<h1 class="entry-title">Category: Gold Market Discussion</h1>

27

May

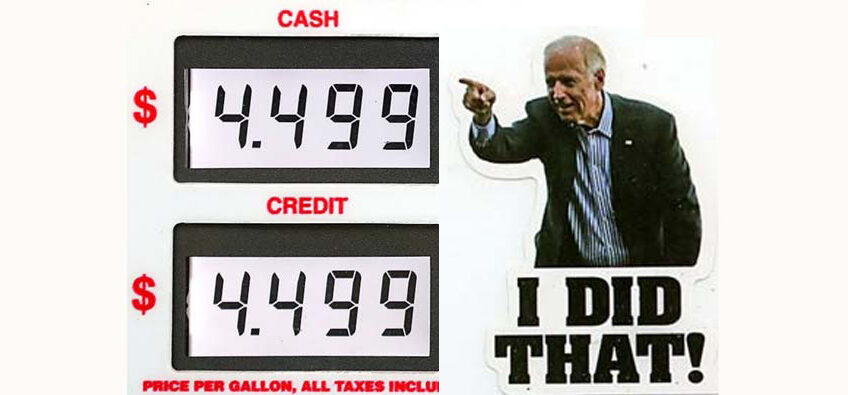

Let’s take a look at the real-world experience people are having with inflation. CBS News has found a handful of California gas stations charging $7.25 a gallon, more that the federal minimum hourly wage. The Wall Street Journal reports that US households are now paying an annual rate of $4,800 for gasoline compared to […]

20

May

Here is a short list of some of the things going wrong. It is not exhaustive. It is just some of the things no one can miss: Gas prices through the roof Double-digit inflation Mortgage rates running up and housing ready to topple Consumer confidence in the tank, an important recession indicator Americans losing trillions […]

20

May

Another real-life indicator of our inflation calamity! Gasoline prices are now over $4 everywhere in the country. But California gets the award for being the first state to cross over $6 a gallon. Why are gas prices so high? In a nutshell, it is because your US dollars don’t buy as much as they did. […]

19

May

How bad has it been? Pretty bad! Fed Chairman Jerome Powell says that restoring price stability is “nonnegotiable.” If price stability is so important, why did the Fed blow up the stock and bond markets in the first place? Did they really not realize that the creation of $8 trillion dollars over the last 14 […]

15

May

How They Made a Mess of the American Economy, the Dollar, and Your Prosperity – and Gave You a Buying Opportunity at the Same Time! The Federal Reserve has made a mess of everything. The American economic establishment has made a mess of everything, too. But I repeat myself. The American economic establishment is the […]

15

May

Things are Even Worse in the Phoenix Area! Two headlines on the same financial news site at the same time: … inflation decelerates slightly. … Inflation comes in hotter than expected. Maybe that’s why President Biden is so confused. He doesn’t know how to sort things out. As it happened the latest Consumer Price […]

14

May

Bidenflation that is… With the news that consumer prices were up 8.3 percent for the 12 months ending in April (and food prices up 9.4 percent), President Biden issued a statement claiming that bringing inflation down is his “top economic priority. But he certainly did not claim any ownership of the inflation calamity. Nor did […]

06

May

Just like it did during the Stagflation Decade! Plus Joe Biden, the fiscal conservative? Just in time for the 2022 election, President Biden is suddenly trying to re-package himself as a fiscal conservative. That’s quite a stretch! Meanwhile, Charlie Bilello, CEO of Compound Capital notes that the US money supply has increased by over 50 […]

06

May

It’s an ever-changing yardstick! Unlike gold! President Biden said something characteristically confused the other day when news came that the US economy is shrinking, down 1.4 percent in the January-February-March quarter. A contracting economy is not good news. It’s even worse when you realize that consensus economists were expecting quarterly growth of 1.1. percent. […]

05

May

No Resolve to End Inflation! The Fed labored mightily, and brought forth… A mouse! We’ve adapted the line from one of Aesop’s fables that describe any great effort that delivers very little. So the Federal Reserve has promised and teased and vowed and threatened for months now that it would get a handle on […]

29

Apr

Just did a quick word search to see how many times we have warned you over the past year about the stagflation headed our way. The answer is many, many times. Now the numbers are in and it’s official. Stagflation is here. Let us re-print some of our warnings about stagflation. We’ll get to […]

28

Apr

Time to be wary! Move to the sidelines with gold! Has there ever been so much blather about a Fed interest rates policy change – especially one so long in coming? In hopes of minimizing the impact of the rate hike when it actually hits, the Fed has been telegraphing its forthcoming decision for months. […]

24

Apr

The US dollar’s role as a substitute for gold in international affairs, formalized with the Bretton Woods Agreement at the end of World War II, continues to break down. It was destined to fail because in substituting dollars for gold, participants were asked to trust in the financial integrity of the government. It was only […]

