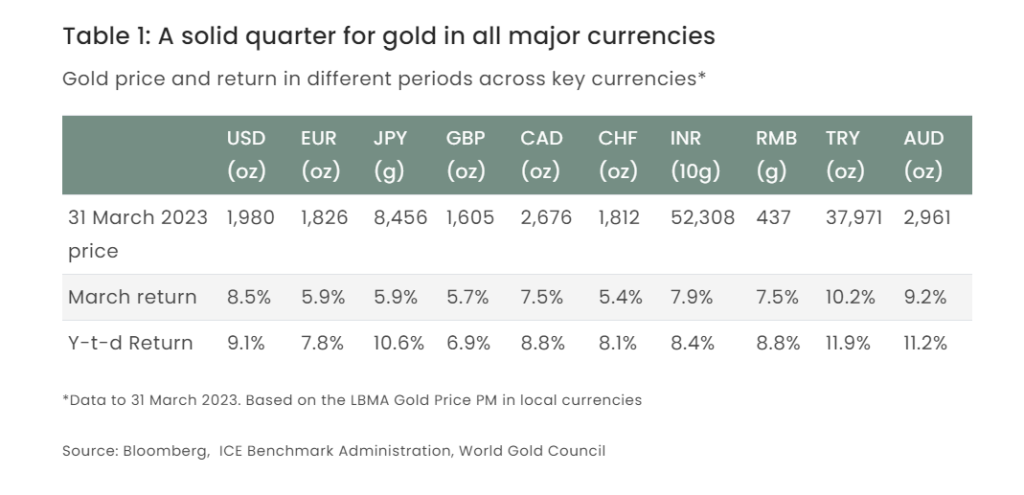

Gold’s rising price has not taken place just against a lower dollar. It has risen against all the world’s major currencies.

Meanwhile, exchange-traded funds (ETFs) have reversed course and begun making net increases in their gold holdings for the first time since April 2022.

And finally, apropos of nothing in particular, we’d like to end this commentary with the most interesting quote of the last few weeks, this one from newsletter writer Bill Bonner:

“No matter how much life insurance you buy, you will still die. And no matter how much money the Fed ‘prints,’ it will still go broke.”