<h1 class="entry-title">Category: Gold Market Discussion</h1>

25

Jul

“The dollar is doomed!” So says bond market guru Jeffrey Gundlach. Well, of course, it is. Throughout history thousands of paper currencies and have come and gone, all failures eventually. It is the common fate of fiat money, money that is decreed to have value by the state, the king, the central bank, […]

23

Jul

Three Financial Bubbles at Once is Playing with Fire! Jeremy Grantham has appeared in these comments several times over the years. He is a co-founder and chief investment strategist of Grantham, Mayo, & van Otterloo (GMO), a Boston-based investment firm with some $62 billion under management. Much of Grantham’s reputation and success rests on his […]

22

Jul

The Fed insists inflation is transitory. But what does that mean? Well, it does not really say. Month after month now inflation has been running hotter than expected. Some of our friends and clients may remember Fed chairman Powell’s telling a Senate committee in February that inflation would not be a problem. But […]

16

Jul

“Money is gold, nothing else.” – JP Morgan In our last post we called your attention to a PBS Frontline documentary called “The Power of the Fed” that premiered on Tuesday, 7/13/2021. We had no expectation that the program would provide a satisfactory critique of the Federal Reserve’s destructive activities. For example, we did […]

15

Jul

The Inflation Outlook “Invest in inflation,” advised Will Rogers. “It’s the only thing that’s going up!” That advice has never been better. One of the great scandals of American monetary policy is the extremes the authorities have gone to in an effort to conceal the speed with which the money is losing value. When […]

15

Jul

Is Surging Inflation the Last Straw? We have been champions of common-sense Constitutional policies for a very long time: sound money, limited government, responsible budgets. Along the way, we have often felt lonely pointing to the Federal Reserve’s role in enabling the opposite: fraudulent, unreliable money, gargantuan government, and uncontrolled spending. For a brief […]

11

Jul

Decades of Skyrocketing Debt and Slowing Growth! We read today that well-positioned Washington lobbyists say that Biden’s tax hikes are dead. We hope our friends and clients know us well enough to know that we are no friends of tax hikes. Even so, we note that when revenue targets will not be hit, spending […]

09

Jul

“Long term, gold is the most significant guardian and guarantor of protection against inflationary and other forms of financial risks.” We have said that sort of thing many times. But this time it is a quote from a European government. The more we hear foreign heads of state and central bankers talking like this, the […]

07

Jul

“Stagflation” is one of those made-up words. Like “rockumentary,” a documentary about rock music, or “brunch,” combining breakfast and lunch. Stagflation describes an economic malady so well that it has become widely used for a period of weak or stagnant economic growth accompanied by inflation. The 1970s are often referred to as the stagflation decade, […]

04

Jul

As we celebrate America, our independence, and the birth of our Republic, remember that the Founders specifically wrote into the Constitution itself a gold and silver based monetary system for the new nation. First of all, they gave the Congress the power to coin money. From Article I, Section 8, “Congress shall have Power…to coin […]

02

Jul

Meditations on Money for the Fourth of July Today’s governing classes have abandoned the Founders’ intent to erect the new Republic on the sound monetary basis of gold and silver. The result has been an ever-growing polarization of wealth, an endless gusher of paper money, and a mountain of unpayable national debt Here is a […]

01

Jul

The Year Inflation Returned! 2021 is half over, so with this post we look at where we are heading into the second half of what we can call the year of inflation’s return. We suspect that our technically oriented readers will find it significant that gold bounced off lows around $1,678 twice this year, in […]

25

Jun

“In Every Single Aspect of Life, I See Inflation” It is everywhere he looks. Inflation, that is. We have written about Kyle Bass before. The last time was just two weeks ago. The official Consumer Price Index reports that prices have risen five percent over the past 12 months. But Bass says the actual inflation […]

24

Jun

What Are Investors Most Afraid Of? A new survey from Deutsche Bank has the answer. Not surprisingly, the Federal Reserve figures in two out of three of their biggest worries. First on the list is inflation. Thank the Fed for that. Second on the list is a new COVID variant. Third is fear of […]

22

Jun

Things We Think Our Friends and Clients Should Know In news that is important for gold and silver investors, we reported in March about an FBI raid on a private storage vault company in Beverly Hills. While the indictments were against the vault company itself, and there were no allegations against the company’s clients, the […]

20

Jun

Having acknowledged in our last post (Fake Money, Fake News) our gratitude to the Fed for providing us a chance to acquire gold and silver at lower prices, in this post we would like to shed a little more light on the forces behind the current price drop. Let us start with the Fed’s policy […]

18

Jun

The Federal Reserve has faked out the gold market with fake news… and provided us all a chance to buy gold at bargain prices! It seems funny to thank the Fed for anything, after the damage it has done to the US economy and the dollar all these years. But whatever the reason, we are […]

16

Jun

Gold Never Lies! If you are putting money in the bank, you are probably taking a real beating. “People who have money in the bank, in their savings, are losing 5 to 12 percent of their purchasing power annually.” So says investment guru Kyle Bass. He’s one of the guys who saw what was […]

11

Jun

The Real Rate of Return If the teacher called you to the chalkboard to do some basic math, you might be asked to solve a problem about the real rate of return. Here is the story problem. The interest rate on US ten-year treasuries (as we write this post) is 1.46 percent. Meanwhile prices are […]

10

Jun

“..that our Keynesian central bankers think inflation is good for everyday Americans and therefore relentlessly strive to generate more of it is one of the great follies of the present era.“ -David Stockman A lot of mainstream financial journalist could have taken some time off. (In fact, we think the public would be better informed […]

