Beware the Stock Market Bear!

Warnings about a steep stock market sell-off are piling up.

Morgan Stanley is cautioning its clients about a plunge of more than 20 percent. CNBC recently surveyed four hundred chief investment officers, equity strategists, portfolio managers and CNBC contributors who manage money. Seventy-six percent of the respondents said now is a time to be “very conservative” in the stock market.

Investment legend Jim Rogers is warning now of the worst bear market of his lifetime.

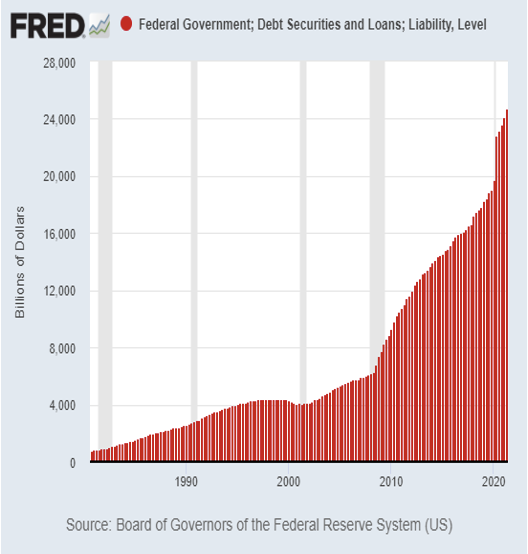

“Nearly every government,” says Rogers, “every central bank in the world has been printing huge amounts of money. And borrowing and spending huge amounts of money. It has never happened like this in the history of the world, never in recorded history have we seen so much excess…. Be worried.”

So where to turn during what Roger says will be the worst bear market of his lifetime?

“Silver – I own silver – is down 60 percent from its all-time highs,” says Rogers. “Look out the window. What do we know that is down 60 percent from its all-time highs?” Today much of the investment world is looking at problems in China. No one can know how the fallout from China’s Evergrande credit crisis will spread. “These things snowball,” says Rogers. “They start where we’re not looking. It may have already started.”

But one need only factor in US problems, a debt ceiling standoff, massive new spending initiatives, and growth issues, to recognize a dangerous environment for stocks. More important still is the troublesome return of inflation. Indeed, another survey, this of clients of Swiss banking giant UBS Group list hyperinflation as their top economic concern. Gold and silver stand out as go-to refuges in an era of systemic risk, just as they were when the failures of Bear Stearns and Lehman Brothers brought on the mortgage meltdown and the Great Recession and set gold marching higher for three straight years.

But one need only factor in US problems, a debt ceiling standoff, massive new spending initiatives, and growth issues, to recognize a dangerous environment for stocks. More important still is the troublesome return of inflation. Indeed, another survey, this of clients of Swiss banking giant UBS Group list hyperinflation as their top economic concern. Gold and silver stand out as go-to refuges in an era of systemic risk, just as they were when the failures of Bear Stearns and Lehman Brothers brought on the mortgage meltdown and the Great Recession and set gold marching higher for three straight years.