2020: Off to an Explosive Start

“Do I have everyone’s attention now?”

If the gold market could talk, we imagine it would be asking something like that.

Gold surged throughout December, ending 2019 at $1523.

Priced in dollars gold rose 18.3% and silver by 15.1% in 2019. Then, with the killing last week of a top Iranian military commander Qassem Soleimani, gold briefly hit seven-year highs, touching $1590.

It is significant that gold also made new all-time highs in the Euro.

Gold Sets New High in Euros

We have repeatedly expressed our view that 2020 will very bullish for gold. Now we have had a glimpse of what the year ahead may hold.

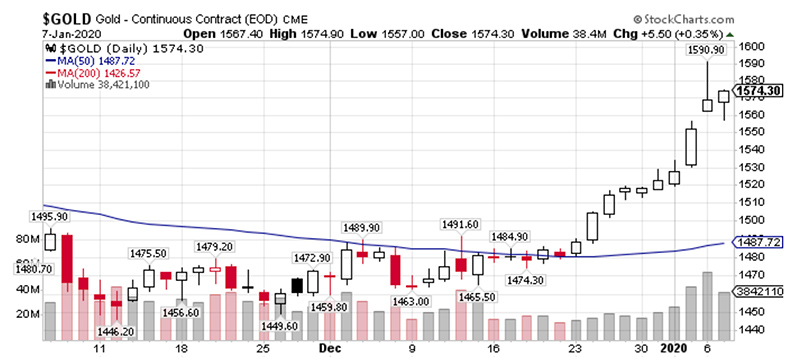

As you can see on the following chart, gold has been up every single day since Christmas week, when it moved – and has stayed – above its 50-day moving average.

In a model of understatement, Moody’s senior analyst wrote clients on Monday that “a lasting conflict would have wide-ranging implications through the broad economic and financial shock that significantly worsens operating and financing conditions.” Senior analyst Alexander Perjessy added, “A protracted conflict would potentially have global repercussions, in particular through its effect on oil prices.”

No kidding.

Both UBS and Goldman Sachs called for gold to outperform oil as conditions in the region worsen. The global head of commodities research at Goldman Sachs said “… history shows that under most outcomes gold will probably rally to well beyond current levels.”

Other analysts are predicting an ‘escalatory’ cycle lasting for months.

We share that view. We have not seen the last of US-Iranian turmoil that dates back more than 30 years. In fact, this is only the beginning.

We hope that gold’s price movement has grabbed your attention. Don’t wait for the other shoe to drop to add to your gold and silver holdings.