10

Jun

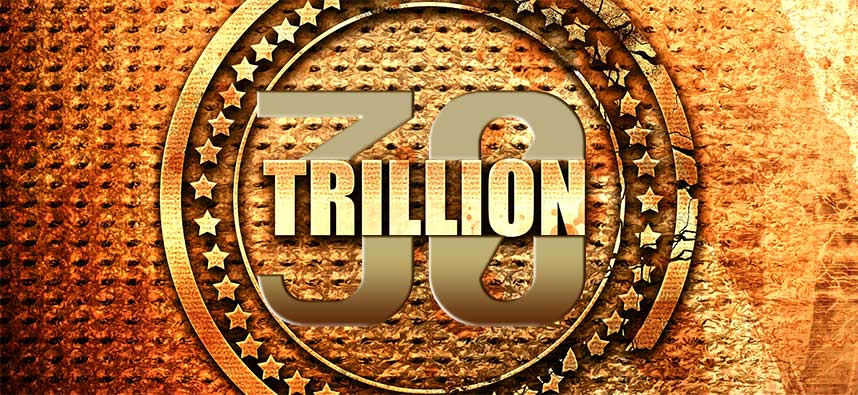

Have you noticed that nobody much is talking about the US debt these days? We scour the news and especially the financial media pretty carefully and it seems that most are hauntingly silent about the debt these days. It is a little bit like the Sherlock Holmes story about the dog that didn’t bark. […]

06

Jun

This is how inflation works: some persons get more purchasing power; some others get less. An examination of today’s wealth disparity growth in America makes clear that those who get more are the already wealthy. Those who get less are not. Social Security beneficiaries are an example of how this works. The cost of living […]

05

Jun

Germany Set their own record for annual gold purchases in 2020 Recently we wrote that due to the brutally destructive German inflation of a hundred years ago, Germans to this day retain a suspicion of money printing. Now we learn from a World Gold Council blog post that Google searches for “inflation” in Germany […]

01

Jun

Are you ready for the “Incredible Shrinking Candy Bar”? As inflation runs hot and destroys the purchasing power of the currency, product manufacturers and markets find inventive ways to conceal price increases. The most common means of hiding price increases is by reducing the size of the packages you are used to buying. For example, […]

28

May

The White House has released President Biden’s budget for his first full fiscal year. FY2022 begins on October 1, 2022 and runs through September 30, 2023. You will note the budget was released on Friday ahead of the long Memorial Day holiday weekend, a strategy to keep publicity and scrutiny to a minimum. Federal debt […]

28

May

We go to great lengths at Republic Monetary Exchange to make sure our friends and clients are well-informed about financial and monetary affairs. The truth is the more people learn about the short fuse burning on the US debt bomb and the unhinged policies of the Deep State Money Manipulators, the more they understand the […]

25

May

The United States will spend over $300 billion on interest expense this fiscal year. And that is with record low interest rates. That represents nine percent of all federal tax revenue. It is about $2,400 per household. Those are just a few of the troubling details from a new report from the Committee for a […]

21

May

The bullish fundamentals for silver are very much intact. Just the other day The Silver Institute, a Washington-based trade association, reported that silver demand for printed and flexible electronics is forecast to increase from 48 million ounces this year to 74 million ounces in 2030. That is a 54 percent increase. The Institute describes […]

21

May

Because we are in the business of helping people protect themselves and their wealth, we have written often about the consequences of inflation: the destruction of the purchasing power of the currency. Long experience shows that owning gold and silver are the best means of personal protection from currency destruction. Digital money printing by […]

18

May

Ron Paul has something to say about both April’s big jumps in prices are not going to mean changes in the Federal Reserve’s near-zero interest rate policies, according to gold expert and former Congressman Ron Paul. The Consumer Price Index rose 0.8 percent in April. Over the last 12 months, the CPI is up 4.2 […]

14

May

A New York Times headline the other day read, “Inflation Is Here. What Now?” It is almost funny the lengths the writer went to in order to avoid talking about the Federal Reserve’s massive money-printing experiments. We even word-searched the article to make sure we did not miss it. He came closest to saying […]

13

May

Pay No Attention to the Mainstream Media! By now you probably know that price inflation is running hot. The government’s Consumer Price Index rose 0.8 percent in April. Over the last 12 months it is up 4.2 percent. For the three-month period February-March-April, consumer prices are up 7.0 percent. And climbing. Wholesale prices rose […]

12

May

“It’s time for a change” in Fed policy. So said legendary hedge fund manager Stanley Druckenmiller in a Wall Street Journal editorial the other day. We first dropped Druckenmiller’s name in this space over a year ago in a piece about Wall Street’s big money players who were buying gold. We have identified […]

07

May

Three news stories that gold and silver investors need to know about! 1. Gold and Silver Prices Break Out! Precious metals have made their biggest weekly gains of this year, with the gold price moving decisively back over $1,800. Gold closed Friday (5/7) (CME) at $1,831. That’s up from the March low of $1,673, and […]

06

May

The National Debt Ceiling! So once upon a time long, long ago (we have heard) America had a political class that thought the country should be managed responsibly. Many of the founders were vigilant about the new Republic and abhorred the idea of it being buried in debt. But eventually less responsible people took over. […]

06

May

Just a short message today to let you know that in establishment financial circles the term “hyperinflation” has popped up. In a post last week, Temporary Inflation, we pointed out that — unable to deny that prices are rising throughout the economy – the Fed and the Biden administration have begun using the talking […]

