Central Banks Are Still Buying Gold!

We call it the biggest monetary megatrend of our time. It is a development with long-term implications for the US dollar (not good) and for the price of gold (very good).

The headline from the World Gold Council reads, “Central banks add more gold in November as China joins the fray.”

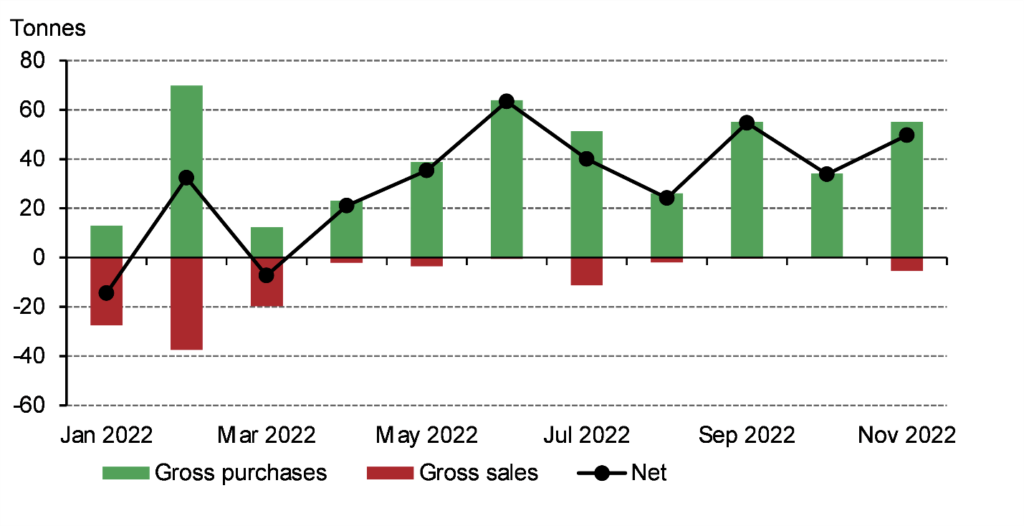

According to the report, “Central banks bought a further 50 tons on a net basis during the month, a 47 percent increase from October’s (revised) 34 tons. Of this net total, three central banks accounted for gross buying of 55 tons, while two largely contributed to gross sales of 5 tons, showing the strength of demand.”

“The biggest announcement of the month came from the People’s Bank of China (PBoC). It reported an increase of 32 tons, the largest reported purchase in November and the first announced increase in its gold reserves since September 2019. This announcement is significant given China’s historic position as a large gold buyer, having accumulated 1,448t between 2002 and 2019.

Central banks added a further 50t to global official reserves in November*

The WGC calls central bank gold buying one of the highlights of the year gone by with acquisitions of 673 tones between the first and third quarter of 2022.

Of course, we think calling this a “highlight” understates its importance for three reasons:

- Central banks fortifying their reserves with gold are doing so after the evaluation of the US dollar. They find gold to be a more reliable alternative.

- It implies the long-term return of gold to its central place in the world’s monetary system. We remind our readers along the way that countries that are net acquirers of gold become more dominant in the affairs of mankind. (That means China.) Those that are net dishoarders of gold find their global positions marginalized.

- Gold held by central banks is gold in strong hands, as opposed to ETF holdings. Central banks are not holding gold as short-term speculations.

We encourage our friends and clients to take note of this gold megatrend and participate in the powerful breakout move in gold that has been underway for two months. Move to the safety of gold.

In the meantime, the WGC promises to make the 2022 full-year numbers available at the end of January.