23

Apr

This is one of the most shocking charts we have seen this year. It shows that Eurozone Producer Prices, or wholesale prices, have climbed 31.4 percent for the 12 months through February. Revolutions have been made of less! US News reports that “energy prices were up 83.8% from March 2021… The main driver of […]

22

Apr

Not the mainstream media, that’s for sure! Inflation has been called “the cruelest tax.” Ruining the currency with inflation is certainly one of the most devious and disgusting things that governments do. After all, there are procedures for raising taxes, procedures that involve legislation, public debate, and votes. But inflation is a tax without legislation, […]

18

Apr

Wholesale Prices are up 11.2 Percent! Inflation, foreign war, rising interest rates, food shortages, sanctions, triple-digit oil prices, Fed policy, frantic White House… Gold gets the picture! Only one day after reporting consumer prices have risen 8.5 percent over the last year, the Bureau of Labor Statistics reported that the Producer Price Index (wholesale prices) […]

16

Apr

WHAT THE HEADLINES SAY NOW: April 12, 2022 Inflation Rate Surges To 8.5 Percent! WHAT THEY WERE SAYING THEN: WHITE HOUSE BRIEFING, Press Secretary Jen Psaki, July 19, 2021 MS. PSAKI: We take inflation very seriously. It is under the purview of the Federal Reserve. As you know, they have regular quarterly meetings where they […]

16

Apr

Inflation is up, and your dollars’ purchasing power is going away! Consumer prices have climbed 8.5 percent over the last 12 months. Stated differently, if you had tucked away $1,000 a year ago – congratulations! Your purchasing power has shrunk to $850. In some parts of the country, the inflation rate is now at 10 […]

10

Apr

…It looks like a great time to buy gold and silver! The Federal Reserve has its sights on the stock market and is about to pull the trigger and bring the bull to its knees. At the same time, the European war has food prices rip-roaring higher. Because people would rather pay high prices than […]

07

Apr

Just like before… only worse! Ever felt like you’ve been here before? We’re having serious inflation déjà vu. Today’s double-digit inflation is like the 1970s all over again. We’re getting used to seeing higher prices every time we go to the store. We’re getting used to the US dollar buying less. And we’re […]

07

Apr

…and Continues to Experience Silver Shortages! Thanks to double-digit inflation, the policy confusion of the monetary authorities, and political chaos, not to mention a war in Europe, the US mint reports record-setting demand for its gold coins in March. American Eagle gold coins sales for March soared 73.7 percent over February, from 89,000 ounces to […]

03

Apr

This Tuesday will be 89 Years Since the Government Criminalized Gold Ownership I, Franklin D. Roosevelt, President of the United States of America, do declare that said national emergency still continues to exist and pursuant to said section do hereby prohibit the hoarding of gold coin, gold bullion, and gold certificates within the continental United […]

03

Apr

Money Printing Causes Inflation… The Mises Institute, Daniel Lacalle Says: The Ukraine war has created another excuse to blame inflation on oil and natural gas. However, it seems that all those who blame inflationary pressures on commodities continue to ignore the massive price increases in housing, healthcare, and education, as well as in goods and […]

02

Apr

The Perfect Storm: Incomes are Lower, Prices are Soaring, and Supply Chains are Fragile 1. Accelerating Inflation Takes Its Toll as American Incomes Continue to Fall The Wall Street Journal Says: Personal income increased by 0.5% in February over the prior month, a pickup after it was nearly flat in January, but inflation rose more […]

25

Mar

Republic Monetary Exchange is a full-service precious metals brokerage firm with friends and clients just about everywhere. Because our offices are in Phoenix, Arizona, you won’t be surprised to learn that we have so many clients in Arizona. Arizona is a beautiful state. People like living here and are coming from far and wide. But […]

24

Mar

If they said to buy gold, we would take them seriously! War! Food crisis! Debt crisis! And double-digit inflation! We’re pretty sure that the same people that brought all this trouble on shouldn’t be giving advice about dealing with it. But they do anyway. So, the experts are once again giving out free advice […]

23

Mar

Snackers and munchers across the land are deeply disappointed to discover that double-digit inflation has now shown up even in the number of chips in their Dorito bags! The nacho cheese-flavored Doritos snack bags have been downsized by five chips, shrinking from 9.75 to 9.25 ounces. It’s just another case of “shrinkflation.” Manufacturers hide rising […]

20

Mar

Here comes the worldwide scramble for gold. This is big. In his State of the Union address, President Joe Biden announced measures to make what he called Russia’s $630 “war fund” worthless. “We are cutting off Russia’s largest banks from the international financial system,” said Biden. There is no way to put it nicely. The […]