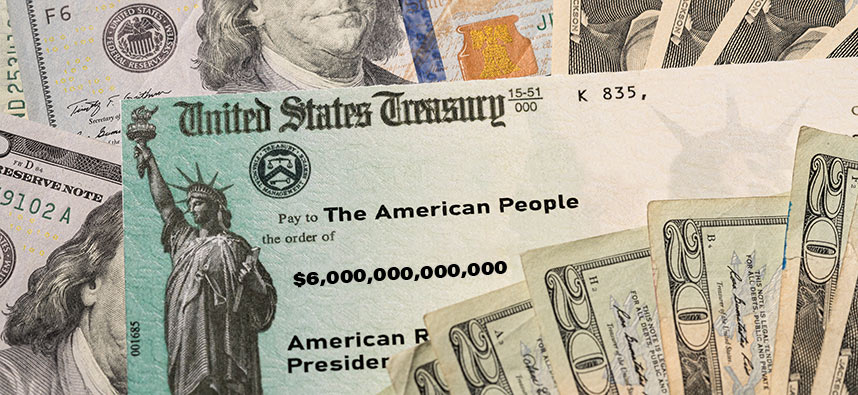

30

Apr

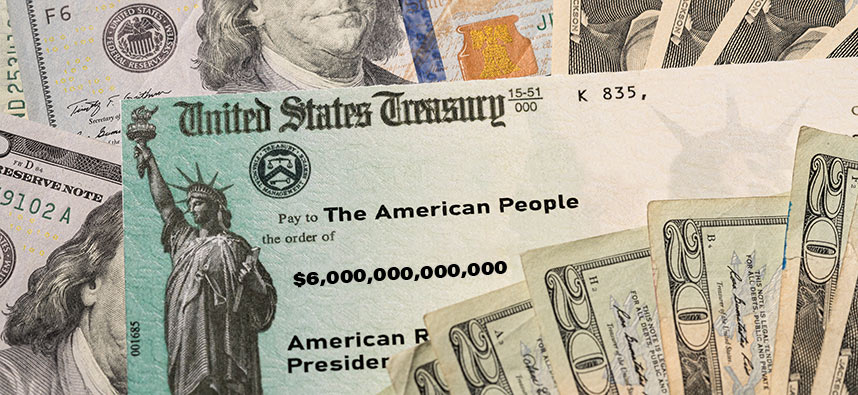

That is what President Biden has spent or intends to spend to get a long-term lease on the White House and the Capitol. Add it up yourself. First there was $1.9 trillion in “stimmy” spending. Then he followed up with his $2.3 trillion “infrastructure” boondoggles bill. And then he announced the $1.8 trillion “families” initiative. […]

30

Apr

The Federal Reserve Board held its regular two-day monetary policy meeting this week (4/27-28), after which it issued its regular post-meeting statement: “Inflation has risen,” it read, “largely reflecting transitory factors.” Transitory? Where have we heard that before? The Fed has created $3.6 trillion out of thin air since the January 2020. All that money […]

28

Apr

Earlier this year we wrote in this space that if you visit the grocery store and discover food prices seem to be rising, contact a Republic Monetary Exchange professional right away and take steps to protect yourself with gold and silver. Because the value of the dollar is going down. Now the news is […]

26

Apr

INFLATION EXPERT SEES “MUCH MORE” HEADED OUR WAY! “It’s as clear as the nose on your face!” That’s what Steve Hanke says about the inflation headed out way. Hanke is a leading inflation expert, an economics professor at the Johns Hopkins University and the director of the Troubled Currencies Project at the Cato Institute. […]

23

Apr

Maybe there is something to the idea of a national memory, the experiences of a people or a country that affect its outlook for a generation or more. Certainly, the Great Depression had a lasting impact on its own generation, and perhaps own their offspring who heard about the travails of those years so many […]

22

Apr

As we write this commentary, the Treasury Department reports that the US national debt is $28.168 trillion. That’s a lot of wampum! A year ago, it was $24.461 trillion. A year earlier, in April 2019, in was $22.027 trillion. The debt has been growing fast, up by more than $6 trillion in two […]

16

Apr

The are some big things going on with gold. Largely unnoticed developments that we would like our friends and clients to know about. We have many times, and in many ways, explained that nations that are net acquirers of gold see their influence rise in the affairs of mankind rise. Those that are dishoarders decline […]

15

Apr

Between the (wholesale) Producer Price Index and the (retail) Consumer Price Index, inflation is the word of the day! With the Federal Reserve printing trillions of dollars, most of which has long been levitating the stock market and now the housing market once again, it is evitable that it would also spill over into wholesale […]

14

Apr

Do they think we are stupid, or do US officials really mean what they say? It’s really getting hard to tell whether they think we are just plain stupid… OR… … whether they are just so stupid that they believe what they say. You be the judge. Here is some of the background. China is […]

12

Apr

Today’s key stories have to do with foreign nations aggressively adding to their gold holdings, while both the deficit and inflation are rising in the United States. HUNGARY TRIPLES ITS GOLD RESERVES! Hungary has added gold reserves at a record rate, tripling its central bank holdings in less than three years. From the Magyar Nemzeti […]

09

Apr

The reality on the ground for silver can be expressed in one word: shortages. The price of real, physical silver remains disconnected from the “spot,” or paper benchmark prices. It is a little like the old Soviet Union, where the posted prices in stores might have been low, but the shelves were all empty! […]

