Biden Goes for Broke

Biden intends to send federal spending to levels not seen since World War II.

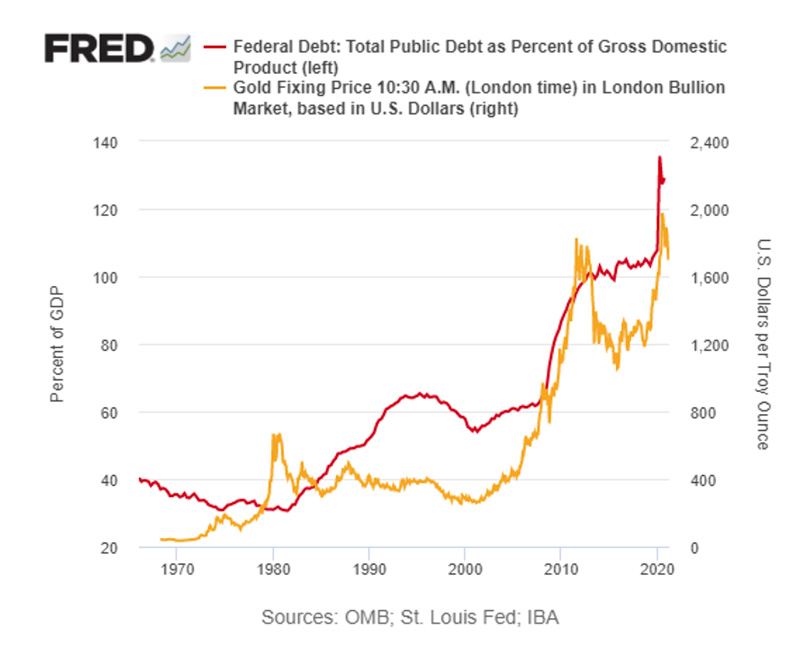

He is doing so at a time that federal debt is already about 129 percent of gross domestic product.

Biden announced the $2.3 trillion dollar plan last Wednesday. It is described as providing funding for bridges and roads, expanding access to high-speed internet, improving public transit, and encouraging the adoption of electric vehicles. It is not described as a plan to stovepipe money to the politically correct and the politically connected.

But it is. It’s a politician’s fantasy come true.

There is still another shoe yet to drop. The infrastructure measure is the first of a two-part plan that the administration will seek to move through Congress. A second plan, to be revealed in April, focuses on remaking American life by escalating the State’s role in childcare, healthcare, and education. It is not described as a means to stovepipe taxpayer money to a vast new social engineering scheme.

But it is. It is collectivist’s fantasy come true.

Biden’s plan rests on raising corporate tax rates 21 to 28 percent. This will make its way to price increases on the goods and services American corporations provide. Fueling further price hikes at a time that there is widespread fear that inflation is beginning to reassert itself is particularly tone-deaf.

Accordingly, the people will pay more for the necessities of daily life. State cronies will fill their pockets at the end of the Biden pipeline.

As the Biden plan advances you will hear like a constant drumbeat the talking point that the measure will so unleash America’s productive might that it will pay for itself. That has been the ceaseless mythology of State for years: that we can spend our way to prosperity. But if all the constantly rising state spending and intervention in the economy pays for itself as alleged, how has the national debt grown to $28 trillion?

(See our posts on “the marginal productivity of debt,” Doom Loop, Part I and Doom Loop, Part II.)

The non-partisan Committee for a Responsible Federal Budget address this very issue:

“As the details come out, you’ll hear advocates claim these new investments will actually pay for themselves through new growth or that deficits don’t matter. That was not true during the 2017 tax cut debate and it certainly is not true now.

“Investing in reliable and resilient infrastructure can help the economy, but the research is clear that the return is fairly modest. In fact, analysis from the Congressional Budget Office and Penn Wharton Budget Model suggests that returns on debt-financed infrastructure investments could well be negative.

“Since the start of the crisis, we have taken on more than $5 trillion in debt to fight COVID, with much of it being justified. But we also borrowed nearly $5 trillion before the crisis for tax cuts and spending increases that were not justified. We are becoming dangerously numb to borrowing massive amounts of money.

“Strong nations borrow when necessary, not when it is politically convenient. It is important for the future health of the economy that we are willing to pay for our priorities.”

The US national debt is already unpayable. As the government, boondoggles, crony capitalism, debt, spending, and money-printing all grow, gold and silver provide a time-tested means of withdrawing from the doom loop. Speak with a Republic Monetary Exchange professional today.