18

Mar

Food Prices Racing Higher! Gold and Silver More Critical Than Ever! Consumer prices are up 7.9 percent over the last 12 months, while wholesale prices are 10 percent higher over the same period as reflected in the following chart: Many believe that these numbers substantially understate the real price shock Americans are encountering every day. […]

17

Mar

Demand for gold by the Russian people is so overwhelming that the country’s central bank has backed away from buying so that the people’s demand can be met. Here’s the lead from a March 15 Reuters account: The Russian central bank said it will suspend the buying of gold from banks from Tuesday to meet […]

11

Mar

All Signs Point to Stagflation with Higher Gold and Silver Prices White House expects inflation will ‘substantially’ increase in coming months Washington Examiner (3/11/22) – The White House is expecting “substantially” higher inflation figures in the coming months, even after the February Consumer Price Index posted the highest year-over-year rate since 1982. Yearly inflation rose […]

10

Mar

It’s Not Really Gold Unless… Financial events in the fallout of the Ukraine war are delivering a powerful message to investors. It is a lesson we have written about before and one that deserves to be repeated again and again. It can save investors looking for the safety and protection of gold a lot of […]

09

Mar

When stagflation made gold skyrocket! I recently heard somewhere that “there may not be a lot of advantages to getting older, but it is a plus for investing”. Live long enough and you will have seen the same old flimflams over and over. Like stagflation. The last stagflation decade was the 1970s. The Fed […]

06

Mar

When the people in charge are this confused, you need to own gold! Today’s subject matter comes from the people at Committee to Unleash Prosperity. “We’re still scratching our heads,” they confess, “trying to figure out what the White House strategy is for bringing down inflation which is now running between 7 and 10 […]

06

Mar

Protect Profits with Gold! Are you paying attention to stock market values decaying right in front of our eyes? For those of you who have had a good ride in the stock market during the period that it was levitated by the Federal Reserve’s pumphouse of liquidity, we want to recommend that you prepare for […]

04

Mar

People in Ukraine with gold will be better off than people with Hryvnia! It is said that the first victim of war is the truth. The war in Ukraine is no exception. People in Washington – never the brightest bulbs – have been caught cheering stories that didn’t actually happen… Supposed footage from the […]

27

Feb

But don’t just take it from us… This blog and commentary are devoted to providing you with information that will help you profit and protect yourself from a decaying monetary and financial environment. Obviously, we represent your first line of defense: gold and silver. That, as they say, is our wheelhouse. It is our expertise. […]

24

Feb

Gold and Silver: For When the Government Decides that What’s Yours is Actually Theirs. The Canadian Truckers’ protest showed, in the words of columnist Eric Margolis, “that less than 100 ZZ Top look-alike truckers could hold Canada to ransom.” That is a funny line. But it also showed something far more diabolical. It showed Big […]

23

Feb

Take a good look at this chart. It is the Commodity Research Bureau’s index of global commodity complex prices. Rather than equity (stocks) or bonds, it represents real things, tangible goods that make the things we consume. It consists of 19 global commodity prices. Energy contracts are 39 percent of the index, while agriculture commodity prices are 41 […]

20

Feb

As if inflation isn’t enough, now war drums are pounding, too. No wonder more people are thinking about protecting themselves with gold and silver. No wonder gold and silver are moving up. After the tremendous run that took gold over $2,000 in August 2020, gold has been mostly consolidating its gains, trading in a narrowing […]

20

Feb

Here are some top-of-the-page news alerts on the popular Drudge Report this past week, (including the photo of the smiling but clueless Treasury secretary Janet Yellen: YELLEN: DON’T WORRY, BE HAPPY! Janet Yellen is “concerned” about inflation, but she assures us that the Federal Reserve will act in an “appropriate way” to contain inflation. We […]

20

Feb

Buy gold now because the Fed is about to get even worse! US wholesale prices are racing higher at a breathtaking rate. For the month of January, the Producer Price Index was up a full one percent. For the 12-month period ending in January, the PPI was up 9.7 percent. From the Wall Street Journal: […]

11

Feb

THERE’S THE GOVERNMENT’S INFLATION RATE… … and there’s the Real Inflation Rate! Try 15 Percent! The US government’s official inflation numbers are bad enough. But what if they also badly understate the real rate of increasing prices? If the books are cooked, it will have a lot of unhappy consequences. Among them are programmed benefit […]

11

Feb

It’s not a surprise to Republic Monetary Exchange friends and clients! The inflation rate keeps powering higher and higher. Consumer prices have climbed 7.5 percent over the last 12 months, according to the Bureau of Labor Statistics. That is the most in 40 years. Inflation ran even hotter than that in the mountain states, […]

10

Feb

If you’re like the rest of us, you’re probably hearing more and more complaints about rising prices. Well, get used to it. Washington could have done the right thing, but it never does. Politicians are too busy buying votes with giveaways and thanking lobbyists for contributions with crony legislation. It’s been going on […]