08

Apr

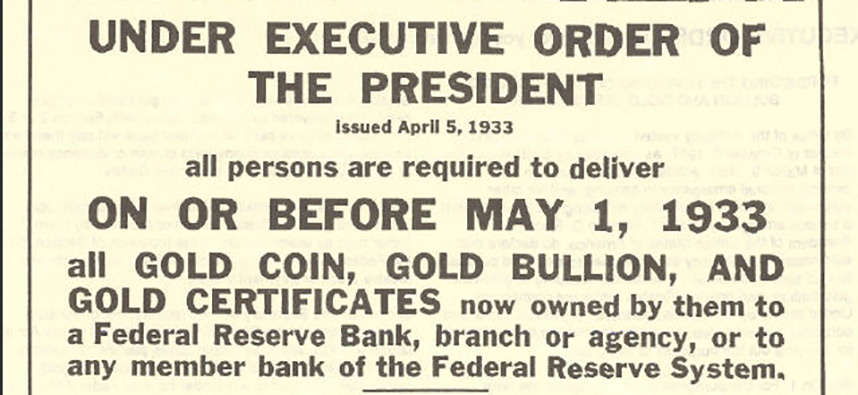

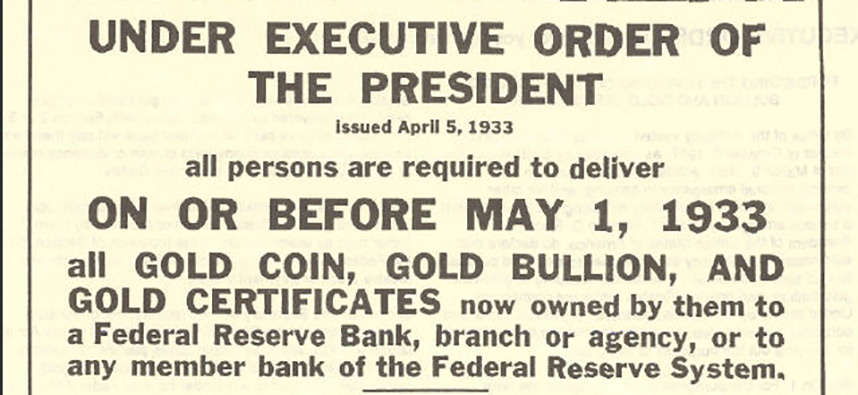

I, Franklin D. Roosevelt, President of the United States of America, do declare that said national emergency still continues to exist and pursuant to said section do hereby prohibit the hoarding of gold coin, gold bullion, and gold certificates within the continental United States by individuals, partnerships, associations and corporations…. Whoever willfully violates any provision […]

05

Apr

With a couple of currency management exceptions along the way, China has mostly encouraged its citizens to acquire gold. The central bank of China has been busy stockpiling gold as well. China seems to understand the age-old lesson that nations that are net acquirers of gold rise in economic might. Those that dishoard their […]

03

Apr

A Key Reason to Own Gold! The US dollar’s share of global currency reserves continues to fall. One financial blogger headlines the story with this question: “Central banks getting nervous about the Fed’s drunken Money Printing and the US Government’s gigantic debt?” (WolfStreet.com) Of course, they are getting nervous. The dollar’s share of global […]

02

Apr

Biden intends to send federal spending to levels not seen since World War II. He is doing so at a time that federal debt is already about 129 percent of gross domestic product. Biden announced the $2.3 trillion dollar plan last Wednesday. It is described as providing funding for bridges and roads, expanding access to […]

28

Mar

Republic Monetary Exchange Continues to Provide Immediate Delivery! The US Mint has been unable to meet strong demand for US gold and silver Eagle coins this year. Numismatic News has learned that the US Mint has not been able to acquire enough gold and silver bullion at the widely quoted benchmark spot or “paper” gold […]

25

Mar

Mark this moment as one when the fate of the global currency reserve dollar took a turn for the worse. The Washington foreign policy establishment just drove its most important adversaries into a marriage of convenience with one another, binding them together in a defensive union against US global hegemony and hastening the end of […]

25

Mar

Big Changes are Coming to America “The best way to destroy the capitalist system is to debauch the currency.” Attributed to Lenin by J.M Keynes Now that the currency is being debauched, get ready for the reshaping of America! From the New York Times: “[President Biden’s} advisers are preparing a set of proposals […]

23

Mar

“Tighten your seat belt!” That is the advice from publisher and one-time presidential contender Steve Forbes. H is the editor-in-chief of the business magazine Forbes. “This is bad stuff, this massive printing of money,” says Forbes. Forbes has always understood that gold needs to have a place in the monetary system. Otherwise, the politicians […]

20

Mar

A majority of money managers in a recent survey say the coronavirus is no longer their number one concern. Now they have something else to worry about: inflation! It will be a relief to have COVID-19 off our minds. But the inflation coming our way is a world-class wealth destroyer in its own right. A […]

18

Mar

Hint: It is a precious metal, gold in color, one that been honest money for thousands of years. Hmmm… America’s European allies are fed up with being pushed around by Washington politicians. We have been telling you that for years, but now even the New York Times has noticed. De-dollarization is on display as central […]

14

Mar

Why US dollar debt is beyond control! Thomas Jefferson declared that public debt is “the greatest danger to be feared.” “I place economy among the first and most important republican virtues,” he declared. Perhaps Jefferson’s strongest admonition on the issue came in these wise words: “We must not let our rulers load us with perpetual […]

