A Look at the Debt Ceiling

It’s Up, Up, and Away!

Washington spends one or two trillion dollars more than it collects in taxes. (We’d be more specific, but what are a trillion dollars between friends?)

So where does it get the difference? Like any household whose income doesn’t keep up with its outgo, it has to borrow the difference. (We’ve covered the government’s money-printing business many times and will save it this time for a later discussion.)

Creditors, like Mastercard and Visa, put limits on individual credit lines. That’s when consumers realize they need to cut back. They can’t spend beyond their income forever without unwanted consequences.

Our government doesn’t seem to believe it must ever cut back its spending meaningfully. When Washington runs up against its statutory debt limit, it just passes another law, unilaterally raising its legal borrowing limit.

And for all the debate, the pitched drama from the media, and posturing politicians, we feel safe in predicting that the debt limit will be raised and that any compromises and concessions will not be enough to save the US from having to inflate wildly to avoid an eventual default on its debt.

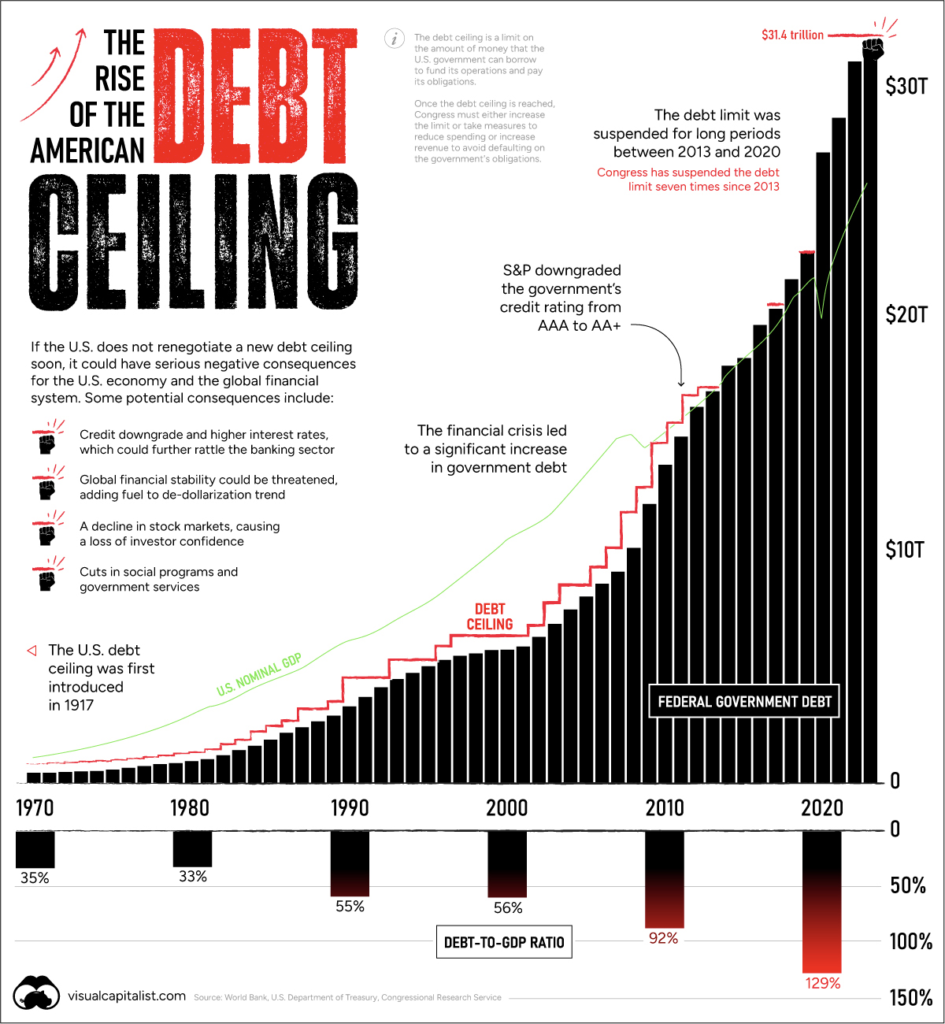

For now, take a closer look at the history of the debt ceiling in this graphic from Visual Capitalist.