04

Feb

Own gold (because the Fed never stops scheming!) It has been a while since we updated you on the Federal Reserve’s leading-edge plan to control the people, and increase their dependency on Washington. But we learn that the Fed is still moving ahead on what we had dubbed “The Full-Tilt Crypto-Boogie”. There is no better […]

03

Feb

We’re writing this post on Thursday (2/3/22), the day Facebook, or more properly its parent company Meta Platforms, lost more than $230 billion in market value. In one day. The Dow Jones Industrial Average fell 518 points, while the Nasdaq market was down 538 points, or 3.7 percent. This isn’t the first time we’ve seen […]

02

Feb

Wow! $30 Trillion! That’s a Surefire Calamity! The US national debt just set a new world indoor record. The official, on-the-books national debt reached $30 trillion on January 30. The national debt has grown by almost $7 trillion in the last two years. Oh, brave new world! That’s more than $90,000 per American or […]

28

Jan

Raising the gold price target, more debt, and a confused Fed! Goldman Sachs: “In our view, this combination of slower growth and higher inflation should generate investment demand for gold, which we consider to be a defensive inflation hedge. In addition, we expect continued growth in [emerging market] dollar-wealth and a rebound in consumer and […]

28

Jan

But gold is a different story! It doesn’t matter whether the government’s unbacked, fiat, made-up money is printed or a mere digital bookkeeping entry, it will always end up worthless. It has happened in more times and places than we can recount. The latest is in Venezuela where the money ends up as roadside garbage. […]

25

Jan

But read every word! We’re busy watching the carnage in the stock market this week as gold works its way higher, just as we have written about so many times. So today we want to share with you a tweet from Marc-André Fongern (@Fongern_FX), a British foreign exchange analyst. It is a short and […]

21

Jan

We think it is a good time to park your wealth – at least the part of your wealth you want to hold on to – in gold and silver. We have detailed the reasons in these posts and invite our friends and readers to review what we have been writing. Those reasons have to […]

21

Jan

More states are expected to recognize Constitutional money as, well, Constitutional money in 2022. That is according to the Sound Money Defense League, an organization that tracks state-level sound money – gold and silver — legislation across the United States. 2021 was a good year for advancing the interests of gold and silver, says the […]

19

Jan

Bullish Figures for Gold! It has been a while since we have focused on the price charts, but this would be a good time. On Tuesday, the Nasdaq tumbled 2.6 percent for its lowest close since October, while the Dow dropped 540 points on the day. Gold has been trading mostly sideways this year, […]

14

Jan

Wholesale Prices Jump Nearly 10%! It is clear that the American people are not pleased with President Biden and the price inflation that is slamming them at the gas pump and in grocery stores. Here is a depiction: Now there is even more for them to be unhappy about. Hard on the heels of the […]

14

Jan

Comrade Lenin would have been proud! Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but […]

13

Jan

There probably are not a lot of places in the real world where one can massively, spectacularly mal-perform – we’re talking world-class failure – and keep a coveted position as the head of an enterprise. Football coaches with losing records get fired. Movie directors with a string of failures do not often get invited back […]

09

Jan

Fed Policy Reversal May Pull the Plug The Federal Reserve is starting to act like the pinball in an old-fashioned arcade game. It is bouncing off everything, reversing policies, and changing directions at a frenzied rate. Ding! Ding! Ding!!! Surprised and discredited by its own cluelessness about surging inflation, the Fed is now going to […]

09

Jan

A Record Year for Global Demand! With inflation’s roaring return, investors purchased US American Eagles gold coins like hotcakes in 2021. The US Mint reports sales of 1,252,500 ounces in one ounce and other gold Eagle denominations last year. That is the most since 2009 and represents a 48.4 percent increase from 2020 sales. […]

07

Jan

An important gold price forecast, top-heavy stock market action, and an important book waiting for you… Along with our best wishes for your prosperity in 2022, here are five things we want to share with you at the beginning of this New Year. 1. Investors will stampede to precious metals in 2022 for protection from […]

02

Jan

Predictions for the New Year that WON’T Happen: Below are our predictions for the New Year. Read all ten 2022 predictions and at the end, you’ll discover a little surprise about our list! 10. The Federal Reserve won’t stop managing the monetary system to benefit the banks that created it to serve their interests in […]

02

Jan

More things said about gold, silver and sound economics worth remembering in 2022! There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final […]

31

Dec

Here are a few observations about gold and silver that we have been collecting to share with out friends and clients! People are frustrated with the economy, because they worry about how everything is getting much more expensive, and they’re blaming the government and politicians because that’s what they’re being asked about, and they’re not […]

19

Dec

This time of year, with holiday gatherings and celebrations, many of our thoughts center on family. For wealth protection, from generation to generation, nothing endures like gold. In fact, someone called gold and silver “the superheroes of wealth preservation.” Gold is one of the least reactive chemical elements; it does not tarnish or […]