12

Mar

There is a lot of backslapping going on in the White House and on at least one side of the aisles in the House and Senate with the passing of President Biden’s $1.9 trillion “stimulus” bill. There was more than backslapping on one of the cable news channel’s coverage of the bill’s passage. They added […]

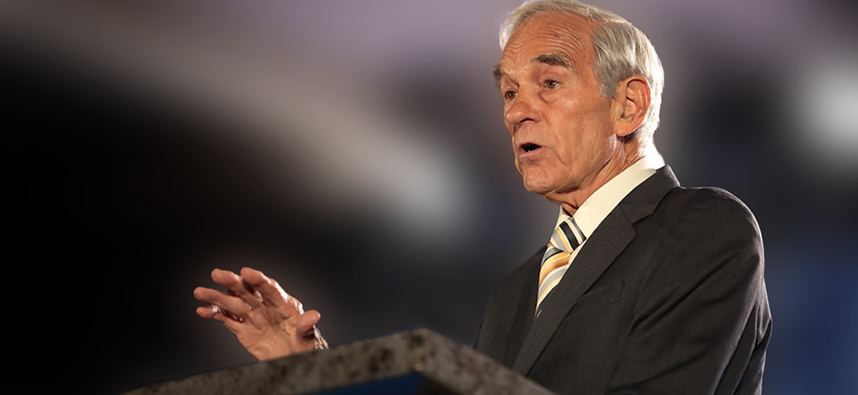

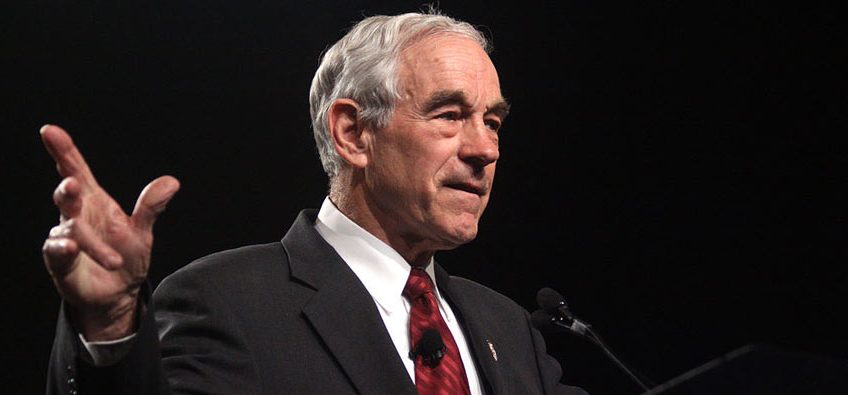

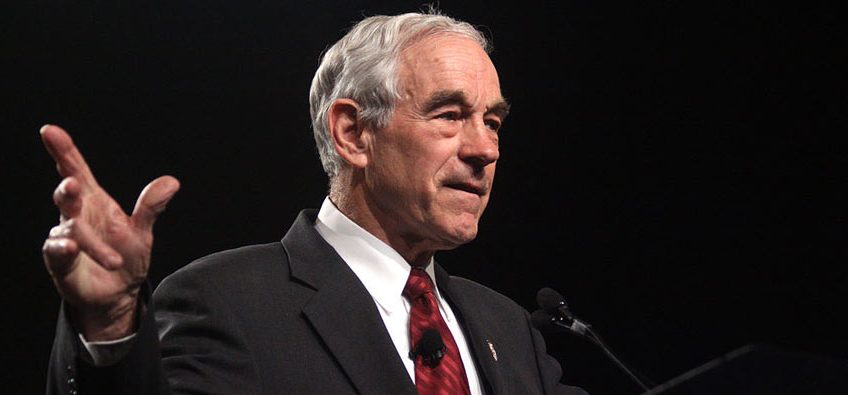

10

Mar

There are two things you need to do: Protect yourself from the coming crisis. And help end the Fed and get the government under control. That is the advice from former congressman and presidential candidate Ron Paul. It will be a long time before anybody in congress knows as much about money and markets as […]

05

Mar

The Wall Street Journal headline said it all: “Powell Confirms Fed to Maintain Easy-Money Policies.” The Drudge Report headline said the same thing, “Fed Vows More Pump as Inflation Fears Take Hold,” but it added a picture of Monopoly money. Nice touch. “We expect that as the economy reopens and hopefully picks up, we will […]

04

Mar

“If the wealth tax passes, go out and buy yourself some gold because people are going to rush to find ways of hiding their wealth.” That’s the advice form Leon Coopeman, It doesn’t matter to him that much if the government takes away rich people’s money, because he already has plans to give his fortune […]

04

Mar

The Fed really has America’s monetary situation screwed up. Badly. The last three Fed chairmen have printed money to beat the band: Bernanke, Yellen, and Powell. They have done the work of three men: Larry, Moe, and Curly. The Fed itself and the lapdog financial press call what the Fed has done under this […]

26

Feb

Do you have assets that are off the grid? Developing a digital currency is a “high priority project for us,” Federal Reserve Chairman Jerome Powell told congress last week. “We are committed to solving the technology problems, and consulting very broadly with the public and very transparently with all interested constituencies as to whether we […]

25

Feb

Here is an illustration from a Wall Street Journal opinion piece by John Greenwood and Steve H. Hanke (2/21/21) called “The Money Boom Is Already Here.” It shows Washington pumping a lot of money into the canyons of Wall Street. The sub-headline reads, “Since February 2020, the M2 supply has increased 26%—the largest one-year jump […]

