Are You As Smart As a French Peasant?

It’s an old expression among people who understand gold: “Are you as smart as a French peasant?”

Of course, it has its roots in the monetary history of the French who have suffered brutal monetary frauds and inflations, including both the Mississippi Bubble scheme and the Reign of Terror inflation. The government’s attempt to enforce the acceptance of its increasingly worthless paper currency in the latter period even saw it decree the death penalty for any merchant who, not wanting to be swindled with a worthless currency, even dared ask if a customer was paying with gold and silver or with paper.

The French suffered destruction inflationary episodes with the world wars of the last century and other episodes of dishonest monetary policies, as well.

Little wonder the French – peasants or not – have learned through the generations to keep gold and silver on hand.

The old expression came to mind just the other day with the news that inflation in France is cranking up again, along with reports that their neighbors in Switzerland and Germany are stepping up their physical gold purchases. In Switzerland, we learn, it is ordinary people rather than speculators who are behind the new gold buying.

The great inflation of Germany a century ago is still the stuff of family legends in that country, so with the central banks of the world flooding the globe with digital money printing, it is no surprise to see the recent Bloomberg News headline that says “Inflation-Wary Germans Are Loading Up on Gold.”

Bloomberg:

“Demand for physical bullion in Germany, traditionally the biggest coin and bar buyer in Europe, was the highest since at least 2009 in the first half, World Gold Council data show. While purchases in other Western markets have also been strong, Germans, in particular, are pouring into the metal as a hedge against rising inflation — and dealers say business remains good.”

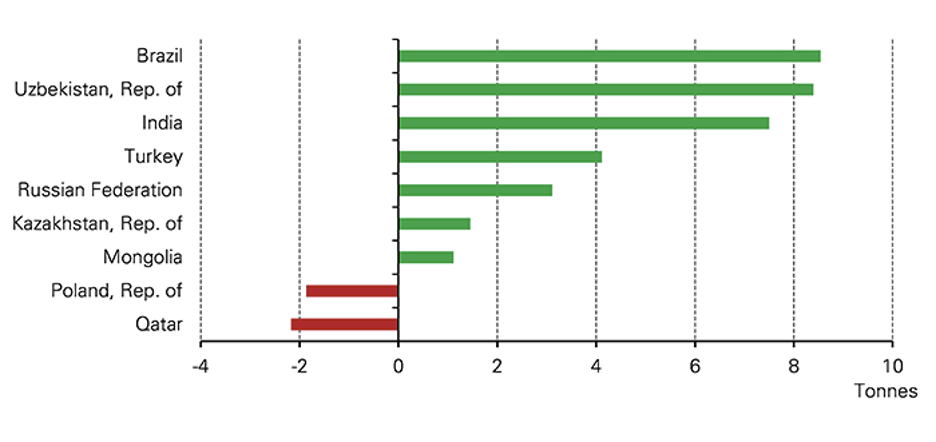

Meanwhile, central bank gold purchase remained positive in July. It was the sixth month in a row of net purchases as well, after a few intermittent months of net liquidations during the worst of the Covid lockdowns. Leading the net 30 tons of purchases in July were Brazil, Uzbekistan, India, Turkey, and Russia.

The lessons that French peasants and German families have learned about the importance of gold and silver will have to be learned again here in the US. But for those that don’t want to experience that suffering firsthand, Republic Monetary Exchange gold and silver professionals are available to help you create a sensible plan of monetary protection that suits your needs.