Analyst Predicts “Extraordinary” Silver Move

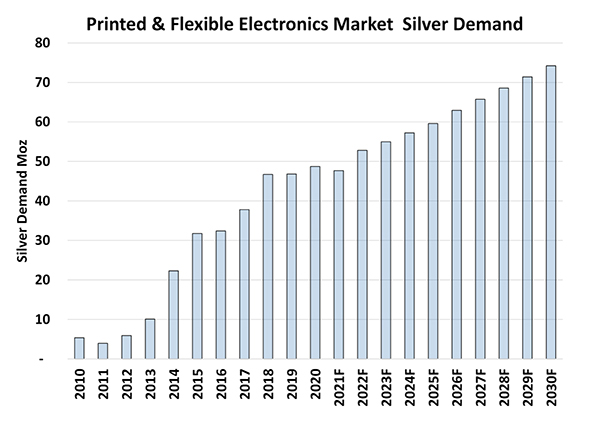

The bullish fundamentals for silver are very much intact. Just the other day The Silver Institute, a Washington-based trade association, reported that silver demand for printed and flexible electronics is forecast to increase from 48 million ounces this year to 74 million ounces in 2030. That is a 54 percent increase.

The Institute describes some of the reason that this application will consume 615 million ounces of silver over the ten-year period: “Printed and flexible electronics are vital to the evolution of electronic technologies as they are mainstays in a wide range of products, including sensors for temperature, pressure, motion, lighting, moisture/relative humidity, radar, heart rate, and carbon monoxide. Other applications include their use in internet-connected devices, medical and wearable electronics, displays for appliances, mobile phones, computers and tablets, medical devices, automotive, and consumer electronics.”

Meanwhile, a noted silver analyst says the bullish case for silver at over $25 in 2021 is even more compelling than when silver was $5 in 1995.

Andrew Hecht has been a major player in the silver markets and a trader with the major international bullion dealers since the 1980s.

Here are the three leading reasons he is calling for a silver move “that could be extraordinary”:

- INFLATION: Hecht says inflation will become rampant, citing “the tidal wave of central bank liquidity and tsunami of government stimulus…”

2. THE GREEN REVOLUTION: Silver is critical for solar energy applications, but Hecht suggests that silver demand in an era of green politics could be much higher than current forecasts.

3. A SHORT SQUEEZE: The GameStop crowd’s interest in silver may be only the first attempt at triggering a short squeeze in silver.

Hecht writes that today’s silver price consolidation may be a prelude to a new high above $50 an ounce. His entire article is available at Seeking Alpha.

Speak with a Republic Monetary Exchange precious metals expert today about silver for wealth protection and profit.