24

Feb

Michael Burry, made famous in the movie about the bursting of the mortgage bubble The Big Short, has gone on a tweetstorm warning about looming US inflation. Burry, who was played by Christian Bale in the movie, made himself and the investors in his fund hundreds of millions of dollars by shorting mortgage credit instruments. […]

21

Feb

Gold on sale, just as inflation returns! It is like a gift from the gods, a smile and a nod from the fates, or maybe just a fortunate coincidence. Whatever you call it, gold is on sale at the least likely time – just when inflation is starting to rear its ugly head. Let us […]

19

Feb

If there was not a problem with paper money, there would be no reason to own gold and silver. If paper money was as good as gold and silver, then all the paper currencies that have failed throughout history would still be around. Still around like gold and silver. Once again, we are experiencing […]

17

Feb

Q: What’s that on the horizon? A: It sure looks like consumer price inflation. But go to the grocery store and have a look for yourself. Here is the lead paragraph from a Bloomberg News story this week (2/16): “There are signs that the food inflation that’s gripped the world over the past year, raising […]

13

Feb

Forecasting higher demand, The Silver Institute, a trade association, says the outlook for silver in 2021 is “bright.” “The outlook for the silver price in 2021 remains exceptionally encouraging, with the annual average price projected to rise by 46 percent to a seven-year high of $30.00,” according to the Institute’s just released analysis. Silver’s average […]

13

Feb

…Gold Goes Up! We have been asking our friends and clients recently if they have invested for the Biden presidency. In our new radio commercials, we point out that Biden and his supporters want the government to pay for everything. Everything! Now, we don’t want you to think we are exaggerating, so here’s the latest: […]

09

Feb

The Labor Department reported Wednesday (2/10) that in the 12 months through January the Consumer Price Index rose 1.4 percent. For the month of January, the CPI was up 0.3 percent. The mainstream media, whose personnel do not really know much about these things, chose to report this as news that inflation was “benign.” We […]

07

Feb

Did you know… That there have been no discoveries with more than two million ounces of minable gold since 2017? That while the rate of growth changes along the way, Russia and China have been aggressively increasing their central bank gold holdings for years? Russia’s central bank holds 2,299 tons of gold, China holds 1,948 […]

05

Feb

Republic Monetary Exchange “Best Practices” Mean Immediate Delivery! A Reuters news story sums it all up this way: “The United States Mint said on Tuesday (2/2/21) it was unable to meet surging demand for its gold and silver bullion coins in 2020 and through January, due partly to pandemic-driven demand and plant capacity issues.” As […]

02

Feb

“At some point someone is going to make the obvious observation, which is that income inequality, which is making our country unstable, is being driven from one main source. And that is the Federal Reserve, which is shoveling money to Wall Street, excluding most people from that payoff, and hurting a lot of people like […]

Listen to the audio from the interview recorded live on 2/1/21. Jim explains the current silver short squeeze as well as the recent Gamestop manipulation. Recorded live on the “Conservative Circus with James T. Harris”, KFYI Phoenix, Monday February 1, 2021.

31

Jan

In our last commentary, Talk About Wealth Preservation! Part I, we made the point that wealth preservation, even for a single century, cannot be trusted to paper currency. On the contrary, paper money’s track record for preserving value is beyond dismal. Gold’s performance is superior. Gold stands the test of time. Perhaps someone will […]

28

Jan

Suppose a hundred years ago some far-sighted benefactor, someone a few generations back, wanted to leave some wealth for their descendants – including you. Would you be better off if they left you $10,000 cash in bills or $10,000 in gold? A hundred years ago American money was gold. Americans commonly carried and conducted commerce […]

26

Jan

“We’re in the throes of the greatest monetary inflation in U.S. history. Things have come home to roost – we just haven’t realized it yet. Fed liquidity is masking deep structural impairment, while Trillions necessary to stabilize a fragile Bubble Economy only push the runaway financial Bubble to more precarious extremes.” Doug Noland, Credit Bubble […]

24

Jan

Is Silver the New Oil? Silver was up 48 percent last year. Now leading refineries and banks in Switzerland are telling their clients to expect even greater silver price increases by the end of 2021. Perhaps they are expecting four years of the most financially irresponsible administration in US history. That is just one […]

23

Jan

Poor Joe Biden. Democrats in control of both Houses of Congress. Janet Yellen at the Treasury Department. Jerome Powell at the head of the Federal Reserve. Biden has a retinue of “doom-loopers”. And he doesn’t even know it. Doom-looper Yellen testified at her confirmation hearing this week (1/19) that low-interest rates make Biden’s big […]

20

Jan

Ready for the New Breed of Spenders? Washington has seen its share of big spenders. Bush and Obama were among them. Trump was an even bigger spender. But now, Washington is home to the biggest spenders of them all. Even before Biden’s inauguration, his Treasury secretary nominee appeared before the Senate for confirmation. Janet […]

16

Jan

In times of crisis, informed people turn to gold and silver. This is such a time. It is a classic descent into chaos. Today we’d like to share a few news stories. None of them take much reading between the lines, so we will be sparse in our comments. The first one is […]

15

Jan

Did the authorities really think they could throw $3 trillion more into the US monetary mix without causing price increases? No, they didn’t think that. Mostly they didn’t think at all. They just did it. And because they are preparing to do even more of the same, you can expect 2021 to be the year […]

13

Jan

So far, the gold and silver bull market that began by our reckoning in August 2018 has been fairly typical. Don’t misunderstand! We’re saying it has been typical for a powerful bull market! The move so far has been most impressive. Gold is up almost $700 an ounce since the bull started running. In […]

