A Briefing for Gold Investors

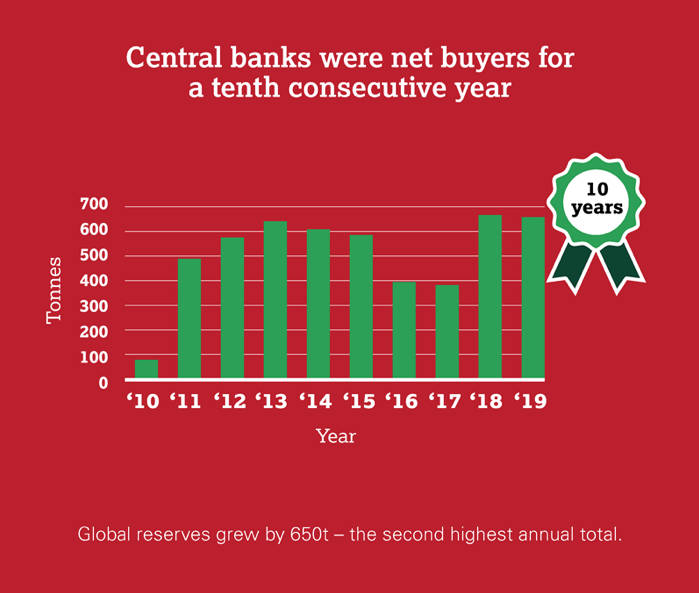

The numbers are in for global central bank gold buying in 2019. The World Gold Council reports, “Central banks were net buyers for a 10th consecutive year: global reserves grew by 650.3 tons, the second highest annual total for 50 years.”

As you know, we believe central bank gold buying is among the most important megatrends of today’s financial world. It eclipses in importance any other supply-demand fundamentals.

The WGC also notes that the central bank buying trend is widespread, with at least 15 central banks acquiring a ton of gold or more last year. Here is the chart from the report:

The Cost of the Coronavirus

Goldman Sachs is estimating that the coronavirus outbreak cost to China and the spillover effects on the rest of the world will reduce global GDP growth by two percent in the current quarter.

The firm expects that impact will be contained in the first quarter, writing, “Aggressive response from the authorities in China and elsewhere will bring the rate of new infections down sharply by the end of Q1.”

That’s the hope, anyway.

Is This a Hospital? Or a Place Coronavirus Victims Go to Die?

Here’s a link to a Bloomberg News story that ran February 5 headlined, “China Sacrifices a Province to Save the World From Coronavirus.”

Hubei province has a population of 60 million. Its capital is Wuhan, the epicenter of the coronavirus. At the time the story was written, Hubei had 67 percent of all patients and had experienced 97 percent of all deaths from the coronavirus.

But amid all the reports and statistics, a photo in the Bloomberg story caught our attention for graphically portraying the possible scope of the outbreak.