Acts of Desperation

The Monetary Authorities Have Fixed Nothing, Learned Nothing

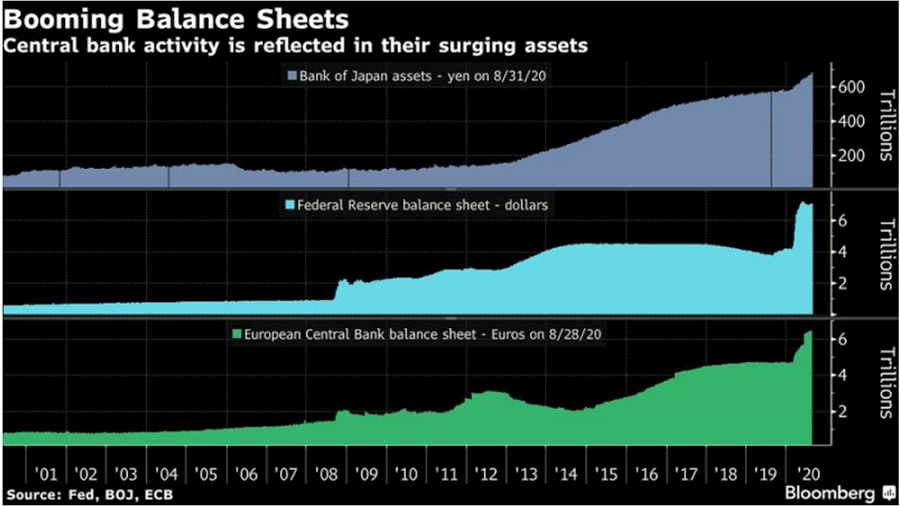

“As of the end of July, central banks had cut interest rates 164 times in 147 days and committed $8.5 trillion in stimulus.”

That is the word from a Bloomberg News story this week, “How Unconventional Monetary Policy Turned Conventional.”

The unconventional has become conventional, eh? The account describes temporary emergency measures becoming long-lasting.

It’s not hard to read between the lines of this kind of stuff. It means that the steps the authorities have taken to deal with a crisis didn’t work. Nothing was cured, except that the patient became addicted to the medication.

Bloomberg:

“As this graphic from Bloomberg shows, most central banks are diving deeper into the unknown. The Fed is buying different types of bonds, the ECB is getting creative with negative interest rates, and Australia has adopted Japanese-style efforts to control bond yields.

“With the global recovery still uncertain and the virus set to leave scars on employers and employees, the likelihood is that monetary policy will stay ultra-loose for years to come — even if that means central banks artificially propping up markets or sparking a run-up in prices.”

The story goes on to describe additional steps central banks may take, “of formerly fringe notions gaining in prominence.” It specifically mentions Modern Monetary Theory (MMT) among them.

We have described MMT many times including in April, MMT and Helicopter Money. We wrote then that “MMT is all the rage. Academics who should know better (and they would know better if they had studied historical schemes like John Law’s Mississippi Bubble debacle three hundred years ago) are climbing aboard. And politicians, many of whom will subscribe to any scheme that allows them to promise to give things to people and get re-elected, are falling all over themselves to sign up.”

There are other acts of desperation afoot. Just last week we wrote that “Fed economists and officials are hunched over their drawing boards designing different ways to insert freshly created digital money directly into citizens’ (and perhaps even non-citizens’) accounts.”

The US fiat monetary system is beginning to fail. The people don’t yet notice it, although the authorities are turning to increasingly desperate ideas to keep it together. But acts of desperation are almost always ill-considered and seldom successful.

Eventually everyone will recognize these acts of desperation. Those that do so now are investing in gold and silver.

You should consider contacting us if you are among them.