10

Jan

Have you seen what has been going on with the US Dollar? It looks like it is diving off a cliff. Here is a one-year chart of the US Dollar Index. You can see the appearance of the COVID-19 shutdown early in 2020 and the confusion in the currency markets. The dollar fell, bounced back […]

07

Jan

Calling Jeremy Grantham an expert on stock market bubbles is justified by the evidence. Wikipedia describes Grantham, whose firm has some $64 billion under management, this way: [Grantham] is a British investor and co-founder and chief investment strategist of Grantham, Mayo, & van Otterloo (GMO), a Boston-based asset management firm. Grantham is regarded as a highly knowledgeable […]

06

Jan

The US Mint reports that sales of its gold and silver coins surged in 2020. Despite mint shutdowns and slowdowns in 2020 – and perhaps because of the economic shutdown and the monetary policies that followed – US mint bullion coin sales rose to the highest levels in years. Sales of American Eagle silver […]

02

Jan

More things said about gold, silver and sound economics worth remembering in 2021! Gold is a hedge on government authorities making poor economic choices. Inflation is usually the result of those poor decisions, but people confuse cause and effect here. Gold is a hedge on policy makers screwing up, and there has been a lot […]

31

Dec

Ten Things That Won’t Happen in 2021! Below are out predictions for the New Year. Read all ten 2021 predictions and at the end you’ll discover a little surprise about our list! 10. The Federal Reserve won’t stop managing the monetary system to benefit the banks that created it to serve their interests in the […]

26

Dec

Here are a few observations about gold and silver that we have been collecting to share with our friends and clients! Gold and silver, like other commodities, have an intrinsic value, which is not arbitrary but is dependent on their scarcity, the quantity of labor bestowed in procuring them, and the value of the capital […]

22

Dec

This time of year, many of our thoughts center on family. For wealth protection, from generation to generation, nothing endures like gold. In fact, someone called gold and silver “the superheroes of wealth preservation.” Gold is one of the least reactive chemical elements; it does not tarnish or rust. It is handy to […]

20

Dec

America’s Wealth Gap Grows… A new Time magazine story (do they still really publish an actual magazine?) is getting a lot of play. It is a story about the wealth gap, the growing disparity between the rich and uber-rich and everybody else. The headline reads: “The Top 1% of Americans Have Taken $50 Trillion From […]

16

Dec

The Federal Reserve has held its 2020 year-end meeting, promising to keep on doing what it has been doing. Which reminds us of the old saying that if you keep doing what you have been doing, you are going to keep getting what you have been getting. In this case, the Fed intends to keep […]

15

Dec

What is our government’s solution to the disaster they created? Well, more money from the Federal Reserve, printed out of nowhere and backed by nothing. You can’t keep printing trillions of dollars without getting serious inflation. There’s no getting around it. Inflation may crush you, but it will make the people making the decisions richer. […]

11

Dec

DEFICITS RACING AHEAD For the first two months of the 2021 government budget year, October and November, the federal deficit ran just over 25 percent higher than the same period a year earlier, before the pandemic. Associated Press: “The Treasury Department reported Thursday that with two months gone in the budget year, the deficit totaled […]

10

Dec

We have written repeatedly that we are fast approaching a crisis of not just liquidity, but of national solvency. Liquidity has to do with somehow – by means wise or foolish – meeting obligations that come due today. Solvency has to do with ongoing financial viability, about long-term viability of affairs as presently structured. Bankruptcy […]

10

Dec

They have stepped on the gas! The pedal is to the metal! Central banks everywhere are scrambling to introduce their own digital currencies. Oh, the power they’ll have to corral every financial transaction into major institutions. To watch everything you do. To instantly impose policies without debate. To cram negative interest rates down your throat. […]

06

Dec

As you know from our repeated comments, the Federal Reserve is moving headlong toward the issuance of its own crypto-currency dollar. This is as good a reason as any to protect your wealth with gold. The Fed’s new digital currency is a variation – although a much more threatening one – on old-fashioned money printing: […]

05

Dec

Solar Demand Figures Large in Goldman Sachs Outlook Goldman Sachs has renewed its call for silver to reach $30 an ounce in the next few months. That target represents a 25 percent near-term gain in the silver price. Earlier this year Goldman set a price target of $30 for silver. Silver touched $29.91 on […]

02

Dec

“How did you go bankrupt?” Bill asked. “Two ways,” Mike said. “Gradually and then suddenly.” – Ernest Hemingway, The Sun Also Rises. The world is awash in debt. Zombie corporations borrowing just enough to stay alive, but never earning enough to survive without borrowing more. Entire countries trying to print their way through the next […]

29

Nov

STUDENT LOAN DEBT Commenting about student loan debt almost two years ago, we wrote, “Everything about student loan debt is bad economics. All the easy money flowing the way of colleges and universities has led to a doubling of the cost of higher education over the past 20 years. It has made the schools rich. […]

25

Nov

We hope that you can count the health and safety of your loved ones as among your greatest blessings of this difficult year. Our heart goes out to all of those that have encountered this pandemic. We are grateful that 2020 has been such a good year for gold and silver and helping our friends […]

24

Nov

As we near the end of the year we’ve been watching price forecasts for gold in 2021. It is hard for anyone to overlook the fundamentals that we have been talking about: unpayable and still climbing national debt and unprecedented Federal Reserve money printing. It is clear that these conditions are accelerating, so we expect […]