19

Dec

(They’re Between a Rock and a Hard Place) It is better to not get started using addictive drugs. Ask any addict. Their trouble does not start when they try to stop. The trouble starts when they start using. It is the same with fiat (legalized counterfeiting, money-printing) monetary policies. The trouble started when they started. […]

17

Dec

Inflation fight lost before it starts! Buy gold now. The Federal Reserve’s response to the highest inflation in 40 years, inflation that already has many Americans struggling with sharply rising grocery bills, is to serve up a giant nothingburger. Fed Chairman Jerome Powell said on December 15th that the Fed is keeping interest rates near […]

10

Dec

Got Gold? Last month we reported the inflation had reached the highest level in 30 years. But that was last month. Now we have the highest inflation in 40 years! On Friday (12/10) the government reported that consumer prices have risen 6.8 percent over the last 12 months. Few have wasted time dubbing this […]

08

Dec

Just like inflation, the financial strain it causes is on the rise. These pair of polls tell the story. A majority of people say inflation is causing them financial strain, according to a new Wall Street Journal poll. 56 percent of respondents say that inflation is rising and that it is causing them financial strain. […]

08

Dec

There are too many unanswered questions about who has title to and controls the gold. We think it is important to be good stewards of our resources. And that includes the American peoples’ gold held by the government and/or by the Federal Reserve. We have long supported the Audit the Fed measure championed for so […]

03

Dec

And what happens to gold? Here’s one of those issues that should not need extensive polling and surveys. It should be self-evident. But let’s back into it. JPMorgan analysts say the price of oil will test $125 a barrel next year, on its way to $150 in 2023. Their analysis HERE finds that producers […]

03

Dec

This is going to be one heck of a gold and silver bull market! The Misery Index is at Carter’s presidency levels. Consumer confidence is at a decade low. And inflation is at a 30 year high. Not good. The Misery Index is the sum of the inflation rate and unemployment. It’s at 10.8 percent. […]

01

Dec

Stop the presses! This just in! Inflation is no longer transitory! Not only that, but the risk for even higher inflation has increased. Like we’ve been saying… In congressional testimony, Tuesday (11/30) Federal Reserve chairman Jerome Powell said it is a good time to “retire” the word “transitory” which he has used all year […]

24

Nov

Catching up on information too informative and interesting to pass up: Bloomberg: The Federal Reserve’s talking point about transitory inflation is “going to go down in history as one of the worst inflation calls.” So says famed portfolio manager Mohamed El-Erian. “They got stuck on the narrative and held on to it for too […]

24

Nov

“WE’RE LIVING THROUGH THE GREATEST TRANSFER OF WEALTH FROM THE MIDDLE CLASS TO THE ELITES IN HISTORY!” Just a few observations about money and the economy we’re been bookmarking lately, thinking that our readers will find them interesting. Let’s start with Ayn Rand, The Ayn Rand Letter: “Inflation is not caused by the actions of […]

23

Nov

This would be a very good time to park your wealth in gold and silver! Well, we missed the boat on that one! We ventured a month ago that President Biden would not reappoint Federal Reserve Chairman Jerome Powell for a second four-year term. Our reasoning was simple enough: Powell would be made the fall […]

21

Nov

Well, what did they think was going to happen? Jerome Powell and the rest of the Federal Reserve money manipulators, we mean. They printed almost $5 trillion dollars in just over two years. And, yes, for those of you new to these comments, welcome, and we know they don’t literally “print” all that money […]

20

Nov

Recovering from pandemic conditions, global silver demand is forecast to reach 1.29 billion ounces this year. Led by demand of more than a half-million ounces from the industrial sector, 2021 silver demand will exceed a billion ounces for the first time since 2015, according to a report from the Silver Institute. Physical investment demand is […]

19

Nov

You know Washington. They want to spend more on everything. If the sun goes down at sunset, they’ll spend a billion dollars to try to do something about it. Do you know why they want to spend so much? It’s the source of their power. It’s how they buy votes. It’s how they raise money […]

12

Nov

With US inflation rates approaching double-digits once again, you need to take steps to protect yourself, your family, and your hard-earned wealth. The background briefing on gold and silver as the world’s time-tested haven against out-of-control government spending is available to you now in a short and easy-to-understand book I have recently released. REAL MONEY […]

11

Nov

The “Wall Street is starting to get antsier about inflation” reads the YAHOO! News headline. “Investors are more worried about inflation than the Fed seems to be…” Then, as the inflation numbers are coming in huge — at the same time along comes some genius at MSNBC to inform us that all this inflation isn’t […]

10

Nov

Market Alert! Consumer prices have risen 6.2 percent over the last 12 months. Gold rocketed higher on the news. The market saw it coming and began climbing days in advance of the reports. But spiking consumer prices tell only part of the story. It gets worse. Wholesale prices have risen 8.6 percent in the […]

05

Nov

…to print more money! We have to take issue with most Americans. They don’t trust the Federal Reserve. Two Ipsos polls this year, commissioned by Axios, show that a majority of the people, ranging from 53 percent to 60 percent, don’t trust the Fed. The numbers might have been higher, but the polling was […]

04

Nov

“WE’RE LIVING THROUGH THE GREATEST TRANSFER OF WEALTH FROM THE MIDDLE CLASS TO THE ELITES IN HISTORY!” Today we push back from the keyboard. Maybe we’ll go fishing. Or see a movie. That’s because what we would like to have said about America’s historic wealth transfer and power concentration out of the hands of […]

03

Nov

Forbes reports that Treasury Secretary Janet Yellen’s net worth is about $2o million. That’s a lot of money for a college professor and occasional bureaucrat. According to Forbes, Yellen “built up her small fortune over time, through years in academia and government, cashing in most clearly after she left her position as Fed chair in […]

31

Oct

Q: How long does it take people to turn to gold and silver when their government’s unbacked, fiat, irredeemable paper money collapses? A: It takes almost no time at all. Just look at what is going on in Venezuela right now. The money-printing madmen have made the national currency, the bolivar, into a national joke. […]

28

Oct

Something is up at the Federal Reserve. Consider this: The inflation that Fed officials didn’t foresee and then called merely transitory has become a problem… for Fed officials. We can safely predict that Chairman Jerome Powell will not be appointed for another term in February. The inflation debacle is one reason. His predecessor at the […]

26

Oct

…and take all of the gold you can get your hands on! We have been seeing a lot of stories lately that make us think it is all over for the American dream. Things going on that are so destructive we would not have believed them possible just a few years ago. They are […]

22

Oct

News you need to know about money and gold Today’s key stories have to do with how American workers and consumers are doing, and where global inflation is the highest. The wage statistics just released by the Social Security Administration show that the median wage for 2020 was just $34,612.04. That means 50 percent of all […]

21

Oct

Don’t Hold Your Breath! “One of the things that surprises citizens in Argentina or Turkey is that their populist governments always talk about the middle classes and helping the poor, yet inflation still soars, making everyone poorer.” -Daniel Lacalle So, if you are waiting for the government to stop inflating, you would be wise to […]

20

Oct

What the 1970’s Stagflation Was Really Like! It was a few small, still voices at first. Warning that the Federal Reserve was creating another stagflation decade like the 1970s. It is not yet a chorus, but other voices are joining in, singing that old song: Just like before It’s yesterday once more. Stephen Roach, former […]

15

Oct

$100 OIL? Markets Insider: Brent crude, the global benchmark oil price, could surge above $100 per barrel for the first time since 2014, in the event of another cold winter, according to a note by Bank of America Friday…. Higher oil prices could spark inflation analysts led by Francisco Blanch said. “Oil prices could spike […]

14

Oct

The Worst of Both Worlds! We have warned several times about the return of stagflation to the US, most recently in July. (See The Mother of All Stagflationary Debt Crises!) But back then most people seemed to believe the Fed’s insistence that inflation itself was not much to worry about. It was only a passing […]

11

Oct

We want to give you a free signed copy! Skyrocketing prices, massive new spending programs, debt ceiling puppet shows, money printing, debt up the wazoo! How did we get here? Where is all this headed? You’ll find the answers to those questions and more in my new book REAL MONEY FOR FREE PEOPLE! It tells […]

08

Oct

Watch out for 20% – 25% inflation over the next few years, says Wharton professor! Leading establishment economists are finally starting to take inflation seriously. About time. Especially since the Federal Reserve has conjured up $4 trillion out of thin air in just the last 18 months. And it’s pretty hard to deny that inflation […]

06

Oct

President Trump has issued a stark warning for Americans to take rising inflation seriously. “It looks to me like inflation is going to ravage our country,” Trump said in an exclusive interview with Yahoo Finance. Trump pointed to surging oil prices, now at their highest level since 2014, as evidence of inflation’s return. “It’s very […]

01

Oct

Inflation? What Inflation? Oh, That Inflation! Federal Reserve Board Chairman Jerome Powell is “frustrated.” And no wonder. He has no clue what is going on. Two of his central bank minions have suddenly resigned amid reports of activities that look like insider trading ducks, walk like an insider trading ducks, and quack like insider trading […]

01

Oct

Thanks to vital applications in technology and consumer connectivity, expect industrial silver demand to grow ten percent over the next few years. That is according to the new report, “Silver and Global Connectivity,” published by the Silver Institute, a trade association. From the report: “With the highest electrical conductivity of all metals, silver is a […]