22

Nov

What a year it has been for silver! Both gold and silver continue their year-over-year bull market runs, but as we have explained, silver likes to magnify the moves! Over the last 12 months (11/19/19 – 11/19/20) silver has gained an impressive 40 percent. And that is after a 2o percent correction from its […]

21

Nov

You may have noticed increasing talk of a confrontation with Iran. While economic warfare with Iran has been US policy for some time, there have been reports of new White House conversations about a possible strike on the Iranian nuclear site at Natanz. Often leaks of that sort are simply part of diplomatic maneuvers. But […]

20

Nov

Meanwhile, Interest Rates are the Lowest in History The debt splurge continues. Reuters reports that global debt is expected to reach $277 trillion by the end of this year. That’s up from $257 trillion last year, with government debt accounting for more than half of the increase so far in 2020. Citing a new report […]

17

Nov

One way to track the growing de-dollarization of the global economy is by the “Strange New Respect” gold keeps getting. That’s what we called it in a piece over a year ago when we reported that central bank gold buying was setting new records. The mainstream media were missing it (of course!), but the world’s […]

14

Nov

Silver Demand Indicator Sales of US Silver Eagles by the US mint have totaled 27.2 million ounces so far in 2020. That compares to the 2019 total of 14.8 million ounces More Debt, Less Production “Simply put, there is a fundamental inconsistency over the long run between an ever-rising share of US debt in world […]

13

Nov

We could not have said it better, so we will let him speak for himself. Doug Noland from Credit Bubble Bulletin has a long record of chronicling the birth of bubbles and the destruction of their popping. Here’s his recent take on the times: “I have never been more concerned. Having watched ‘money’ and […]

12

Nov

We’re Always Grateful When They Do This We are heading into the homestretch of 2020. Soon will be the holidays and then 2021, which looks to be another dynamic year for precious metals. Through last week gold gained more than 27 percent in 2020. That is after a strong year in 2019 as well, one […]

08

Nov

Gold does not care who controls the White House. It goes up either way! That is the conclusion of a review of half a century of gold price action. The World Gold Council points out correctly that gold goes up no matter which party controls the White House! Let us give you some recent examples. […]

05

Nov

Gold After the Election Let’s sample some informed opinions about what will happen once the election is (more or less) settled: According to the Royal Bank of Canada, once the dust settles, gold will resume its march higher. According to The Union Journal, George Gero, the managing director of RBC Wealth Management, believes traders […]

04

Nov

It’s a good thing we have two eyes. For good and sufficient reasons most people have been keeping a close watch on domestic affairs. It’s a good thing to do, especially in the political season. But we have also been keeping an eye of global affairs where something important is happening. Most of the media […]

30

Oct

Just like in Alice in Wonderland, the Federal Reserve has to run faster and faster just to stay in the same place. The Fed has had to buy a growing share of US government debt instruments to keep interest rates low and to keep Washington afloat. Here are recent remarks from Federal Reserve […]

29

Oct

The Left and Right Agree About Only One Thing: Printing More Money! Today’s commentary is drawn from observations by hedge funder David Einhorn of Greenlight Capital. In a rather dramatic announcement, Einhorn says that we have seen the top of the stock market. It has been a bubble, one drivne by technology stocks, and that […]

27

Oct

We promised you last week that we would keep an eye on the Federal Reserve and let you know what it is up to. That is because there is always a plan afoot to manipulate the currency and destroy its value. Today we want to warn you about the latest. There is no name […]

25

Oct

Dear Fellow Patriots! Below is a list of conservative candidates I am recommending for almost all offices on the ballot. You can view below or click here for the printable version to take with you to the polls. Let’s keep Arizona Red and Make America Great Again! President and Vice President Donald Trump and Michael […]

25

Oct

$40? $50? $100? How much higher do you think silver will go? One of the world’s largest investment banks agrees with us that it will go higher. Much higher. Twice in less than 50 years, silver has raced to the $50 an ounce neighborhood. The last time was in 2011. Before that, it […]

23

Oct

We think gold and silver will go up if Donald Trump is re-elected president. We think gold and silver will go up if Joe Biden is elected president. I’m sure you’d like us to explain since we have a two-party system and candidates that differ on the issues and on how the government should be […]

22

Oct

Mercifully, the US government accounting year, Fiscal Year 2020, ended a few weeks ago. It was one for the books. The record books. We’ll get to the numbers in a moment. But we must tell you that in some ways this a repeat of a commentary we posted two years ago, with the ending of […]

16

Oct

A look at the Greatest Money Supply Surge in History The headline above is borrowed from Michael Shedlock’s blog, Global Economic Trend Analysis, at TheStreet.com. Although we have tracked the Federal Reserve’s massive dollar creation for you, we think the headline frames the frenzy in a dramatic way. Almost a quarter of the US money […]

16

Oct

And a Wobbly Social Order! We have made the point many times that the US stock market is floating on the back of a loose money regime, money the Federal Reserve has been stove-piping to Wall Street. Here is a 10-year chart of the S&P500 stock index. Most of the left half of the chart […]

15

Oct

It’s all unfolding like a bad dream. I mean our financial and monetary future. Maybe it is more like a “B” movie, one that is totally predictable. Nations globally have spent $12 trillion they do not have on “stimulus” measures this year. The US is more than $3 trillion of that. But it is […]

09

Oct

Leon Cooperman Discovers Gold at the Age of 77! Like so many of the superrich these days, Leon Cooperman has discovered gold! The 77 year-old billionaire, senior Goldman Sachs investment veteran, and now chairman and CEO of the New York-based investment firm Omega Advisors, did just a few days ago what he had never before […]