30

Sep

Is anyone surprised? Insider trading practices that are rightly being called scandalous have led to the resignations of the presidents of the Federal Reserve banks of Dallas and Boston. But they are not among the greatest of the Federal Reserve’s scandals. Both Eric Rosengren, head of the Boston Fed, and Robert Kaplan head of the […]

24

Sep

Warnings about a steep stock market sell-off are piling up. Morgan Stanley is cautioning its clients about a plunge of more than 20 percent. CNBC recently surveyed four hundred chief investment officers, equity strategists, portfolio managers and CNBC contributors who manage money. Seventy-six percent of the respondents said now is a time to be “very […]

24

Sep

In China, local government officials are buckling up for what could be a bumpy ride in Evergrande Group’s insolvency. Evergrande is a Chinese real estate developer that, riding the country’s property bubble, has amassed $305 billion in outstanding debt that it is now unable to service. A default of such a gargantuan borrower has the […]

21

Sep

No wonder people seek the privacy of owning precious metals! This is an update to our commentary two weeks ago in which we described the Biden administration’s total financial surveillance as becoming quite serious. “Not only is Big Brother watching you,” we wrote, “he is also getting bigger every day. “ In its most recent […]

16

Sep

“The most insane accumulation of debt… ever imagined!” Total world debt is now approaching $300 trillion. And it continues to grow at a breathtaking pace. The Institute of International Finance’s latest Global Debt Monitor reports that the world’s wobbly debt structure grew by $4.8 trillion in the second quarter of this year to total $296 […]

15

Sep

Rising Prices, More Gov Borrowing, Illusory Growth, Inadequate Cost of Living Adjustments. And So It Goes! “The last 50 years is the first time we’ve seen such a broad upswing in the global price level across multiple countries.” Jim Reid, Chief Credit Strategist, Deutsche Bank “A new CNN poll finds that 74% of U.S. adults […]

14

Sep

Gold or a Government Program that is Headed Towards Insolvency? What do you think is more reliable for your retirement? Gold and silver, which are not dependent on politicians’ empty promises? Or the government’s Social Security program? If you answered Social Security, here are a couple of things you should consider. First, Social Security is […]

10

Sep

Even Establishment Figures Aren’t Buying It! Producer prices in the month of July rose 0.7 percent. Over the past 12 months, producer price have risen 8.3 percent. The Federal Reserve’s insistence that the inflation we are experiencing is merely transient is cracking up on the reefs of widespread disbelief. Even leading establishment economists find it […]

09

Sep

It’s starting to get serious! We have strongly urged our friends and clients to have some assets off the grid. See here and here. It has always been the prudent thing to do. But now it is becoming imperative! Reason Magazine reports: Imagine living in a world where every one of your non-cash financial transactions—a […]

08

Sep

Start with Gold and Silver! After witnessing the hyperinflation of the 1920s in Germany and Austria, the great free-market economist Ludwig von Mises coined an evocative term for the last stage of a currency breakdown. He called it the Crack-Up Boom. In German, it is “Katastrophenhausse,” a catastrophe boom. US monetary policies ensure that something […]

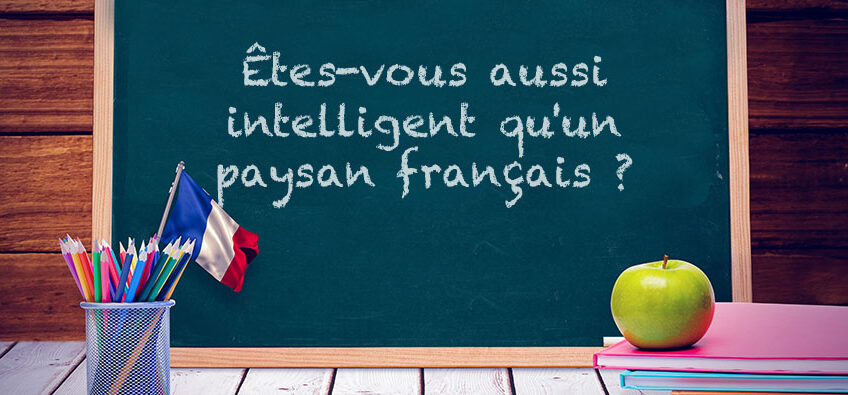

03

Sep

It’s an old expression among people who understand gold: “Are you as smart as a French peasant?” Of course, it has its roots in the monetary history of the French who have suffered brutal monetary frauds and inflations, including both the Mississippi Bubble scheme and the Reign of Terror inflation. The government’s attempt to enforce […]

02

Sep

Today we want to sample some billionaires’ views. But not just any billionaires. There is no reason to think billionaires are generally wiser or morally superior to other people. Bill Gates and Mark Zuckerberg loom large among the billionaire class. Their opinions about software marketing and social media respectively may be worthwhile. But there is […]

01

Sep

Four headlines all in a row on the Drudge Report one day last week tell the whole story of US fiscal and monetary policy today. It is an alarming line-up that will have informed people moving to profit and protect themselves with gold and silver now! INFLATION 30 YEAR HIGH… FED KEEPS PUMPING…STOCKS HIT MORE […]

27

Aug

…Coming Soon to an Economy Near You! Washington is a clown car full of geniuses who are now trying to remake the American economy. From top to bottom. And they are not even trying to conceal it. The New York Times, the house organ of the new socialist America, is explicit. An 8/26/2021 story is […]

27

Aug

We have written many times about the impact on you – and on supercharging gold prices – as the dollar loses it privileged position as the world’s reserve currency. See here, here, and here. But we have never stated the case quite a dramatically as was done by Erik Prince on Tucker Carlson’s show this […]

26

Aug

Less Bang for Your Buck Rapidly rising prices are hitting Americans hard. A recent Fox News poll reveals that 83 percent of Americans are now “very” or “extremely” concerned about inflation. That concern is not just theoretical. Rising grocery prices are already causing financial hardship for 70 percent of voters. 29 percent say their families […]

20

Aug

You’ve got to love Ron Paul! There simply hasn’t been a national political figure like him! A couple of examples: When Dr. Paul was running for president, someone (probably an opposition candidate) discovered that some purportedly disreputable fellow had made a contribution to his campaign. If you follow politics, you know the standard political playbook […]

19

Aug

Hi-Tech Billionaire’s Company Buys $50 million in Gold Bars! Concerned about a coming unexpected, high-impact event, “a black swan,” Palantir Technologies, a software company co-founded by billionaire Peter Thiel, purchased $50.7 million in 100 ounce gold bars. Thiel is a forward-looking entrepreneur. He was an early investor in Facebook and a co-founder of PayPal. Palantir […]

18

Aug

How Different is 20 Years of Afghanistan from 13 Years of Quantitative Easing? WHO ARE THESE PEOPLE? The Deep State geniuses behind our foreign and monetary policies? It was reported that just days before the 2003 invasion of Iraq, President Bush knew nothing about Sunnis and Shia. “I thought Iraqis were all Moslems,” said the […]

14

Aug

Looking for Part I? Click Here. It was a fateful decision fifty years ago today, one that spelled a slow unwinding of the US dollar’s value and undermined America’s unique financial position in the affairs of the world. That it has taken fifty years is a testament to the might that America’s free economy had […]

13

Aug

50 Years Ago this Week! Gold moved out 50 years ago this week. That is when the paper dollar moved front and center in the US economy on August 15, 1971. Of course, Americans had paper dollars before that date. But nobody assumed that some fancy linen stock, engraved scrollwork, and official signatures […]

12

Aug

Inflation, Anyone? The official inflation numbers for July continue to show persistently climbing consumer prices. The Labor Department’s Consumer Price Index rose 0.5 percent in July. For the twelve-month period, the CPI was up 5.4 percent. The three-month annualized rate, after 0.6 percent increase in May, 0.9 percent increase in June, and July’s 0.5 […]

08

Aug

“Dollar’s Purchasing Power Gets Zapped. And It’s Permanent!” Wolf Richter from WolfStreet.com point out that the Fed’s “transitory” inflation claim is a joke” “Inflation means that the dollar loses its purchasing power. It means that labor loses its purchasing power. In other words, people have to work more the maintain their standard of living. Or […]

07

Aug

The body of work of George C. Scott, who won an Oscar for his unforgettable portrayal of World War II General George Patton included films like Anatomy of a Murder and Dr. Strangelove. Less well known is his starring role a few years before in a film called The Flim-Flam Man, a comedy about […]

05

Aug

The US national debt ceiling, suspended by Congress two years ago, kicked back in on July 31. That left federal debt capped at the current $28.5 trillion level. The Treasury will employ a full suite of measures, moving money around and borrowing from account to account, to avoid default for now. It can use accounting […]

30

Jul

The World Gold Council reports that gold bar and coin demand for the 2021 April-May-June quarter grew by 56 percent over the same quarter a year earlier. For the quarter demand measured 243.8 tons. Altogether bar and coin demand in the first half of this year was the strongest since 2013, at 594 tons. […]

30

Jul

China is still gobbling up much of the world’s gold. China is the world’s largest gold producer, with more than twice the annual gold production of the US. It is also the largest gold refiner. Much of China’s gold position is kept under wraps. It reports its gold reserves occasionally but will go for […]

29

Jul

David Stockman shows up on the financial news shows a fair amount. But I don’t remember any of them asking him about gold. Of course, they don’t. That’s the mainstream media for you. Mostly they practice a form of journalism you might describe as news reporting by government handouts. But they should ask him […]